Monthly Energy Digest – December 2024

- Ukraine has officially suspended the transit of Russian gas due to the expiration of the five-year transit contract for Russian gas established in 2019.

- Slovakia threatens to stop electricity supplies to Ukraine in response to the suspension of Russian gas transit

- Russia carried out two additional large-scale attacks on Ukraine’s energy infrastructure in December.

- In 2024, Ukraine increased its gas production by 2.2%.

- In 2024, Ukraine boosted electricity imports by 5.5 times, reaching 4.4 million MWh.

- The Supervisory Board of NPC “Ukrenergo” was created.

The Electricity Market

The general situation in the power system

In the first half of the month, the power system has been recovering from the Russian attacks in November, which included two large-scale assaults. During the first week, some external power lines connected to the NPP remained disconnected for some time. Due to transmission bottlenecks, power consumption had to be restricted with rolling blackouts. Three Ukrainian nuclear power plants have mostly resumed electricity generation after a brief capacity reduction after Russian shelling.

During the first week of December, electricity imports remained low, largely due to high prices in neighboring countries that exceeded the price caps in Ukraine’s electricity market during peak hours. Other factors affecting import were a low demand for imported power during off-peak hours and bottlenecks in the power transmission system limit the ability to convey essential amounts of electricity.

On December 13, Russia used 93 missiles to conduct the 12th wide-scale attack on Ukrainian energy infrastructure in 2024. Russia targeted transmission substations that handle electricity imports. Additionally, the equipment at one of the thermal power plants sustained significant damage. Russian forces also attacked four underground gas storage facilities in western Ukraine. However, the damage was less than in previous attacks. TSO did not even implement emergency cutoffs, opting instead for planned rolling blackouts, albeit on a broader scale compared to the first part of the week.

On the night of December 25, Russia launched another extensive assault on Ukraine’s energy infrastructure. The primary targets were thermal and hydropower plants located on the left bank of the Dnipro River, while transmission substations sustained relatively less damage. Specifically affected were the thermal power plants in Kharkiv (one cogeneration thermal power plant), Dnipro (thermal and hydropower plants), one TPP in Donetsk, and one in Lviv. In total, Russian forces fired 70 missiles and deployed numerous drones. As a result of this attack, half a million customers in the Kharkiv region were left without heating supply.

Due to the damage, a significant capacity shortage occurred on the left bank of the Dnieper

River. When the temperature drops, transferring all necessary capacity volumes from the right bank, where all available nuclear power plants and import connectors are located, to the left bank will be impossible. Ultimately, this means that rolling blackouts on the left bank will last longer than those on the right bank. Further massive strikes may worsen the situation.

Electricity imports after the attacks rose significantly to cover most of the deficit. The volume of imports set a record since early October.

Exports and Imports

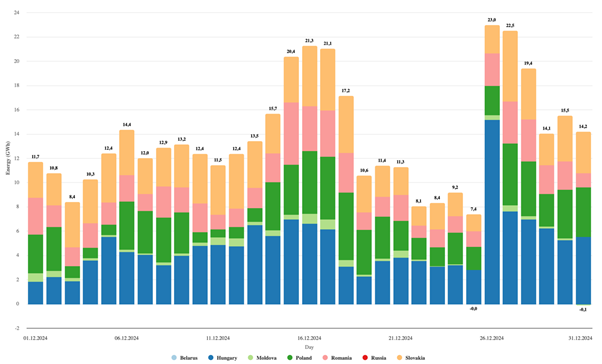

Electricity export and import during the month

In 2024, Ukraine increased electricity imports by 5.5 times – up to 4.4 million MWh.

In December 2024, Ukraine increased electricity imports by 2.6 times compared to November 2024, exceeding 430,000 MWh.

Imports from Hungary saw the largest increase during the month, rising fourfold to reach 152,000 MWh. Hungary holds the largest share of these imports at 35%. Slovakia ranks second with 25%. Imports from Hungary saw the most significant increase this month, rising fourfold to reach 152,000 MWh.

