Events and trends in Russia over the week of June 13-17th

Conclusions

1.Putin’s speech on Friday, June 17th, at the St. Petersburg Forum shows that he intends to raise the stakes in his dialogue with the West, based on the old idea of dividing the world into spheres of influence. At the same time, Putin’s general tone indicates his desire to negotiate with the West. Of course, on Russia’s terms. Concessions, in Putin’s view, will be equal to his defeat. That is why, speaking about Ukraine, he states that “the tasks of the special operation will be fulfilled.”

2. Hoping to ease the existing sanctions or stop the new ones, Russia is resorting to outright blackmail and bluffing – limiting the supply of resources to Europe, thereby affecting the price. Rising prices are helping to offset revenue losses, but more importantly, they are a factor that could make Europe blackmailed and less tough on Russia and its military aggression.

3. In the coming months, Russia will face a lack of elemental base (according to the Webb Institute, the industry’s dependence on imports is 88%). Compensation in the form of “parallel imports” will not be able to solve the problem in the complex. Most likely, the Russian government will focus its efforts on closing the deficit of critical industries (MIC, Roscosmos, communications).

4. The food crisis remains a №1 theme for European countries in the near future. It will become an increasingly severe factor influencing a change in the EU sentiment about the need for peace talks between Russia and Ukraine. The aggravation of the situation with humanitarian supplies to Syria in the coming month will be the first “rehearsal” of how the issue of “global hunger” will affect the balance of power around Ukraine.

5. In 2014, Russia set a course for import substitution when the first sanctions were imposed due to the annexation of Crimea and the occupation of the Donetsk and Luhansk regions. In April of the same year, the state program of import substitution – “Development of industry and increasing its competitiveness” was launched. Billions of rubles are allocated annually for the implementation of projects. But Russia’s import substitution is a myth. They never learned to make electronics, chips, and other tools that the military-industrial complex depends on and the production of modern equipment for business and everyday life. Russia’s technological backwardness and dependence on critical materials imports, which are not available in Russia, is only growing.

6. Over the past two weeks, the Russian president has resorted to using the past as an excuse for his current policies but has now chosen a new role model. This year’s celebration of the 350th anniversary of Peter I will obviously mark the restructuring of historical policy in Russia.

What did Putin say, and what was he afraid to mention

at the St. Petersburg forum?

The first part of Putin’s speech was about the new world order and current issues. Putin connects all (this is not an exaggeration) the negative that is happening with the destruction of the old system, forgetting to mention Russia’s role in this process. At the same time, speaking about the problems, he constantly repeats the thesis “it started long before the special operation” or simply asking “how (and why) is Russian connected to this?” (meaning that it is not).

For the internal audience, these are traditional topics about the decay of the “rotting West”. Externally, the focus is on possible crises, from product prices to food and fertilizer shortages (and the resulting destabilization in a number of regions). It emphasizes the role of Russia as a force capable of minimizing the same food crisis.

Concerning Russia’s policy, what has been said can be summarized in a simple phrase: we do what we want because we have the right, and we are right because we are “strong”. At the same time, speaking about the sovereignty of states, Putin made an interesting reservation about its “completeness”. He meant that sovereignty could not be limited by anything, which indicates the attitude to the rules of international law and international agreements. It is worth mentioning the amendments to the Constitution of the Russian Federation, which concerned the priority of national legislation.

In terms of international cooperation, he stressed the readiness to trade in grain and raw materials with Asia and Africa and, of course, with those who recognize “Russia’s role in the international system.” And it is worth noting an important aspect of transport corridors. Putin spoke of one thing – the South-North. This is an Indo-Iranian project that can compete with the Belt and the Road. This was a message to two world players who expect the weakening of Russia – the United States and China.

