May 2024.

Summary.

In April 2024, the US Congress and Senate voted for a $60.8 billion support package for Ukraine. Meanwhile, the economic aid in interest-free loans will be $7.85 billion, with the possibility of writing off 50% of the loan by the President of the United States after November 15.

The Board of the National Bank decided to reduce the discount rate from 14.5% to 13.5% starting from April 26, 2024.

The events of April showed that the National Bank of Ukraine (NBU) changed the exchange rate policy of the hryvnia against the US dollar. Despite the external financing of $9 billion in March, the NBU continued to devalue the hryvnia in April from 39.00 to 39.7 hryvnias to the dollar.

International reserves in April 2024 decreased from $43.8 to $42.4 billion.

| Apr-24 | Mar-24 | Mar-24 | |||||

| Macro summary: | 2020 | 2021 | 2022 | 2023 | 2024E NBU | 2024E IMF | 2024E UIF |

| GDP, billion hryvnias | 4 194 | 5 459 | 5 191 | 6 538 | 7 590 | 7 748 | 7 678 |

| GDP, billion US dollars | 156 | 200 | 158 | 179 | – | 190 | 199 |

| GDP growth | -3,8% | 3,4% | -29,1% | 5,3% | 3,0% | 3,5% | 3,6% |

| National debt/GDP | 60,8% | 48,9% | 68,3% | 81,3% | – | 94,1% | 92,7% |

| International reserves, year-end | 29,1 | 30,9 | 28,5 | 40,5 | 43,4 | 42,1 | 46,5 |

| Inflation | 5,0% | 10,0% | 26,6% | 5,1% | 8,2% | 8,5% | 8,9% |

| UAH/USD exchange rate, average | 26,9 | 27,3 | 32,9 | 36,6 | – | 40,7 | 38,5 |

| Unemployment | 9,9% | 9,8% | 24,5% | 19,1% | 14,2% | 14,5% | – |

| Current account, billion US dollars | 5,2 | -3,9 | 8,0 | -9,2 | -20,6 | -10,8 | -7,9 |

| Goods and services (balance) | -2,4 | -2,7 | -25,8 | -37,4 | -33,2 | -33,3 | -34,4 |

| Export of goods and services | 60,7 | 81,5 | 57,5 | 51,1 | 57,1 | 57,7 | 56,3 |

| Import of goods and services | 63,1 | 84,2 | 83,3 | 88,5 | 90,3 | 91,0 | 90,8 |

| Budget deficit, % of GDP | -5,2% | -3,3% | -16,3% | -20,5% | -18,4% | -13,7% | -19,9% |

Fact 2020-2023, Forecasts of the NBU, IMF, and UIF for 2024

The US aid package.

After six months of debating, the US Congress and then the Senate voted for the $60.8 billion aid package for Ukraine, which includes both military and financial aid. This vote will conclude the uncertainty regarding the funding sources for Ukraine’s budget in 2024. Unlike 2022 and 2023, this package provides financial assistance not in the form of grants but in the form of an interest-free loan, 50% of which can be written off by the President of the United States after November 15, 2024. Military assistance includes the transfer of ATACMS long-range missiles. After the vote at the end of April, the US gathered the first $1 billion package of military aid.

Economy.

GDP growth. The economic situation in Ukraine reflects the process of decelerating growth after rebounding from the bottom in the second—third quarters of 2023. The growth of the Ukrainian economy in 2023 was 5.3%. According to operational data from the Ministry of Economic Development, the Ukrainian economy’s growth in the first quarter of 2024 was 4.5%. The NBU worsened the estimate of GDP growth in the 1st quarter of 2024 from 7.1% to 3.1%. In general, this forms a negative dynamic in the Ukrainian economy, with a slowdown in its growth. The National Bank worsened the assessment of the growth of the Ukrainian economy in 2024 from 3.6% to 3.0% due tothe missile strikes on Ukraine’s energy sector. The Ukrainian Institute for the Future forecasts GDP growth in 2024 to be 3.6%.

Quarterly GDP growth forecast. Source: NBU. GDP Growth, %

Changes in the energy sector. Missile strikes in March and at the beginning of April, unlike in 2022, were carried out not at electricity distribution nodes but at electricity production nodes. Russia targeted maneuverable capacities, such as hydroelectric and thermal power plants. At the beginning of April, Ukraine lost 2/3 of its maneuverable generation capacities with a total volume of up to 7 GW. The integrity of the power system has been maintained, but starting in mid-March, Ukraine began to experience a shortage of electricity production, which has already started to be replaced by imports.

