Starting from February 5, the EU embargo on the supply of petroleum products with price restrictions came into effect, and earlier, from December 5, similar measures regarding the supply of Russian crude oil came into force. The market of countries that have embargoed petroleum products accounted for 2/3 of all Russian diesel fuel and fuel oil exports.

Crude oil sanctions will have a moderate impact on oil production and export figures in the Russian Federation but a more significant impact on revenues due to the application of price restrictions. According to our estimates (baseline scenarios of price forecasts and discounts), the total drop in revenues from Russian oil exports may amount to 25-46% compared to 2021 if the Russian Federation does not resort to market manipulation and blackmail in response to the embargo.

The change in the petroleum products market after the embargo and price caps is much more difficult to forecast than in the case of crude oil. However, the export of petroleum products may decrease by 20-35%. At the same time, having reduced the volume of oil refining, Russia will try to send this oil for export. However, it will still sell it at a discount: “friendly” cranes want and do not support sanctions, but demand discounts, taking advantage of the original position of the Russian Federation. Meanwhile, significantly longer distances to China and India, compared to EU countries, mean higher transport costs, hence the need to lower the price of oil to compete. The key markets for the Russian Federation will be India and China, which will process Russian oil and export oil products separately to those regions that used to be the Russian market.

Overview of sanctions against the Russian oil industry

The export of energy carriers is a key article of Russian exports and an important article of income for the Russian Federation’s federal budget. In the pre-war year of 2021, crude oil exports alone provided $110.1 billion of export revenue, and petroleum products – $68.5, compared to $492 billion of the country’s total exports. The high role of the oil industry in the Russian economy determined the significance of the corresponding sanctions.

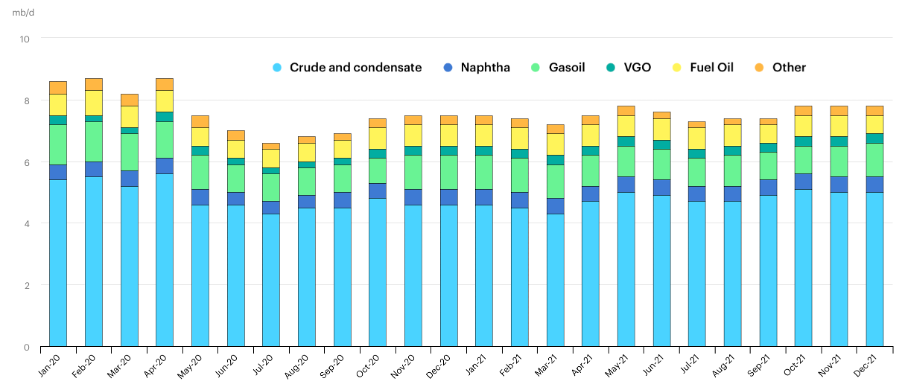

The volume of crude oil exports by Russia before the invasion of Ukraine amounted to 4.3-5.6 million barrels per day mb/d and 2.2-3.3 of oil products.

The dynamics of the export of oil and oil products from the Russian Federation before the full-scale invasion of Ukraine, mb/d

Restrictions introduced against the Russian oil industry

An embargo on the supply of Russian oil products to EU countries came into effect on February 5, while the United Kingdom and the United States banned imports earlier. The G7 countries and the EU have agreed on a price ceiling for Russian petroleum products: $100/bar for petroleum products that trade at a premium to the price of oil, such as gasoline and diesel, and $45/bar for petroleum products that trade at a discount to the price of oil, such as fuel oil.

Previously, since December 5, a similar embargo on sea deliveries of Russian crude oil has been in effect. Despite the restriction of sea supplies, Poland and Germany, which receive oil from the Russian Federation through the Druzhba pipeline, announced their intentions to abandon pipeline oil. Although by the end of 2022, these countries were making efforts to quit pipeline supplies, imports were still being carried out in January, and the final abandonment is expected in February when the delivery of Kazakh oil through the Druzhba pipeline is planned.

