Monthly Energy Digest – July

By Andrian Prokip

- Due to capacity shortages, July was the most challenging month for the power system.

- Naftogaz Group companies increased gas production by 8% in the first half of 2024.

- Ukraine expanded sanctions against Russian Lukoil, prohibiting the transportation of its oil across the country to Hungary, Slovakia, and the Czech Republic. However, the total volume of oil transit remained the same.

The Electricity Market

The general situation in the power system

July was the most challenging month for the power system in 2024. Due to extremely hot weather, power demand has risen drastically. At the same time, a significant share of the nuclear power units was under maintenance to be prepared to operate at total capacity in winter. Imports were insufficient to cover the deficit, and the transmission system operator had to restrict consumption with scheduled and emergency power cutoffs. Some days, customers were cut off longer than when electricity was supplied.

By the end of the month, demand had decreased due to cooler temperatures, and some capacities were put into operation after the maintenance. So, the country entered the period without restrictions and cutoffs.

Occasional Russian air attacks still happened, damaging Ukrainian power substations and power plants. But the scale of damage was smaller than in the first half of the year.

Exports and Imports

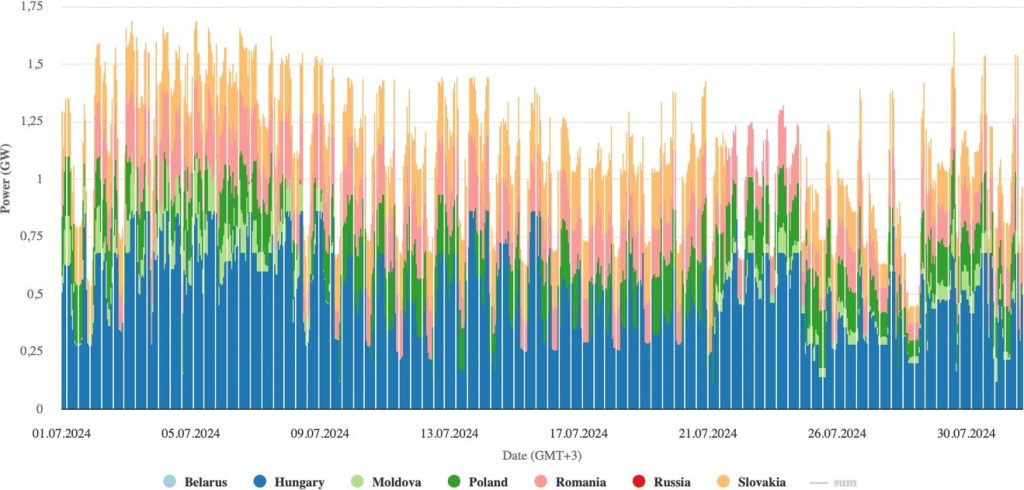

Electricity export (- minus) and import (+ plus) during the month

In July, Ukraine reduced electricity imports by 2%.

In July 2024, Ukraine reduced electricity imports by 2% compared to June 2024 – to 837.8 thousand MWh. During the month, deliveries increased only from Hungary, by 5.5%, and from Poland, by 10%. In the rest of the directions (Slovakia, Moldova, Romania), electricity imports decreased. Hungary continues to hold the largest share of the imports – 45%, followed

by Poland (19%) and Romania (18%). Slovakia and Moldova were responsible for the rest.

From July 10 to July 21, during the period of abnormal heat, the import of electricity from Moldova was temporarily stopped by the decision of the local operator of the transmission system as part of energy security measures.