Import and export of electricity in March 2024

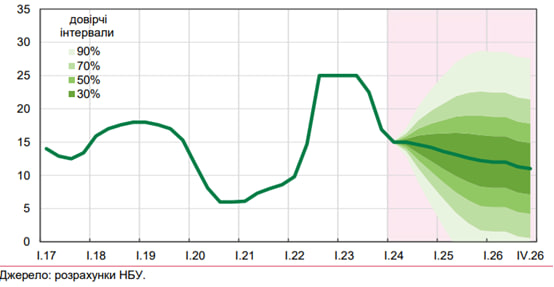

NBU rate. On April 25, the Board of the National Bank decided to reduce the interest rate from 14.5% to 13.5% starting from April 26, 2024. This decision was made taking into account the weakening of actual and expected price pressure and the reduction of risks associated with the receipt of international financial support. The basic scenario of the NBU forecast foresees a reduction of the interest rate to 13% in the current year. According to UIF’s experts, the rate should already be lower than 13%, considering the annual inflation in March at 3.2%. It can be promptly increased by 1-2% at any moment when inflationary expectations rise. Interest rates on new loans in national currency in March 2024 for the corporate sector were 16.6% and 34.5% for the households.

NBU rate forecast. April 2024 Confidence intervals

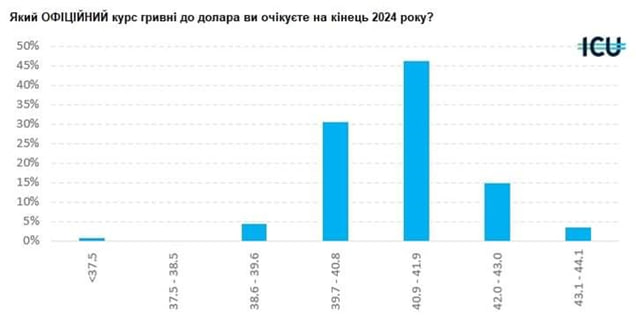

Changes in the exchange rate policy. In April, the National Bank of Ukraine changed the hryvnia’s exchange rate policy to the US dollar. If, in October 2023, with the arrival of financial aid, the NBU was ready to strengthen the hryvnia by selling $3 billion a month, it has now started the policy of deliberate devaluation of the national currency. Despite the external financing of $9 billion in March, the NBU continued to devalue the hryvnia in April from 39.00 to 39.5-39.7 hryvnias to the dollar. A survey conducted among economic experts and financial analysts showed a change in expectations regarding the hryvnia exchange rate at the end of 2024. More than 45% of experts see the hryvnia exchange rate in the 41-42 hryvnias to the dollar and more than 75% in the range of 39.5-42.

The hryvnia exchange rate to the US dollar from September 1, 2023. Source: NBU. US dollar

Survey data from April 24, 2024. What official exchange rate of hryvnia to the US dollar do you expect at the end of 2024?

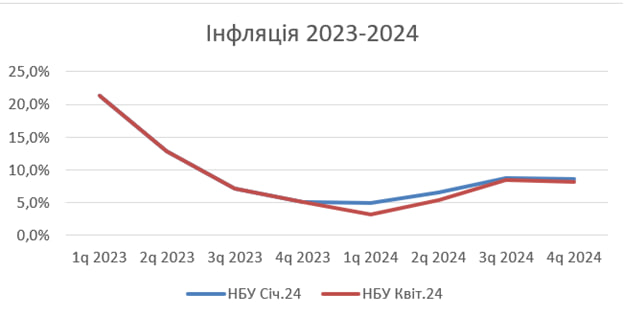

Inflation. Inflation in Ukraine fell to a record low in annual terms, reaching 3.2% at the end of the first quarter of 2024. Overall, inflation is expected to increase in the coming months until the 4th quarter of 2024. The National Bank of Ukraine lowered its annual 2024 inflation forecast from 8.6% to 8.2%. The current UIF forecast for the annual Inflation at the end of 2024 is 8.9%

Quarterly inflation forecast. Source: NBU. Inflation 2023-2024 NBU Jan 24, NBU Apr 24

Budget.

According to the consolidated budget, the first quarter of 2024 ended with a deficit smaller than a year ago—169.2 billion hryvnias compared to 181.8 billion hryvnias in 2023. This was achieved due to the measures taken by the Ministry of Finance and the legislative authorities to avoid liquidity issues in the absence of Western financing during the 2.5 months of 2024.

Thus, income tax revenues amounted to 107 billion hryvnias, up from 38.7 billion a year earlier, due to the banks’ transfer of 50% of profits for 2023. Revenues from VAT increased significantly due to the cancellation of tax incentives that were in effect until July 1, 2023.