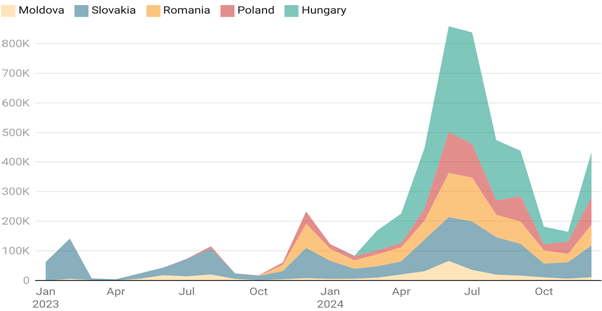

In 2024, Ukraine boosted electricity imports by 5.5 times compared to 2023, reaching 4.4 million MWh. Hungary accounted for 39% of the import structure for the whole year, Slovakia 23%, Romania 18%, Poland 14%, and Moldova 5%. The peak of imports this year was in June, with a total of more than 850,000 MWh delivered. The supply increase was due to the favorable price situation in the neighboring electricity markets.

Electricity import, per month, 2023-2024, MWh (ExPro agency data)

In 2024, electricity exports remained nearly at the 2023 level, totaling 366 thousand MWh. The highest volume of electricity was delivered in March, reaching 154 thousand MWh.

Slovakia is threatening to halt electricity supplies to Ukraine in response to the suspension of Russian gas transit.

Slovak Prime Minister Robert Fico threatened to halt electricity supplies to Ukraine in response to the discontinuation of Russian gas transit following the expiration of the corresponding contract.

Officially, the government is unable to suspend the electricity supply. These privately owned, independent companies supply electricity, alongside the independent transmission system operator responsible for power transmission to Ukraine. The only legal justification for this is sanctions. However, the question remains whether the European Commission will have a dispute with Bratislava if sanctions are imposed.

If the Slovak TSO, SEPS, suspends electricity transmission due to a political decision, ENTSO-E may launch an investigation to assess its independence. This could lead to sanctions, including the revocation of the TSO’s certification. Therefore, Fico’s statements can be viewed as blackmail.

ENTSO-E can also allocate Slovakia’s interstate capacity with Ukraine to other countries, ensuring that the total remains at 2.1 GW.

- Since the beginning of 2024, Ukraine has imported over 1 million MWh from Slovakia, which represents approximately 23% of its total electricity imports. Slovakia ranks second in share after Hungary.

- From January to November 2024, Ukraine spent over 135 million euros on imports from Slovakia, not including the cost of accessing cross-border capacities.

The Ukrainian Ministry of Energy has contacted the EU Energy Commissioner, ENTSO-E, and the Energy Community. Polish officials have stated that the country is ready to increase electricity supplies to Ukraine if necessary. In early 2025, international electricity trade with Slovakia persisted. The Slovak TSO, SEPS, confirmed the planned continuation of supplies to Ukraine.

Debts and non-payments

Energoatom settled the debt to the Guaranteed Buyer for subsidizing household electricity tariffs.

Energoatom has fully fulfilled its special obligations to ensure the availability of electricity for household consumers (Public Service Obligation, PSO). In 2024, it paid UAH 145 billion 356 million (including VAT) for the PSO service. Energoatom paid 100% of the contributions for the PSO service in 2024, totaling 128 billion 303 million UAH, and repaid 17 billion 53 million UAH of the debt for the PSO service in 2023.

Energoatom subsidizes lower-than-market-priced electricity tariffs for households, which are calculated based on Energoatom’s cost of electricity production.

Market shaping

Ukraine did not achieve the goal of installing 1 GW of gas-fired generation in 2024

Ukraine did not succeed in launching 1 GW of electricity generation in 2024. According to statements from some top officials, by the end of 2024, only about 30% of the planned capacity had been realized. Additionally, of the approximately 300 MW of newly installed capacity, only about half—around 150 MW—was operational. State-owned companies (Naftogaz, UkrNafta, UkrZaliznytsia, and Gas TSO) were required to purchase and install gas-fired power generation equipment. However, they largely struggled to locate and acquire gas pistons and gas turbines within such a tight timeframe. The energy ministry reported that the total capacity of generating units for distributed gas generation, connected as of December 31, 2024, amounted to 967 MW. Of these, 835 MW were put into operation this year. These numbers include the capacity that industrial customers built for their needs (both in-grid and off-grid).

The schedule for auctions to allocate the support quota for RES in 2025 has been approved.

Next year, four green auctions are planned. The Cabinet of Ministers approved the schedule: for 33 MW solar PV in March 2025; for 100 MW wind farm in April 2025; for 47 MW for other sources in May 2025; for 150 MW wind farm in July 2025. The maximum bid prices at auctions in 2025 will be 8 euro cents per kWh for solar and wind power plants and 12 euro cents per kWh for other types of alternative energy sources.