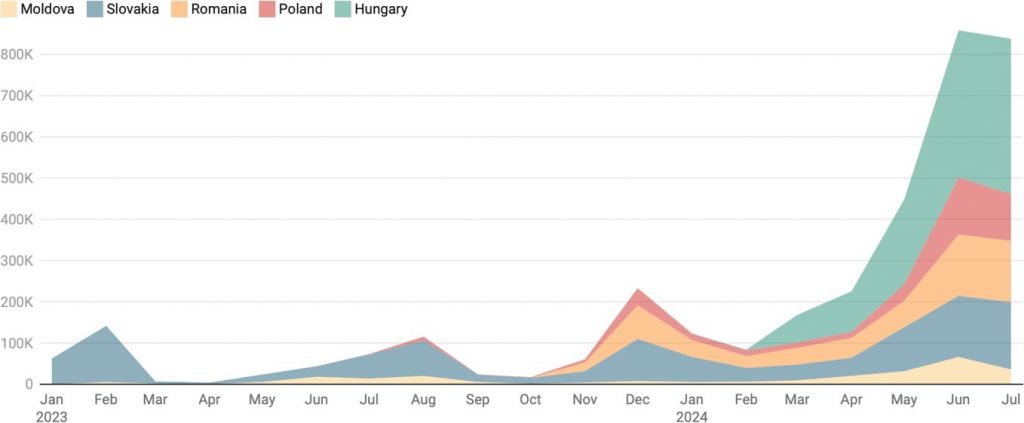

Monthly electricity import in 2023-2024, MWh – ExPro Consulting

In June 2024, Ukraine imported 858.3 thousand MWh of electricity, 91% more than the previous month’s volume (May 2024). There was no electricity export in June.

There has been no electricity export for two months. The last time electricity was supplied abroad was on May 12, at a minimum level of 125 MWh. Since the beginning of 2024, electricity exports have amounted to 238,000 MWh (217,000 MWh before Russia’s first strike in 2024 – March 22). Imports for this period amounted to almost 3 million MWh.

Ukraine spent EUR 212 million to import electricity in the first half of 2024.

According to independent estimates by ExPro Consulting, Ukraine imported 212 million euros of electricity in the first half of 2024.

The cost of imports in June 2024 exceeded 100 million euros. Due to higher demand from the EU and possible price increases in neighboring markets, the cost of imported electricity is expected to increase even more in the second half of 2024.

A decision on increasing electricity imports from the EU is expected in September.

The Ministry of Energy reports that Ukraine is negotiating with European transmission system operators to increase the capacity for electricity imports from 1.7 GW to 2.2 GW. A decision on raising the limit for electricity imports from the EU is expected in the next few months. Ukraine wants to increase the limit to at least 2.2 GW with the existing import limit of 1.7 GW.

The critical concern is that increased imports and a failure of one of the powerlines may cause overload in some European countries, including those not bordering Ukraine. Ukrenergo proposes to improve the equipment in Ukraine, which would help to avoid such a scenario. ENTO-e must assess this step and make necessary tests.

Market shaping

Ukrenergo is starting test auctions for auxiliary services for up to 5 years.

Ukrenergo (transmission system operator) started test auctions for auxiliary services for up to

5 years on July 18, 2024. At the end of June, the energy regulator allowed Ukrenergo to purchase auxiliary services for up to five years.

The Gas Market

Gas transit status and updates

The transit of Russian gas to Europe through Ukraine increased by 11% in the first half of 2024.

In January-June 2024, compared to last year, Russia increased the gas supply for transit through the Ukrainian gas transport system to the European Union and Moldova by 11% to 7.7 bcm.

In 2023, Ukraine reduced the transit of Russian gas by 28.5% to 14.65 bcm compared to 2022.

Gas import and storage

The state provided guarantees for the EBRD loan to Naftogaz for 200 million euros.

Naftogaz will be able to attract EUR 200 million from the European Bank for Reconstruction and Development (EBRD) under state guarantees to support the creation of strategic natural gas reserves.

At the end of 2022, Naftogaz has already attracted an EBRD loan under state guarantees of 300 million. These were used to create a natural gas reserve of 748 million cubic meters in the “customs warehouse” mode.

Exploration, Drilling, and Production

Naftogaz Group companies increased gas production by 8% in the first half of 2024.

Naftogaz subsidiaries UkrGazVydobuvannia and UkrNafta increased natural gas production by 8% in the first half of 2024. Thus, in 6 months of 2024, these produced 7.3 bcm of commercial gas.

Naftogaz plans to increase gas and oil production in 2024. In 2024, the company plans to produce 15 bcm of natural gas and 2 million tons of oil. In 2023, the company’s total gas production amounted to 14 bcm.

- In 2022-2023, Ukrainian gas production companies drilled 224 wells. In the first year of the full- scale war, 74 wells were drilled, exceeding the pre-war indicators, and in 2023, this indicator increased to 150 wells. This is the highest indicator in Ukraine over the past six years since introducing incentive taxation for drilling new gas wells: 2.5 times more wells were drilled in Ukraine in 2023 than in 2020 and 24% more than in 2018.

- The sector leader is the state-owned UGV, which commissioned 86 new wells last year, 24 of which have an initial flow rate of more than 100,000 cubic meters.