Non-tax revenues also increased significantly due to dividends of state-owned enterprises, the income from which was received in February, while usually dividends of state-owned enterprises are paid in June.

| Indexes | 2021, 3m | 2022, 3m | 2023, 3m | 2024, 3m |

| млрд грн | млрд грн | млрд грн | млрд грн | |

| Total income | 330,8 | 418,5 | 627,6 | 747,2 |

| Tax revenues | 303,5 | 324,0 | 353,3 | 505,1 |

| Personal income tax | 74,6 | 86,0 | 105,8 | 120,3 |

| Income tax | 34,2 | 40,1 | 38,7 | 107,0 |

| Rent | 11,7 | 23,6 | 17,0 | 10,4 |

| Excise tax | 34,8 | 23,4 | 39,3 | 44,9 |

| VAT | 115,9 | 120,1 | 117,6 | 178,0 |

| Toll | 8,1 | 6,0 | 8,5 | 12,1 |

| Local taxes | 20,5 | 21,4 | 23,4 | 28,8 |

| Non-tax revenues | 26,6 | 89,9 | 139,8 | 202,8 |

| Revenues of budgetary institutions | 16,2 | 27,9 | 112,5 | 138,1 |

| Other income and grants | 0,0 | 3,8 | 133,9 | 37,7 |

| Total expenses | 336,3 | 447,3 | 809,5 | 916,4 |

| Administrative expenses | 18,8 | 18,4 | 18,8 | 23,3 |

| Debt service | 37,7 | 40,9 | 24,5 | 44,2 |

| Defense | 20,9 | 75,7 | 403,4 | 423,7 |

| Internal security | 32,5 | 51,8 | 91,7 | 143,0 |

| Economic activity | 18,1 | 20,5 | 20,8 | 22,4 |

| Natural environment | 0,9 | 0,8 | 1,0 | 1,7 |

| Housing and communal services | 4,2 | 8,1 | 7,5 | 8,5 |

| Health care | 39,7 | 45,9 | 45,2 | 47,5 |

| Sports, Culture | 7,4 | 7,7 | 7,3 | 8,5 |

| Education | 65,5 | 69,9 | 63,8 | 71,9 |

| Social and pension expenses | 90,5 | 107,6 | 125,4 | 121,7 |

| Deficit | 5,5 | 28,9 | 181,8 | 169,2 |

Implementation of the 2021-2024 consolidated budget in the 1st quarter of the year.

It must be stated that Western military aid, despite the absence of military support from the USA in the 1st quarter, has been even in a somewhat more considerable amount than in 2023, and defense expenditures were higher. Therefore, if the war continues until the end of 2024, then the military expenses at the end of the year may exceed the indicators of 2023, taking into account both the military support from the USA voted for in April and the 2nd-party security treaties signed by Ukraine with European countries.

Extra attention should be paid to 3 factors that can significantly increase the budget deficit in 2024.

- Loans from the USA instead of grants. $7.8 billion of loans instead of grants increase the budget deficit by 300 billion hryvnias.

- A 50% increase in internal security spending in 2024. If, in 2023, these expenditures amounted to 591 billion hryvnias, then with the dynamics of 2024, these expenditures may reach the level of 900 billion hryvnias.

- The Law on Mobilization 15 million hryvnias payments for each fallen soldier. If Ukraine loses 50,000 soldiers at the current intensity of hostilities, it will cost the budget an additional $19 billion. Although the Ministry of Finance plans to pay 20% immediately and then 2% for the next 40 months, this may still significantly affect the budget deficit growth as early as 2024.

External financing Ukraine received $11.78 billion in external financing in the first four months. Of these, $1.021 billion were granted in grants and $10.759 billion in loans, including €1.5 billion from the European Union in April. The US aid package vote concludes the uncertainty of Ukraine’s budget funding sources in 2024. According to our estimate, Ukraine should receive another $25 billion in foreign financing by the end of the year.

Ministry of Finance of Ukraine. Sources of financing of the state budget’s general fund The balance of funds in the government and local budgets accounts after receiving financing in the amount of $9 billion in March increased by the beginning of April to more than 300 billion hryvnias, or more than $7.5 billion, which forms a sufficient reserve of liquidity. Following this, one can argue that the budget crisis in 2024 will be solved.