REMIT: the energy regulator has improved the requirements for the disclosure of insider information

The NEURC adopted a resolution to approve modifications to the requirements for maintaining integrity and transparency in the wholesale energy market. These changes relate

to the management of insider information and are part of implementing the REMIT regulation. Enforcing REMIT regulations is a vital step toward improving transparency and competitiveness in Ukraine’s electricity market and its integration with the European market.

Ukraine and its neighboring countries have launched a Local Implementation Project aimed at integrating energy markets.

Market operators and transmission system operators from Ukraine, Poland, Slovakia, Hungary, Romania, and Moldova established a Local Implementation Project (LIP) aimed at integrating the Ukrainian spot market into the unified European market. A Memorandum of Understanding was signed between the key participants from Ukraine: (JSC “Market Operator”, NPC “Ukrenergo”), Poland (PSE, TGE, EPEXSPOT, NordPool), Hungary (HUPX, MAVIR), Romania (Transelectrica, BRM, OPCOM), Slovakia (OKTE, SEPS), and Moldova (Moldelectrica, OPEM).

The LIP envisions regional collaboration to prepare the Ukrainian day-ahead market (DAM) and intraday market (IDM) for integration with the European day-ahead market (SDAC) and intraday market (SIDC). The project entails sharing information, bridging legal gaps, and implementing coordinated organizational and technical solutions to unify the markets.

“Ukrenergo” held the third special auction to purchase quick reserves.

Ukrenergo conducted the third special auction to procure auxiliary services for balancing the energy system: automatic frequency restoration reserves. In addition to existing suppliers, investors intending to construct and operate gas piston, gas turbine, biomass power, and energy storage facilities were invited to participate.

According to preliminary results, all accepted bids are for 55 MW of load products and 1,785 MW of symmetrical reserve products daily for five years. The auction winners will enter into a fixed-price contract in euros with Ukrenergo to provide services for five years, with a one-year postponement from the time of the auction.

- In September, Ukrenergo held the first two long-term auctions for auxiliary services: to purchase frequency containment reserves and automatic frequency restoration reserves. The weighted average price per megawatt was about twice less than the current price of services.

- About 90% of the auction participants were newcomers to the electricity energy market.

- Bidding prices were about two times lower than the actual price of those services.

Others

Supervisory Board of NPC “Ukrenergo” was created.

The Cabinet of Ministers of Ukraine approved the nominations of members of the supervisory board of Ukrenergo as representatives of the state – Yuriy Boyko, Anatolii Guley, Oleksiy Nikitin.

- Yuriy Boyko, a member of the current supervisory board of Ukrenergo and former deputy energy minister.

- Oleksiy Nikitin worked at Ukrenergo as the head of the electricity market development department, and he also served as the director of commerce at UkrHydroEnergo.

- Anatoliy Guley served as the chairman of the board of Oschadbank, the deputy chairman of the board of Alfa-Bank, and was a shareholder of Acordbank. Currently, Guley is listed in the registers as a director of PRJSC “Ukrainian Interbank Currency Exchange,” but the exchange has reported that he resigned in 2023, and certain legal aspects prevent changes from being made to the register.

Earlier, the government approved candidates for the positions of independent members of the supervisory board of the transmission system operator NPC Ukrenergo: Patrick Greichen, Luigi De Francisci, Jeppe Kofod, and Jan Montell.

The newly appointed Supervisory Board of Ukrenergo held its first meeting on December 12, 2024. Danish politician Jeppe Kofod became the head of the newly appointed supervisory board of NEC Ukrenergo. State representative Anatolii Guley became the deputy chairman of the supervisory board. The Supervisory Board created committees on audit issues, on appointments and determination of remuneration, on investments and strategy.

In general, the Supervisory Board of NEC Ukrenergo consists of 7 people: four independent members, selected based on the results of the competition, and three representatives of the state.

The Gas Market

Gas transit status and updates

Ukraine has officially suspended the transit of Russian gas.

On January 1, 2025, at 7:00 am Kyiv time, the gas transmission system operator of Ukraine halted the transit of Russian gas through its territory. The stoppage occurred due to the expiration of the five-year transit contract for Russian gas established in 2019.

- Over the course of five years, Ukraine transported approximately 148 billion cubic meters of Russian gas to European countries. This volume accounts for nearly 66% of the reserved capacity outlined in a long-term contract, which totals 225 billion cubic meters.