Then there was a block of internal issues designed for the “average Russian.” Its task was to calm down and “fill the problems with money”. In fact, Russia’s surplus profits over the past eight months have allowed the Kremlin to increase budget spending. This time, Putin talked about the birth support program, the mortgage (emphasizing the completion of the program in 2022 – that is, encouraging citizens to participate in keeping the construction industry), and education. He also talked a lot, really a lot, about the development of rural areas (settlements/villages). This is logical since a large number of residents of “depressed” regions who are fighting in Ukraine, upon their return to Russia, may ask the question, “why is it better there?”.

Conclusions

Putin intends to raise the stakes in dialogue with the West based on the old idea of dividing the world into spheres of influence. But given that a similar result is now possible even without Russia (due to the US-China agreement), he made a separate reference to Beijing. In foreign policy section, by statements of cooperation with “independent countries”, Putin announced another zone of tension – the use of Russian raw materials in Asia and Africa.

At the same time, these messages were something new. Putin’s general tone indicates his desire to negotiate with the West. But, of course, on his own terms. Concessions, in Putin’s view, will be equal to defeat. That is why, speaking about Ukraine (by the way, very little was said), he only stated that “the tasks of the special operation will be fulfilled.”

The general nature of Putin’s speech has little to do with Peskov’s announcement of “sensational theses.” Either the sensation was not planned, or the performance was rewritten at the last moment.

At least there have been no phrases about the possible annexation of new territories (in the occupied parts of Ukraine). Although indirectly, such a thesis may have been sewn up and manifested itself in the announcement of next year’s grain market with volumes of 50 million tons. This would be impossible within the Russian Federation in light of sanctions.

Russia’s strategy in anticipation of restrictions

on energy imports from Western countries

In anticipation of the oil embargo and other restrictive measures, Russia has begun to implement a plan to manipulate Europe’s energy markets (known as energy blackmailing). The critical task for Russia is to manipulate the volume of supplies to increase the prices. In addition to maintaining revenue, Moscow expects to raise negative consumer expectations, encouraging European governments to “soften” their policies toward Russia.

In May, Russia imposed sanctions on the Yamal Europe gas pipeline. Subsequently, after the occupying forces intervened in the gas compressor stations’ operation, the GTS operator informed Gazprom of force majeure, proposing to use other entry points into the GTS. Gazprom refused on a contrived pretext and now uses Ukrainian transit below the paid level: 42.2 mcm against 110.

In June, Gazprom announced a 60% reduction in supplies through Nord Stream to 67 million m3 per day. But the trend of declining supplies to Europe has already been noticeable over the past two months, although, since mid-June, the action has become not hidden. Traditionally, the Kremlin manipulates the West by saying that the Western countries will suffer more from sanctions than Russia.