The Oil Market

Oil transit status and updates

Ukrainian sanctions blocked the transit of Lukoil’s Russian oil to Hungary and Slovakia.

- Ukraine expanded sanctions against Russian Lukoil, prohibiting the transportation of its oil across the country. Naftogaz says oil from the sanctioned Lukoil in transit to Europe was replaced by supplies from other companies, and the total volumes of oil

transit in July, after the application of sanctions, remained unchanged.

Slovak Prime Minister Robert Fizo criticized Lukoil’s termination of the transit through Ukraine of the supply of Russian oil to the Slovnaft oil refinery. He said this would not only impact the Slovak market but may also lead to the cessation of supplies of petroleum products (produced at Slovnaft) to Ukraine, which comprise almost a tenth of all Ukrainian consumption.

Hungary called the decision to stop transit allegedly a clear violation of the Association Agreement with the EU. Hungary plans to block reimbursement from European Union funds to member states that supply arms to Ukraine until Kyiv resumes the transit of Russian Lukoil oil to the MOL refinery.

Prime Minister of Ukraine Denys Shmyhal stated that Ukraine will not renew the transit of Lukoil oil through the Druzhba oil pipeline, as the refusal of these supplies does not threaten the energy security of the EU and its individual members. This position complies with the European Commission’s, which stated that there is no immediate risk to the security of oil supplies to Hungary and Slovakia, as sanctions imposed by Ukraine on Russian oil company Lukoil do not affect the transit of oil through Ukraine to Hungary.

At the same time, Kyiv says it guarantees the transit of oil to companies that are not subject to sanctions and is ready to resolve the transit issue with Slovakia following the association agreement with the European Union –to join the consultations within the framework of the early warning mechanism.

Russian “Lukoil” has been under Ukrainian sanctions since 2018. However, previously, they were limited—they related to the withdrawal of capital, restrictions on trade operations, and prohibition of participation in the privatization or leasing of state property. In June, the National Security and Defense Council expanded them, adding a ban on transit

Lukoil has a contract with the Hungarian MOL group to supply about 4 million tons of oil annually to refineries in Hungary and Slovakia.

Russia supplies about 500,000 tons of oil per month to the Slovak refinery Slovnaft of the MOL group. More than 50% of this volume comes from Lukoil resources.

Hungary’s Duna refinery can import alternative Urlas oil blends through the Mediterranean port of Omisal in Croatia, while Slovnaft receives oil only through the Druzhba system.

Regulations

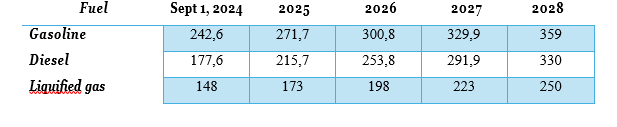

The parliament supported the increase in excise duties on automotive fuels.

On July 18, the Verkhovna Rada passed draft law No. 11256-2 on increasing the excise tax on fuel. The issue is contradictory, as it will push inflation. Supporters of the law argued it complied with European regulations.

Schedule of increases in fuel excise tax rates (euro per 1,000 liters)

The increased excise duty on fuel will provide UAH 2.7 billion to budget monthly during 2024.

Developments on Assets Nationalizations

The Prosecutor’s Office announced that Medvedchuk was suspected of stealing a diesel pipeline.

The Kharkiv Regional Prosecutor’s Office notified Viktor Medvedchuk and four accomplices of suspicion of organizing crimes aimed at seizing the Samara – Western direction pipeline.

- On February 1, 2024, the Supreme Court finally recognized the state’s ownership of the Ukrainian part of the oil pipeline “Samara – Western direction”.

The court canceled the arrest of the Ukrainian subsidiary “BelorusNeft”.

The Kyiv Court of Appeal canceled the arrest of the company Service Oil, which belongs to the Belarusian government, rejecting the appeal against the decision of the first instance.

- The company’s property was seized at the beginning of the full-scale war due to Belarus’s involvement in the Russian aggression against Ukraine. In March 2023, the company’s assets were transferred to the management of DTEK.

Other News and Developments

Preparations to winter

18 out of 91 small-scale combined power plants provided by USAID have already been connected in the regions.

USAID delivered 91 cogeneration plants to Ukraine, with a total capacity of 56.5 MW. Eighteen are installed, and the rest are in the process of connecting to grids.