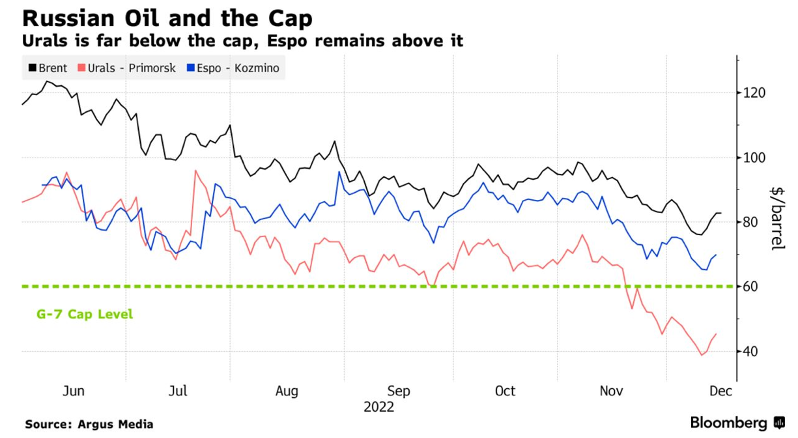

On December 5, the G7 countries, the EU, and Australia introduced a price cap for Russian oil of $60 per bar, which prohibits the insurance of oil cargo if it was sold above the price ceiling. The countries agreed to review the price cap every two months. More than 90% of the world’s sea freight is insured by a group of international insurance companies registered in Europe, which makes it possible to control the deliveries.

Assessment of Restriction Impact: Crude Oil

Market balance. As a result of the introduced embargo on crude oil supplies, various organizations estimate the volume of decline in Russian oil exports in 2023 to be 1.2 – 1.5 compared to the pre-war level (2021). At the same time, the fall in the Russian Federation’s production volume is estimated at a smaller amount of 0.84 – 1.4. However, even if the decline in production is higher than these expected levels and corresponds to the expected decline in exports, it will still not be the minimum recorded volume of oil production in the Russian Federation over the past two years. In particular, even lower production rates were observed during the pandemic in 2020 and April-May 2022. The export of crude oil to the Russian Federation in 2021 was in the range of 4.3-5.1 mbd.

The specified expected fall in Russian exports will not cause significant problems on the market: it is expected that Kazakhstan and the USA will be able to cover part of this decrease by increasing supply in the amount of 1.1 mbd.

In addition, the Russian Federation resorts to gray export schemes, under which buyers remain unknown. If before the invasion of Ukraine, the share of supplies that went to unknown buyers was about 20%, then during October-November 2022 – more than 30%. Before the invasion, Russia’s fleet’s sufficiency was at 62% of the supply of its own oil and 17% of petroleum products. At the same time, reorientating supplies from Europe to Asian countries will mean a more extended supply period and a decrease in the adequacy of Russia’s tanker fleet. This, in turn, will also affect the export price and increase the cost of freight.

Hiding buyers will make it possible to partially save export volumes and reduce the real need for additional volumes of oil for the market from other suppliers. Most probably for this purpose, the Russian Federation purchased more than a hundred used tankers that can transport the equivalent of 0.34 million barrels of oil per day in recent months. However, having one’s fleet will allow earning a higher income, considering how much the freight price has increased in the market and providing a lower discount. To solve the problem, Russia is trying to use the fleet of other countries to hide the seller and the buyer. By the end of January, the shadow fleet of the Russian Federation had grown to 600 vessels: 400 for the transportation of crude oil (20% of the world fleet) and 200 for the transportation of oil products. The West is trying to fight this phenomenon.

Price situation and Russian oil revenue. The above-mentioned indicates that the embargo on the supply of crude oil will not have a critical impact on the production indicators of the Russian oil industry; the embargo on Russian petroleum products will play a significant role, which will have a significant impact on the volume of oil production. However, it will have a more substantial effect on the income of the Russian Federation: “loyal” buyers of Russian oil, who support embargoes and price caps, demand significant discounts instead.

Reuters estimates that after introducing a price cap on crude oil, discounts on Urals oil in Russia’s western ports for sale to India under some deals have increased to $32-35 per barrel if freight is not included in the price. At the same time, throughout almost a year of war in Ukraine, freight rates have increased significantly: 11-19 dollars per barrel compared to less than 3 dollars per barrel before February.

The price of Brent hovered below $80 per barrel in early December, while the estimated cost of Russian oil to producers, including production costs, taxes, and transportation to export ports, was around $15-45 per barrel, Deputy Energy Minister Pavlo Sorokin said.

Quotation of Russian oil grades relative to Brent before and after the date of the introduction of the oil embargo and price restrictions

Source: Bloomberg

The income of the Russian Federation will be determined by oil prices on world markets and the policy of key buyers of Russian oil regarding the demands for discounts, which in turn will be formed based on how strong the “buyer’s market” will be for the Russian Federation and what will be the difference between the price and the established price cap (it is assumed that $60 is not the final limit, but it can be revised in the event of a significant change in market conditions). OPEC countries consider a comfortable price of 90-100 dollars. Morgan Stanley, anticipating growth in demand and continued tight supply, forecasted a price of $110/barrel, and the Wall Street Bank lowered its forecasts for Brent for the first and second quarters of 2023 to $90 and $95 per barrel from $115 and $105 per barrel, respectively.

