Monthly Energy Digest – November

- Russia renewed its energy terror campaign: two wide-scale attacks on energy facilities took place in November.

- “Ukrenergo” temporarily suspended payments for green bonds.

- The Cabinet of Ministers approved the candidacies of independent members of the supervisory board of NEC Ukrenergo.

- Two more pilot auctions were held to distribute the support quotas for RES. But only a few applied.

- “Ukrnafta” buys 51% of the Shell gas station network shares.

- The State Geological Survey again suspended the operation of Smart Energy special permits.

International Cooperation

The G7+ group noted Ukraine’s progress in reforming the energy sector.

The G7+ Energy Coordination Group members commended Ukraine’s advancements in energy sector reform and pledged continued support in rebuilding the nation’s energy infrastructure, focusing on the shift towards a decentralized, sustainable energy system. This was marked in the joint statement of the G7+ Ukraine Energy Coordination Group and the Government of Ukraine promoting sustainable green recovery of Ukraine’s energy system.

Ukraine and the U.S. will expand cooperation in small modular reactors.

At the COP29 climate conference in Baku, the United States and Ukraine announced the launch of three new small modular reactors (SMR) projects with a total funding of $30 million. The partnership will be implemented within the FIRST (Foundational Infrastructure for the Responsible Use of Small Modular Reactor Technology – Basic) program infrastructure for the responsible use of small modular reactor technology.

The program involves the implementation of three interrelated projects:

- Construction of a pilot plant for producing pure hydrogen and ammonia (the Clean Fuels Project).

- Conversion of coal-fired power plants to SMR (the Phoenix Project).

- Development of a roadmap for decarbonizing the steel industry using SMR (the Clean Steel project).

The Electricity Market

The general situation in the power system

As of November 16, the Ukrainian energy system has functioned for 61 days without nationwide restrictions on consumer electricity supply.

On Sunday, November 17, Russian armed forces carried out a widespread combined attack on Ukraine’s power system. Kremlin forces launched approximately 120 cruise, ballistic, and aeroballistic missiles, as well as 90 drones. Targeting thermal, hydro, and transmission infrastructure led to emergency cuts in some regions. The power supply situation was most difficult in the Odesa, Volyn, and Rivne regions.

The International Atomic Energy Agency (IAEA) announced that Ukraine’s nuclear power plants (NPPs) have lowered electricity production as a precaution. On Sunday, only two out of nine reactors produced electricity at full capacity, while the remaining units operated at reduced generation levels ranging from 40% to 90% of their capacity.

On November 28, Russia conducted another wide-scale attack on Ukraine’s power system. This time, all missiles and drones were targeted at transmission substations. This was the 11th massive attack in 2024. During the shelling, the Russians used more than 90 missiles of various types, including Calibers with cluster ammunition.

The attack was designed to shut down nuclear power plants and disconnect them from the power grid to cause a blackout in the power system. NPPs decreased the operating capacity before the attack (emergency cutoffs were introduced to reduce demand so that it could meet power production). The consequences of the attacks are complicated as Russians now use missiles with cluster munitions (at least, that was the second attack when missiles with cluster munitions were used).

Exports and Imports

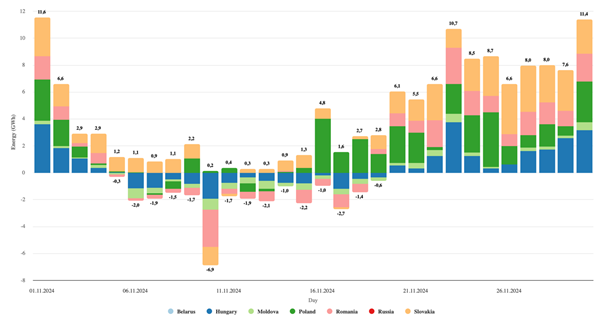

Electricity export (- minus) and import (+ plus) during the month

Electricity imports decreased by 9.4% in November.

Electricity imports in November 2024 decreased by 9.4% compared to the previous month, totaling almost 165,000 MWh.