- From 2019 to 2024, Russian gas transported through Ukraine reached five countries. During the five-year contract, the majority of the Russian gas, totaling 108 billion cubic meters (bcm), was sent to Slovakia, which accounted for over 73% of all supplies. Hungary received 16.5 bcm (11%), Moldova received 12.6 bcm (8.5%), Poland received 8.5 bcm (5.5%), and Romania received 1.7 bcm (1.2%).

- In most years, the transit volumes were below the contracted capacities. However, in 2021, transit volumes exceeded planned levels, reaching 41.6 bcm instead of 40. Naftogaz secured additional capacity at short-term auctions of OGTSU for Gazprom, which came at a higher cost.

- In 2024, the transit of Russian gas through the Ukrainian GTS reached nearly 15.43 bcm, representing a 5.7% increase compared to 2023, when the volume of transit fell to its lowest level since 1991 at 14.6 bcm.

- Russia’s Gazprom transferred approximately $6.2 billion to Ukraine’s Naftogaz for transit services of Russian gas through Ukraine as part of a five-year transit contract that spans from 2020 to 2024. In return, Naftogaz paid about $5.4 billion to the Operator of the GTS of Ukraine to facilitate transit. Russia made the largest payment in 2020—over $1.7 billion—due to higher volumes of reserved gas capacities.

- Because of the occupation of the Luhansk region, Ukraine temporarily lost access to the Sokhranivka gas measuring station, one of the two entry points into the Ukrainian gas transmission system that allowed Russian gas to flow in. Russia declined to transfer the transit volume to another point, Suja, and also reduced its payment for transit. In this context, Naftogaz of Ukraine turned to international arbitration.

According to Bloomberg estimates, Gazprom sold around $6 billion worth of gas through Ukraine in 2024. However, many economists and researchers expect a limited economic impact from the loss of these sales. Various estimates suggest Russia will lose approximately 0.2-0.3% of its GDP.

For Russia, rerouting all the gas that was previously sent to Europe through Ukraine will be challenging. Increased shipments to China will partially compensate the decline in supplies through Ukraine. The volume of supplies to China in 2024 was about 31 billion cubic meters. By 2025, this is expected to grow to 38 billion cubic meters as the Power of Siberia gas pipeline attains its full design capacity.

It cannot be excluded that the transit may be renewed in the future. At least, Kyiv expressed its readiness to transit gas if it is not of Russian origin.

The energy regulator raised tariffs for natural gas transportation through the main pipelines.

On December 30, the National Commission for State Regulation in the Energy and Utilities Sector (NEURC) adopted a resolution to establish new tariffs for natural gas transportation for the gas TSO Ukraine LLC for 2025-2029. The resolution took effect on January 1 2025.

According to the resolution, tariffs for entry/exit to the Ukrainian GTS were increased:

- from €4.1 to €10.29 per thousand cubic meters for most entry points into Ukraine’s GTS;

- from з €7,6-8,6 to €14,58-15,74 per thousand cubic meters, up to €14.6 to €15.8 for most exit points from the Ukrainian gas transmission system (GTS).

Tariffs for entering/exiting the GTS for internal points were increase by more than 4 times:

- from UAH 101.93 to UAH 464.37 per thousand cubic meters for internal entry points;

- from UAH 124.16 to UAH 501.97 per thousand cubic meters for internal exit points.

The tariffs do not include connection points on the border with Russia (Sudzha and Sokhranivka) due to a lack of information on the volumes booked for them. The tariffs also consider the scenario of no transit of Russian gas beginning in 2025.

However, the share of transportation costs in the price is small and will not significantly affect prices. This will not impact household gas prices, as the tariff is regulated.

Exploration, Drilling, and Production

In 2024, Ukraine increased gas production by 2.2%.

According to the 2024 results, Ukraine’s gross natural gas production increased by 2.2% compared to 2023, reaching 19.12 billion cubic meters. Gas production rose from 18.7 bcm in 2023 to 19.12 billion cubic meters in 2024, despite the ongoing war and the suspension of Smart Energy’s special permits.

- The growth rate of production volumes in 2024 was higher than the previous year, when production increased by 0.9%. This is also the highest production growth since 2018. However, the volume of gas production decreased from 2019 to 2022.

- In 2022, Ukraine’s natural gas production decreased by 6% as a result of Russia’s full-scale invasion.

- In 2023, Ukraine ramped up gas production, primarily through state-owned companies. These companies are still the primary drivers of the increase in natural gas production in Ukraine for 2024, while private companies continue to show a decline. However, in the second half of 2024, production from private companies also rose compared to the previous year.