National debt. In March 2024, the national debt increased from $143.7 to $151 billion, against the background of receiving external support from Western partners at $9 billion. Since the beginning of the war, the national debt has increased from $90 billion to $151 billion, or by $61 billion. Due to fewer grants in 2024 and the corresponding higher budget deficit, the national debt will continue to grow actively both in nominal terms and as a percentage of GDP. The current forecast of the Ukrainian Future for the Institute is that the national debt will amount to 92.7% of GDP by the end of 2024.

National debt, billions US dollars

National debt, % of GDP

Balance of payments.

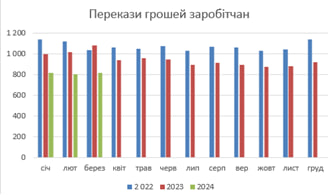

The positive trend of the first quarter of 2024 is improving the balance of payments trade balance. If, in the first quarter of 2023, the negative balance was $9.5 billion, then in the first quarter of 2024, it will be $7 billion. This was achieved both due to the stabilization of the export of goods through the logistics corridor by sea and a decrease in the import of services. Despite a slight drop in the export of goods in March 2024, the new logistics corridor by sea operates well. After the export failure in the 3rd quarter of 2023, when exports fell to $2.5 billion per month, the 1st quarter of 2024 shows exports of $3.1-3.3 billion per month. According to operational data, $3.3 billion worth of goods were exported in April, which creates an export potential of about $40 billion by the end of the year. (the UIF forecast from March — $38.5 billion). The negative trends of the 1st quarter of 2024 include the drop in remittances from Ukrainian economic migrants to Ukraine. If earlier they transferred $1 billion per month, then from the beginning of 2024 this amount has already dropped to $800 million. This indicates the acceleration of families moving from Ukraine when there is no one to whom to send money. A positive trend in March was the stabilization of society’s demand for cash currency. After a surge in demand from December 2023 to February 2024, demand for cash currency fell to $1 billion per month in March, common for wartime figures. This indicates a decrease in devaluation expectations in the future. The US aid package vote for Ukraine in April allows the claim that Ukraine’s balance of payments will be positive at the end of the year in 2024. At the same time, fewer grants and more loans are projected to worsen the current account balance and improve the financial account balance.

Export of goods in 2022-2024. Source: NBU. Export of goods, millions US dollars

Transfer of money from economic migrants to Ukraine in 2022-2024. Source: NBU. Transfers from economic migrants

Purchase of cash currency in 2022-2024. Source: NBU. Purchase of cash currency by the population

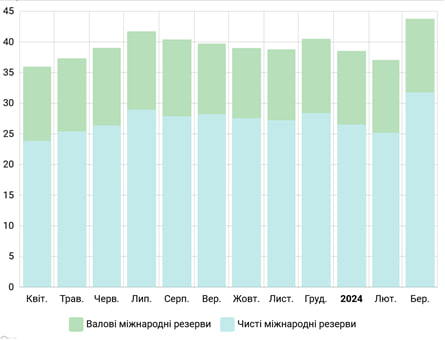

International reserves In the first quarter of 2024, Ukraine’s international reserves increased from $40.5 to $43.8 billion (+$3.3 billion). The increase was achieved due to the receipt of $10.2 billion in Western aid. International reserves decreased from $43.8 billion to $42.4 billion in April 2024. The net sale of currency by the NBU in April amounted to $2,264.5 million. $1,649.7 million was deposited into the government’s foreign currency accounts at the National Ban. €1.5 billion was received as a second tranche from the European Union. For service and repayment of the national debt in foreign currency, the government paid $884.5 million. The NBU improved its forecast of international reserves at the end of 2024 from $40.4 to $43.4 billion. The Ukrainian Institute for the Future forecast is $46.5 billion by the end of 2024

Changes in international reserves over the past 12 months. Source: NBU.

Expected events.

At the beginning of May, Ukraine is ready to send a proposal with the $20 billion debt restructuring plan to the owners of international bonds.

10/05 Ukrstat. Price indices. as of April 2024.

18/05 The Law on Mobilization enters into force.

30/05 Ukrstat. Financial results of large and medium-sized enterprises from the 1st quarter of 2024.

10/06 Ukrstat. GDP in the 1st quarter of 2024. Preliminary data.

Вам також буде цікаво:

The Ukrainian Institute for the Future calculated effect of introduction of tax on withdrawn capital in March 2018

Estimation of economic effect of the exit capital tax (July 2017)

UKRAINIAN METALLURGY: MILKING IT TO DEATH

Glen Grant: A real action is now needed in the Azov Sea

IF AL CAPONE WAS PROSECUTED IN UKRAINE

STRATEGY FOR DEVELOPMENT OF INTELLECTUAL PROPERTY – THE USA CASE