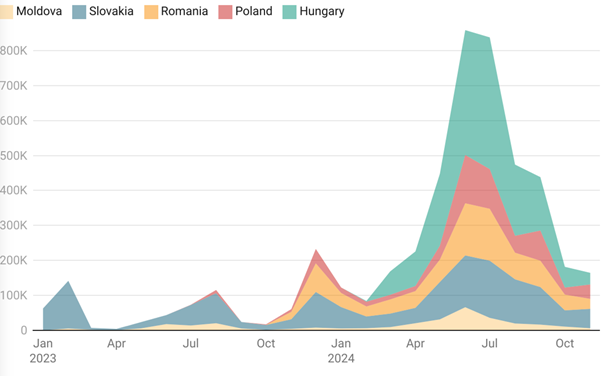

Electricity import, per month, 2023-2024, MWh. ExPro agency data

The volume of deliveries decreased the most in the Hungarian and Moldovan directions – by 44%. At the same time, the import of electricity from Poland doubled – to more than 40,000 MWh. Slovakia had the largest share of imports in November, with 33%, followed by Poland, with 25%.

The largest daily import was 12,000 MWh on November 1, and the smallest was 1,000 MWh on November 10. The average hourly electricity import during the evening peak in November was 470 MW, representing 27.6% of the total technical capacity of 1700 MW.

The Cabinet of Ministers has lowered the threshold for importing electricity by enterprises to operate without outages.

The Cabinet of Ministers of Ukraine has reduced the level of electricity imports by enterprises from 80% to 60%, for which power supply cutoffs will not be applied. If any company imports or produces 60% of its electricity consumption, it will not be subject to scheduled cutoffs.

Debts and non-payments

“Ukrenergo” temporarily suspended payments for green bonds.

Ukrenergo has temporarily suspended payments on debt obligations for green bonds issued in 2021 under a state guarantee. On November 9, Ukrenergo had to pay for these green bonds, which were issued for about 830 million dollars to cover the debt for feed-in tariffs to renewable energy producers.

The Law of Ukraine imposes the corresponding suspension On the Peculiarities of Transactions with State, State-Guaranteed Debt, Local Debt, and State Derivatives, the decisions of the Cabinet of Ministers of Ukraine (made in late August), and the relevant authorized management body—the Ministry of Energy of Ukraine—adopted in implementation of this Law. In accordance with these legislative acts, Ukrenergo was compelled to negotiate debt restructuring and, as a result, did not have sufficient time to make the payment on time.

The governmental resolution allows for “consent payment” to investors who agreed to the Ukrainian terms of debt restructuring. So, the legislation temporarily suspends bond payments until the restructuring process ends. Ukrenergo and the Ukrainian Cabinet of Ministers are taking the necessary measures to reach an agreement with the bond owners in the coming months.

Ukrenergo’s debt to the “Guaranteed Buyer” for RES Service exceeded UAH 30 billion.

As of October 1, Ukrenergo’s debt to the Guaranteed Buyer for renewable energy sources support (to pay feed-in tariff) has exceeded UAH 30 billion. Settlements with RES producers under the green tariff in 2024 were 60.8 % (61.6 % as of September 1). In general, the final payment level for previous years was 91.5 % for 2023, 61.3% for 2022, and 99.7 % for 2021.

Renewable Power Sector

Two more pilot auctions were held to distribute the support quota for RES.

The second pilot green auction, held on November 14, distributed quotas for small hydropower plants. Two companies participated, offering 900 and 999 kW, respectively. The maximum size of the auction offer is 12 euro cents per 1 kWh. The participants offered 11.10 and 11.90 euro cents for 1 kWh, respectively.

The third pilot green auction for the allocation of the quota of 88 MW of wind energy capacity did not take place because only one participant applied, while the minimum required number is two. Only one company applied for 20 MW at an 8.99 euro cents per kWh price.

- On October 31, the first pilot green auction was held to distribute the support quota to construct new capacity from alternative energy sources. The auction offered a quota for 11 MW of solar PV power plants. However, no bidder applied, so the auction did not take place.

- Mistakes in the rules to apply auctions, defined by legislation, explain the weak interest of potential participants.

The Gas Market

Gas balance

Gas consumption rose by 6% in November 2024 compared to the same month last year, driven by a surge in demand for electricity generation along with fluctuating weather conditions.

Ukraine’s daily gas consumption has surpassed 100 million m³/day. In addition to the short-haul re-export from underground gas storage facilities (UGS), which can reach up to 10 million m³/day, this necessitates a withdrawal of up to 60 million m³/day from UGS.

In November, NJSC Naftogaz of Ukraine did not import natural gas but purchased it from private gas production companies.