Estimation of the Russian Federation’s expected losses under the scenario of the base range of price assumptions. According to our estimates, depending on the price dynamics on world markets (without considering the options of crisis price collapses and price shocks) and the policy regarding discounts of key buyers, based on the expected structure of Russian oil exports, the drop in revenue from Russian oil exports in 2023 may amount to 25- 46% relative to 2021. It is worth reminding that in 2021, oil exports (excluding petroleum products) amounted to 110.1 billion dollars, accounting for 22.3% of Russia’s total export revenues.

Options of Russian Federation’s actions in response to sanctions on crude oil. From February 1, the ban of the Russian Federation on selling the resource to buyers who support the specified restrictions or the establishment of a legal minimum export price came into effect. At the same time, the Kremlin said they are ready even to reduce the production volume.

Russia’s attempts to delay exports from Kazakhstan by creating formal obstacles in the work of the Caspian Pipeline Consortium are not excluded. Speculation about the supply of the Druzhba oil pipeline can also be used to manipulate the price.

Thus, the Russian Federation’s actions may affect the market balance and the price, which is also sensitive to speculation.

From the point of view of supply sufficiency and the physical balance of the market, an independent decrease in export volumes (and production), if it is a response to embargoes and price caps only concerning “unfriendly countries”, will not have a significant impact, because half of the Russian crude oil exports used to be to the EU. Today almost all expected Russian exports can be accepted by “friendly countries”. Thus, in November, Russian supplies to India reached a record of 1.3 mbd, while those to China remained unchanged at 1.9. Therefore, deliveries to these two key global oil importers make up the lion’s share of the expected exports of the Russian Federation in 2023 (3.6 mbd), even beyond the lower limit of the estimate of the drop in its exports (1.2 mbd) relative to the pre-war level (in the range of 4.3-5.1 mbd depending on the month of 2021). Another thing is that these “friendly” countries demand significant discounts, ultimately affecting the Russian Federation’s income.

Of course, it cannot be ruled out that the Russian Federation will further reduce production and exports (even at the expense of a partial reduction in exports to friendly countries) – such speculative steps may be taken precisely to stimulate price spikes, in which Russia is particularly interested both for the reason of receiving higher prices and for the reason of influencing the stability of the countries participating in the coalition. However, most likely, such actions should be expected closer to the introduction of the embargo on the supply of petroleum products in February 2023 because this step will have a significant impact on oil production in the Russian Federation, which will have to be reduced.

The actions of OPEC if the Russian Federation begins to manipulate the volume of exports remain a certain intrigue. On the one hand, in the public sphere, the leaders of the member countries do not approve of “non-economic” methods of market regulation. On the other hand, OPEC is also interested in price stability without significant distortions both in the direction of growth and in the direction of decline. And even individual OPEC countries have enough resources to replace the potential deficit created by Russia.

Assessment of Restrictions Impact: Petroleum Products

The change in the market of petroleum products after the embargo and price caps is much more challenging to forecast than crude oil. The embargo will hit Russian oil production, processing, and corresponding incomes. Likewise, there will be an impact on the price situation in the EU, especially given the ongoing strikes at French refineries and plans to overhaul many refineries in the US. The situation with diesel fuel, which is used by 40% of European cars, will probably be agitated, and the Russian Federation accounted for half of EU diesel imports. However, the potential of the Russian Federation to diversify the supply of oil products to other countries is currently not fully understood. Therefore it is difficult to accurately assess the impact on oil refining and oil production in the Russian Federation.

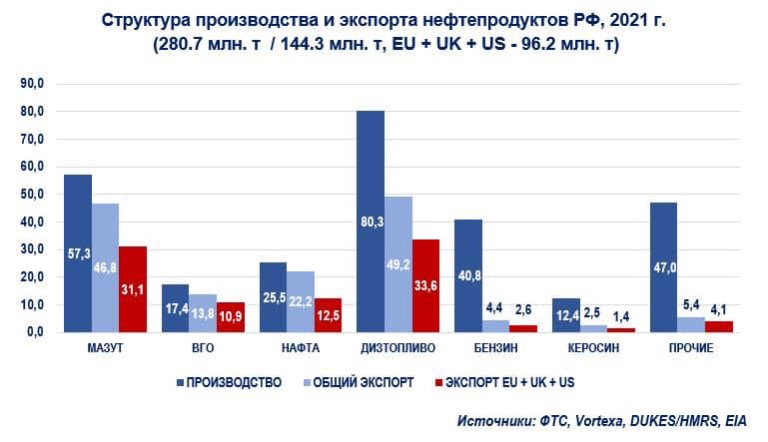

The main petroleum products produced in the Russian Federation are diesel (1/3), fuel oil (1/5), and gasoline (1/7), and the key export positions are diesel and fuel oil.