Others

The supervisory board of Naftogaz has appointed Roman Chumak as the acting chairman of the board.

On December 3, Oleksii Chernyshov, Naftogaz’s CEO, left the company to join the government. The next day, the Supervisory Board of Naftogaz of Ukraine elected Roman Chumak as acting chairman of the board.

The supervisory board agreed to start selecting a new head of Naftogaz.

- Roman Chumak served as the financial director of Naftogaz Group and has been a member of the company’s board since September 28, 2021. He has been with Naftogaz for around 20 years, holding various positions, from chief specialist to department director. Before that, he worked in major banking institutions and the private sector.

- At Naftogaz, Chumak managed the establishment of relationships between the group’s enterprises and banks and financial institutions. He was responsible for attracting financing in domestic and international financial markets, conducting short-term planning, and balancing the group’s liquidity. He also executed operations with securities and other treasury activities for the Group.

DTEK received the first tanker with US LNG.

Ukrainian energy holding company DTEK has received its first shipment of US LNG. On December 27, the tanker Gaslog Savannah delivered approximately 100 million cubic meters of natural gas from the US liquefaction plant in Louisiana to the Greek LNG terminal Revithoussa. D. Trading expects this cargo to be the first in a series of shipments from the US and aims to expand its LNG operations to northern Europe and the Baltics.

***

Ukraine’s power systems faced two more large-scale Russian attacks in December. However, the damage was less severe than in previous times, and the extent of power supply restrictions was smaller. Additionally, warmer temperatures led to reduced power demand, resulting in fewer cutoffs.

The attacks led to a 2.6-fold increase in imports in December compared to November 2024. Two waves of significant Russian attacks on Ukraine’s power systems boosted demand for imported electricity. Meanwhile, prices in neighboring countries have dropped slightly, making electricity imports commercially viable. New attacks are likely to occur in early 2025, especially when temperatures fall below freezing.

On January 1, 2025, Ukraine’s gas transmission system operator stopped the transit of Russian gas through its territory. This halt was caused by the expiration of the five-year transit contract for Russian gas established in 2019. However, we cannot rule out the possibility that gas contracts may one day be renewed. In 2024, Ukrainian officials stated multiple times that Kyiv was prepared to transit gas, as long as it was not of Russian origin.

Some European countries that benefited from Russian gas in the past continue to pressure Kyiv, demanding that gas contracts be renewed. Slovak Prime Minister Robert Fico threatened to cut electricity supplies to Ukraine in response to the halt of Russian gas transit after the relevant contract expired. However, Fico’s statements can be interpreted as mere blackmail.

Officially, the government is unable to suspend the electricity supply. These privately owned, independent companies supply electricity, alongside the independent transmission system operator responsible for power transmission to Ukraine. The only legal justification for this is sanctions. However, the question remains whether the European Commission will have a dispute with Bratislava if sanctions are imposed. And if the Slovak TSO, SEPS, suspends electricity transmission due to a political decision, ENTSO-E may launch an investigation to assess TSO’s independence. This could lead to sanctions, including the revocation of the TSO’s certification.

The government approved the nominations for members of the supervisory board of the National Power Company Ukrenergo. The board, comprising experienced foreign professionals with excellent reputations, has begun its work. This means that Ukrenergo will soon be able to negotiate with creditors on green bond payments. Negotiations on payment restructuring stopped in November, which led to a downgrade of Ukrenergo’s long-term issuer default rating to restricted default. The company’s lack of a supervisory board contributed to the suspension of the restructuring negotiations.

The situation with the electricity market is expected to stabilize in 2025. Energoatom has settled its debt to the Guaranteed Buyer for subsidizing household electricity tariffs. The new tariffs approved by the energy regulator for Ukrenergo will most likely mean the capability to cover all expenses in 2025. However, the debts from the previous year will not be paid off in 2025.

Вам також буде цікаво:

Spy scandal in Britain: who poisoned Sergii Skrypal and how will this end for Russia?

IS UKRAINE READY FOR THE UPCOMING GLOBAL CRISIS?

FLAMBOYANT TORY AT THE HEAD OF THE UK: WHAT TO EXPECT

Ukrainian authorities and Saakashvili on their way to abyss

GRAIN TERMINAL IN THE PORT YUZHNY – A NEW INVESTMENT PARADISE

RUSSIA WILL NOT ALLOW TO PROVE THE EXISTENCE OF THE ECOLOGICAL DISASTER IN THE OCCUPIED CRIMEA – TYSHKEVICH