Gas transit status and updates

Slovak SPP signed a pilot agreement on Azerbaijani gas.

SPP, Slovakia’s primary gas purchaser, announced it had signed a short-term pilot contract to acquire natural gas from Azerbaijan, with plans to explore a long-term agreement while strategizing for potential interruptions in Russian supply to Ukraine.

Oleksiy Chernyshov, head of Naftogaz, informed that the test batch of Azerbaijani gas to Slovakia will not be pumped through the Ukrainian gas transportation system. Some media outlets reported that small amounts of Azerbaijani gas will be transported through the Trans Balkan pipeline in Bulgaria.

Gas transit volume through Ukraine remained stable when direct Gazprom supplies to Austrian OMV were suspended.

On Saturday, November 16, Russia stopped gas supplies to Austria due to a payment dispute but maintained consistent gas flows to Europe through Ukraine, as other buyers requested additional gas. Gas is likely traded to Slovak or Hungarian companies and then retraded to OMV.

Gas transportation tariffs in Ukraine might rise significantly starting in 2025.

The National Energy and Utilities Regulation Commission (NEURC) plans to consider a draft resolution setting new tariffs for natural gas transportation by gas TSO for 2025-2029. The tariff for entry/exit to the Ukrainian GTS will be increased. The tariffs also consider the scenario of no transit of Russian gas starting in 2025.

Tariffs do not include connection points on the Russian border (Sudzha and Sokhranivka), as there is no information on the volumes booked for them. If an agreement is reached on the transit of Russian or Azerbaijani gas, the tariffs may be revised, and additional tariffs may be imposed for entering the Ukrainian gas transmission system at the Russian border.

According to the published draft resolution, it is planned to double the tariff for entry/exit to the Ukrainian GTS for international points:

- from €4.1 to €10.3 per thousand cubic meters for most entry points into Ukraine’s GTS;

- from €7.6 to €8.6 per thousand cubic meters, up to €14.6 to €15.8 for most exit points from the Ukrainian gas transmission system (GTS).

Tariffs for entering/exiting the GTS for internal points are proposed to increase by more than 4 times:

- from UAH 101.93 to UAH 464.87 per thousand cubic meters for internal entry points;

- from UAH 124.16 to UAH 505.5 per thousand cubic meters for internal exit points.

At the same time, considering the relatively small share of the gas transportation fee in the final gas price, this increase will not be very sensitive.

Exploration, Drilling, and Production

Naftogaz Group’s companies increased gas production by 6%.

Subsidiary companies of Naftogaz—JSC UkrGazvVydobuvannya and PJSC UkrNafta—increased natural gas production by 6% to 12.3 billion cubic meters in the first ten months of 2024.

The Oil Sector

“Ukrnafta” buys 51% of the Shell gas station network shares.

PJSC Ukrnafta has reached an agreement with Shell to purchase 51% of the shares in Alliance Holding LLC, the owner of the Shell gas station network. Ukrnafta will take majority ownership of the gas station network, comprising 118 operational stations and additional facilities.

The state, represented by the State Property Fund, is another co-owner of Alliance Holding LLC, which owns 49% of the company.

- At the end of October 2024, the State Property Fund officially owned 49% of Alliance Holding LLC’s authorized capital. Alliance Holding LLC manages the network of Shell gas stations in Ukraine. This share previously belonged to the Russian citizen Eduard Khudainatov. After the start of a full-scale invasion, Ukraine imposed sanctions against Khudainatov.

- In compliance with this decision, the previous owners of Alliance Holding LLC – Cicerone Holding B.V. and Bogstone Holding B.V. – the founders of the company were removed from the list and a new ownership structure was approved: 51% owned by Shell Overseas Investments B.V. and rest 49% by the State Property Fund of Ukraine.

- The State Property Fund (SPF) is preparing to privatize 49% of Ukraine’s nationalized Shell gas station network.

The winner of the competitive process, Ukrnafta, and Shell must apply to the Antimonopoly Committee for a concentration permit. This permit is a mandatory prerequisite for completing the agreement. After that, the company will be able to fully complete the transaction and acquire all the rights and obligations of the shareholder.

Developments on Assets Nationalizations and Sanctions

Developments on assets nationalizations

The State Geological Survey again suspended the operation of Smart Energy special permits.