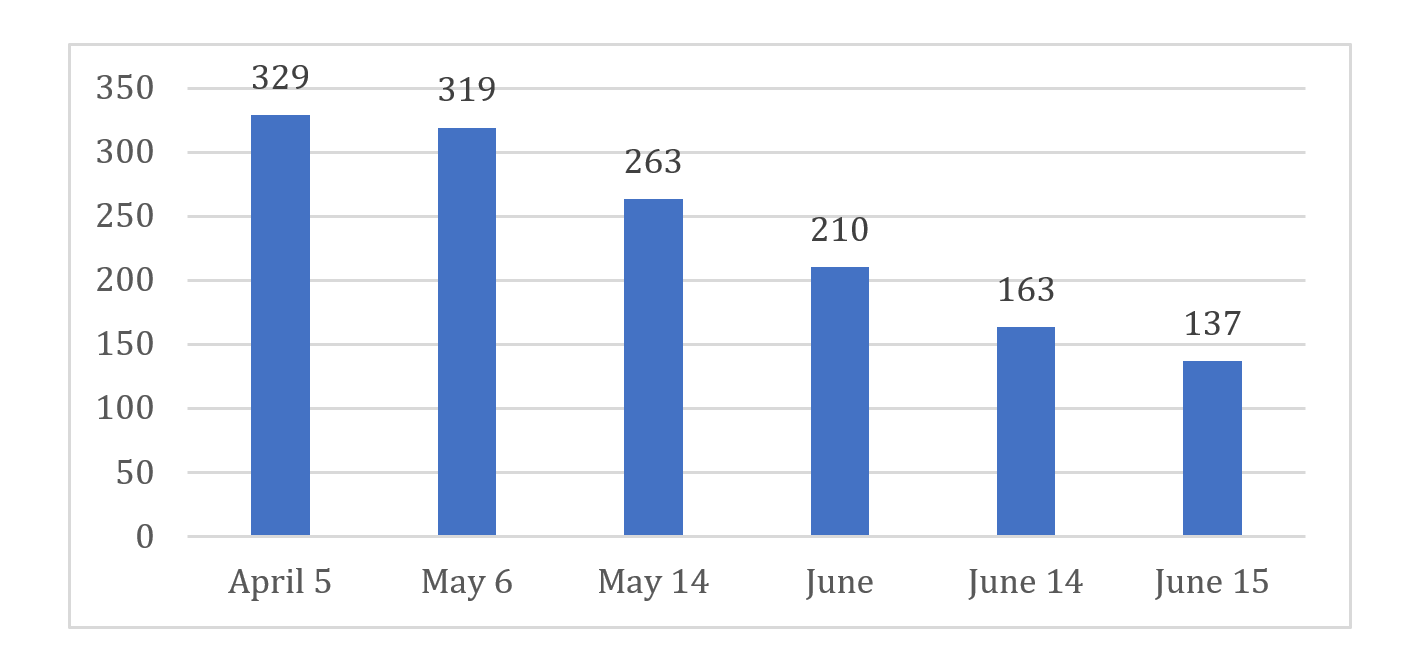

Russian daily gas supplies to the EU, mcm

Since the full-scale invasion, prices in European gas markets have not been lower compared to the eve of the war. At the beginning of the downward price trend, Gazprom speculatively raised the price in June. Supply reductions hit the price by 40% for the week – up to $1,500 per thousand cubic meters.

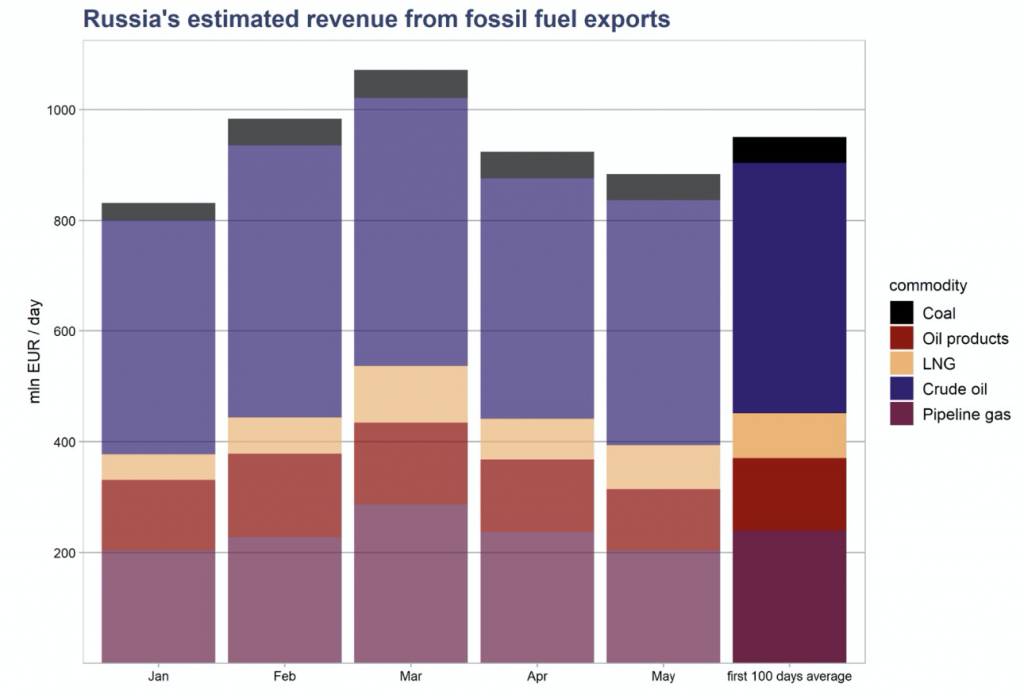

As a result of rising prices, despite a certain decline in the physical volume of supplies, revenue grew. For example, in May, Russia’s export revenue increased by 11% compared to the previous month, with a drop in physical exports by 3%.