At the same time, in 2021, the USA, Great Britain, and the EU – the countries that announced a ban on the import of Russian petroleum products – accounted for 68.3% of the total export of diesel and 66.5% of the export of fuel oil, and respectively 41.8% of the total production of diesel and 54.2% from fuel oil production. Canada and Australia supported the ban but accounted for small shipments.

The introduction by Western countries of restrictions on the import of Russian oil products will force the Russian Federation to either diversify their exports or reduce the volume of oil refining while at the same time trying to increase the volume of crude oil exports to at least partially compensate for the losses. Still, at the same time, there will be a significant reduction in domestic production and employment. First of all, Russia’s oil companies that are focused on the production of Rosneft and Surguneftegaz oil products will suffer. According to our estimates, the export of petroleum products may account for 20-35%.

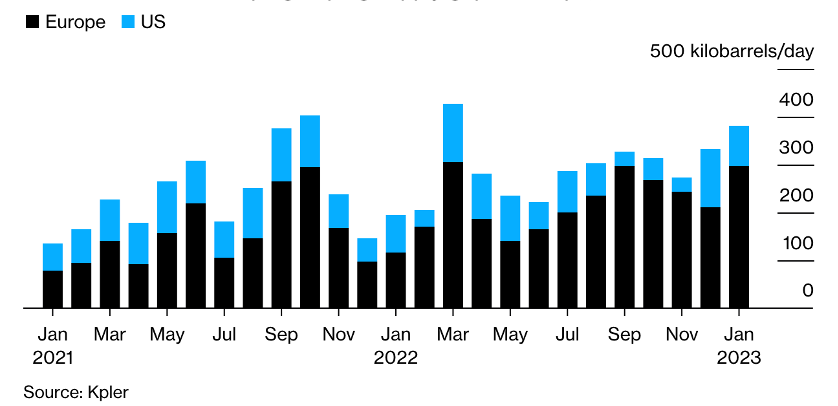

At the same time, it will be complicated to reorient the entire export of petroleum products to “friendly” countries. In particular, China and India, which gladly accept Russian oil at a discount, have excess oil refining capacity and are interested in importing cheap oil and exporting petroleum products of their production. At the end of 2022, China increased export quotas for its own refiners, but despite the increase in refining volumes and exports at the end of 2022, there was a decline in Chinese refining volumes for the first time since 2001. At the same time, China has sharply increased the volume of diesel exports, considering the global market

‘s deficit.

China and India, importing cheap Russian oil, will likely cover the shortage of diesel fuel on the world market. This, of course, carries the potential of a high price of oil products for buyers (even based on more complex logistics compared to direct Russian supplies). Still, it will reduce the income of the Russian Federation both in terms of oil refining and in oil trade at a discount to “friendly” countries.

Dynamics of the geographical structure of the petroleum products export from India

In 2022, having lost the US and UK markets, the Russian Federation increased exports to other “friendly countries” that had the potential to increase imports. So, diesel deliveries to Turkey increased to 5.05 million tons compared to 3.99 in 2021 and to Morocco from 66 thousand tons to 735 thousand tons. However, shipments to Turkey and Africa accounted for only 2/3 of supplies to the EU, and these regions’ potential to import oil products is believed to have already been exhausted. Thus, in 2021, the total diesel fuel consumption in Turkey amounted to 17.04 million tons, domestic production was more than 1 million tons, and net imports minus changes in stocks were 7.47 million tons.

The emergence of seasonal markets for Russian fuel oil, which will be used as a cheaper substitute for its resource, is not excluded. Thus, in 2021, Saudi Arabia imported 100,000 b/d of Russian fuel oil at a discount to fuel its power plants during peak demand seasons instead of saving its high-quality oil products for export. China acted similarly at the beginning of 2023, increasing imports of Russian fuel oil, which Chinese refineries use as a cheap raw material.

The impossibility of fully diversifying the export of oil products under the embargo will force a partial reduction in the volume of oil refining in the Russian Federation and an increase in the export of crude oil that was previously processed. The price cap on oil products of $100/bar, at current prices, will not have a critical impact on the profitability of Russian oil refining and will ensure a sufficient margin. However, for those oil products that are traded at a discount from the price of oil, it will most likely significantly limit the profitability of production.

Вам також буде цікаво:

Куди рухається Україна в цифрову епоху

Візит Зеленського до США: Ключові позиції для успішних перемовин

Дострокові вибори у Вірменії стануть поразкою лідера опозиції Пашиняна

Для чого (пере) винаходити університет?

Отчет НБУ и языковой вопрос: прогноз на неделю от политического эксперта UIF

Росія детально: події та тренди в РФ за минулий тиждень (18.07-22.07)