For the second time, the State Geology and Subsoil Service of Ukraine (DerzhGeoNadra) has suspended the validity of special permits for subsoil use for companies from the Smart Energy Group. The suspension of special permits is related to NSDC sanctions against some foreigners who are the ultimate beneficiaries of Smart Energy Group companies. The NSDC sanctions were approved by the presidential decree dated October 8, 2024.

DerzhGeoNadra suspended the special permits for the Svyridivskoe and Mekhedivsko-Holotovshchyna gas condensate fields in the Poltava region (Representative Regal Petroleum Corporation Limited) and the Vasyshchiv gas field in the Kharkiv region (ToV Prom-Energo Produkt). Subsoil users are obliged to stop the work provided for by special permits for the use of subsoil on the plots provided for their use within 20 calendar days.

Other News and Developments

Russian Attacks on Energy Infrastructure

Except for the power system, during the wide-scale attack on November 28, Russian missiles targeted underground gas storage facilities in the west of the country. These underground gas storage facilities located in the western regions of Ukraine have repeatedly been the targets of Russian missiles. More than 200 missiles and almost as many attack drones have attacked the Ukrainian energy facilities during November 28-29. In addition, in November, the Russian army actively shelled the infrastructure of electrical distribution networks in front-line regions.

Others

The Cabinet of Ministers approved the candidacies of independent members of the supervisory board of NEC Ukrenergo.

The Cabinet of Ministers of Ukraine approved the nominations of the winners of the selection for the positions of independent members of the supervisory board of the transmission system operator NEC Ukrenergo.

Approved candidates are the following.

- Patrick Greichen, head of the German think tank Agora Energiewende, served as State Secretary at the Federal Ministry for Economic Affairs and Climate Protection in Germany from 2021 to 2023.

- Luigi De Francisci was previously on the supervisory board of Ukrenergo and was a former top manager of the Italian energy company Terna.

- Jeppe Kofod, a Danish politician, served as the Deputy Head of the Delegation for Relations with the United States and was a member of the Committee on Industry, Research and Energy. He is also a former Member of the European Parliament and served as Minister of Foreign Affairs of Denmark..

- Jan Montell is the former Chairman of the Board of Directors of Nord Pool AS and Fingrid Datahub Oy, as well as the current Chairman of the Board of Directors of Skarta Energy.

The State Property Fund was unable to sell its share in oil refinery PJSC Naftohimik Prykarpattia.

The State Property Fund of Ukraine (SPFU) put up for privatization the state package of shares in PJSC Naftohimik Prykarpattia (formerly the Nadvirna oil refinery). The SPFU put 26% of the shares up for sale for UAH 440.45 million. The auction took place on November 20 in the Prozorro.Sales system, but it did not occur due to a lack of participants. The SPFU is holding a repeat auction to sell 26% at a reduced price of half – to UAH 220 million.

- PJSC Naftohimik Prykarpattia is situated in Nadvirna, within the Ivano-Frankivsk region. The company has faced prolonged unprofitability. According to its own data, it experienced a net loss of UAH 74.6 million in the first half of 2024, following a loss of UAH 189.6 million in 2023. Since 2012, its facilities have not been employed for oil processing and are currently used solely for the storage of oil and oil products.

Oleg Hotsynets has been appointed as the new chair of the State Geology and Subsoil Service Ukraine.

On November 29, the Ukrainian Cabinet of Ministers appointed Oleg Hotsynets head of the State Geology and Subsoil Service (Derzhgeonadra). Oleg Hotsynets was the head of the subsoil use department of JSC UkrGazVydobuvannia, the largest subsoil user in Ukraine. Hotsynets also worked as a project manager at NJSC Naftogaz of Ukraine and is an expert of the State Commission on Mineral Resources.

Вам також буде цікаво:

CREATIVE CITIES: AN AGENDA OR A CARGO CULT

$100 BILLION INVESTMENT. SOON YOU WOULDN’T RECOGNIZE THE ECONOMY OF UKRAINE

POLITICAL CRISIS IN AUSTRIA: FOUR MAIN CONCLUSIONS

Three main consequences of Saakashvili’s breakthrough

IT IS NECESSARY TO TIE THE INCREASE IN TEACHERSʼ SALARIES TO THEIR PROFESSIONAL STRENGTHS – MYKOLA SKYBA

RED LINES OF NEGOTIATIONS ON GAS TRANSIT, OR HOW NOT TO FALL INTO THE TRAP OF “GAZPROM”