Estimation of Russia’s income from energy exports since the beginning of the year

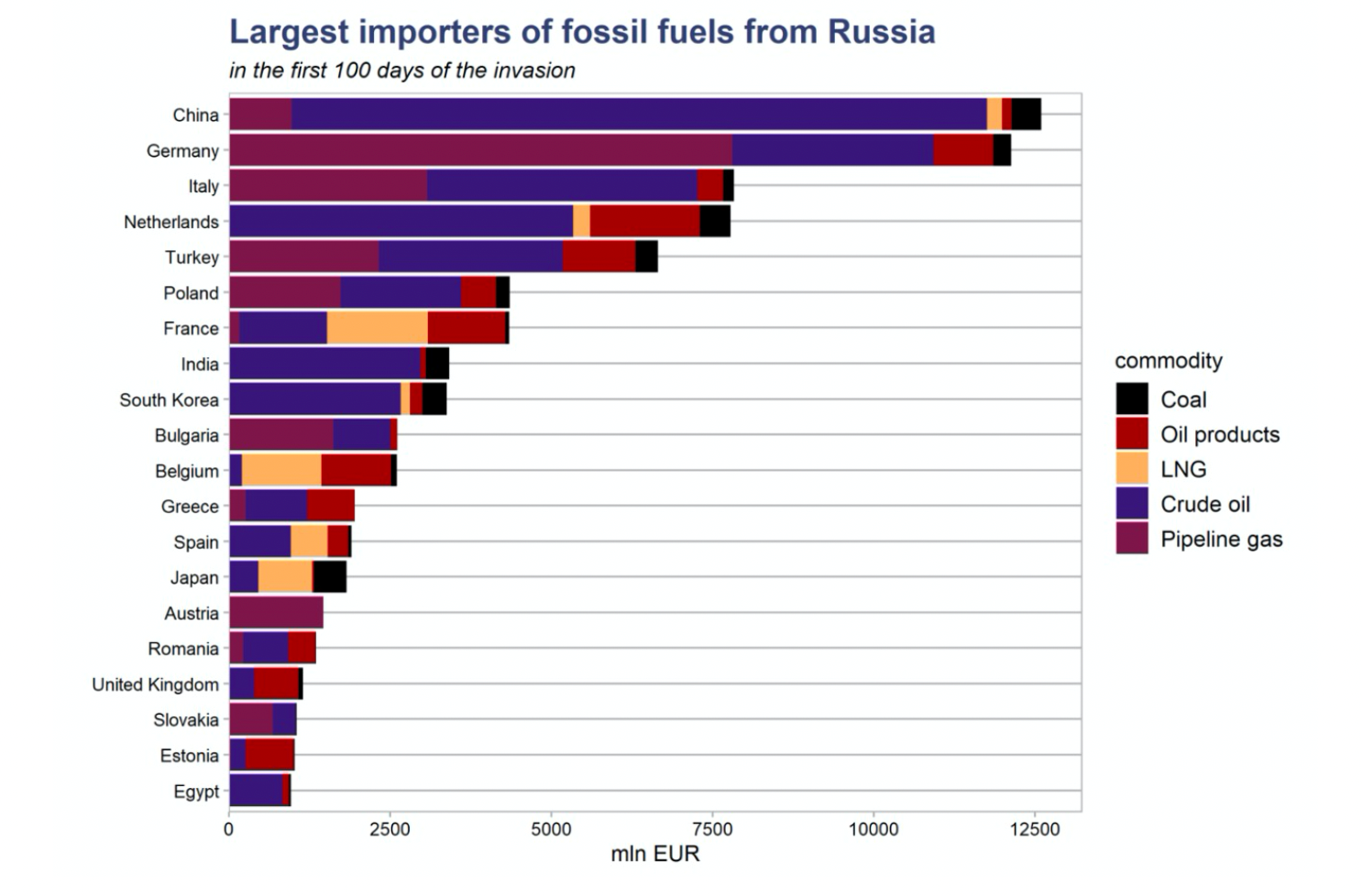

The largest importers of Russian fuel energy resources during the 100 days of the war