The parliament introduced preferences for the import of energy equipment into Ukraine.

The Verkhovna Rada adopted draft laws No. 11258 and No. 11259 on the provision of customs and value-added tax (VAT) privileges for the import of energy. The list covers solar and gas power generation and energy storage systems, as well as diesel and other fuel power generators. At the same time, the list does not cover wind power equipment.

The government has simplified the conditions for the implementation of distributed generation projects.

The government has simplified the conditions for the implementation of distributed generation projects.

Simplification for business:

- The list of necessary documents for entrepreneurs to construct and place gas piston and gas turbine installations is shortened. It is no longer required to receive – urban planning documentation, urban planning conditions and land development restrictions, a report on the results of the examination of project documentation for the construction of objects, the right to perform construction works, and an environmental impact assessment.

- The Unified State Electronic System is unnecessary in construction, heat supply schemes, or land allocation.

- Construction can be carried out during the development of project documentation, and operation is carried out without a certificate of acceptance into operation.

Regarding connection to power grids:

- The required documents have been reduced from 7 to 2.

- The deadline for issuing and approving technical conditions has been reduced from 10 to 2 days.

- Only a certificate from the local administration about the need for urgent connection of electrical installations and graphic materials indicating the location of the installations is required.

The conditions for connecting to heating networks have also been simplified.

- The deadlines for considering the application and providing the draft contract for accession were reduced from 10 to 1 day.

- The fee for connecting to heat networks is not charged if the relevant local self- government unit decides to allocate funds from the regional budget to compensate for all costs.

Financing

- For small and medium-sized businesses, the state program “Affordable loans 5-7-9%” expanded to the construction and arrangement of gas turbine, gas piston, and biogas generation plants.

- For the public – introducing loans for installing solar panels with storage systems at 0% per annum. The loan amount can be up to UAH 480,000, and the loan term can be up to 10 years.

Others

The government appointed two new members of the NEURC.

The Cabinet of Ministers appointed Yury Vlasenko and Ruslan Slobodyan to the positions of members of the National Commission for State Regulation in the Energy and Utilities Sectors (NEURC). The contest committee selected both as two existing commissioners were finishing their terms of service in the regulator. Later, Vlasenko was elected chair of the commission.

Fitch confirmed the rating of “Ukrenergo” at the CC level.

The international rating agency Fitch Ratings confirmed the long-term rating of NPC Ukrenergo at the CC level (pre-default level). Fitch expects the war to last until 2025, with electricity consumption steady in 2024, still well below pre-war levels, and burdened with deficits due to destroyed energy infrastructure. According to the agency, this will continue to limit Ukrenergo’s income from transmission and dispatch and will lead to additional costs for reconstruction and new investments. At the same time, Fitch expects that Ukrenergo’s EBITDA will stabilize in 2024-2025, and the EBITDA indicator in 2025 will generally correspond to UAH 16 billion in 2023. According to forecasts, capital expenditures are expected to average UAH 4.9 billion per year in 2024-2025 compared to UAH 4.1 billion in 2023.

The government approved the Strategy for the Development of Distributed Generation until 2035.

The Cabinet of Ministers approved the Strategy for the Development of Distributed Generation until 2035 and the operational plan of measures for its implementation in 2024- 2026. The strategy stipulates constructing 1 GW of gas-fired capacities by the end of the year and an additional 4 GW by the end of 2026.

Naftogaz made payments on Eurobonds.

Naftogaz of Ukraine made mandatory payments on Eurobonds following the restructuring schedule. Under the terms of the restructuring, Naftogaz has made compulsory payments; the next one is planned for November 2024.

- In November 2022, Naftogaz of Ukraine appealed to the owners of Eurobonds due in 2022 and 2026 with a proposal to intensify cooperation to find a mutually acceptable solution to exit the default.

Вам також буде цікаво:

France after election: how the relationships with Ukraine will be changed (ua)

Special operation of law enforcement bodies “Ex-tax collector”: dedicated to all “ex”

Africa. Hidden Opportunities for Economic Growth in Ukraine

SAYING THAT UKRAINE CAN INFLUENCE SANCTIONS AGAINST RUSSIA IS MERE PAPHOS — TYSHKEVICH

CONVICTED FOR THE IL-76 ACCIDENT GENERAL NAZAROV GETS AN APARTMENT FROM THE MINISTRY OF DEFENCE

Revolution on water: how Ukraine can make money on the rivers