Rising prices led to an increase in federal budget revenues. Oil and gas budget revenues for January-April 2022 were almost twice as high as in the same period last year. But revenues were still less than planned: in April, Russia under received oil and gas revenues in the federal budget by -133 billion rubles, according to the RF’s Ministry of Finance. To some extent, this is due to the need to sell some oil at a discount.

At the same time, in April, there was a record decline in non-oil and gas revenues in the year and a half – by 18% less than in the same period last year. Moreover, this does not consider the inflation, which for the same period amounted to 17.8%. As a result, dependence on oil and gas exports is growing. Since the beginning of the year, the share of oil and gas revenues in the structure of federal revenues of the Russian Federation was 49%, compared to 39% in 2019 and 28% in 2020.

In the near future, we should expect a new round of higher rates and the Kremlin’s bluffing with the West and the European Union. In anticipation of the embargo, Russia may begin to restrict oil supplies on its own to influence the markets.

Moscow will try to influence energy markets to pressure the West to ease or at least not tighten the sanctions. The critical question is whether the EU will succumb to bluffing and blackmail or whether it will use all its energy reserves and the potential for energy efficiency. This will determine the losses of the Russian economy next year.

The import substitution program in Russia has failed

In the next few weeks in the UIF’s digests on Russia, we will talk about the process of import substitution in Russia. Import substitution is the establishment of goods production in one’s own country due to the rise in price, reduction, or suspension of imports of these goods.

Russia set a course for import substitution in 2014, when the first sanctions were imposed due to the annexation of Crimea and the occupation of the Donetsk and Luhansk regions. These restrictions included the freezing of assets, the introduction of visa restrictions for persons included in special lists, and a ban on companies from sanctioned countries from maintaining business relations with persons and organizations included in the lists.

In April 2014, the state program of import substitution – “Development of industry and increasing its competitiveness” was launched. In 2015, a Government Commission on Import Substitution was established. There are two subcommissions in the commission’s structure: on the issues of civil branches of the economy and in the matters of the military-industrial complex. A strategic list of products with the highest priority of import substitution was determined. First of all, the emphasis was on food. In a short time, large agricultural complexes appeared in Belgorod, Kursk, and Bryansk regions. The most dependent on imported raw materials and components were such industries as agriculture, mechanical engineering, and information technology, where the share of imports reached 90%.

In 2022, new and even stricter restrictive measures were imposed against Russia, during which almost 1,500 foreign companies left the Russian market or reduced their activities in the country. In this regard, the Russian government has taken new measures to support domestic producers: by simplifying the public procurement procedures, providing concessional lending and tax benefits to small and medium businesses, and other state activities.

Russia has managed to establish food production and thus ensure food security. According to Rosstat, the consumption of such products as grain, meat, meat, fish, and potatoes is provided by Russian production in 2021 by more than 100%, but these goods are still being imported.

According to Russian officials, the shutdown of fast-food restaurants such as McDonald’s, KFC, and others was painless. After announcing its exit from the Russian market, McDonald’s sold its business to Russian businessman Alexander Govor, who launched a new network, called now “Tasty and that’s it.” (Вкусно и точка”)

In March, it was reported that the level of import substitution in critical areas in Russia ranges from 80% to 100%. Russia will definitely not be able to replace these materials with its own production.

A difficult situation can also be seen in the pharmaceutical market. For example, the share of imported drugs in Russia in 2021 was 67% (by value). It should be borne in mind that for the production of so-called Russian drugs, mainly imported substances, technologies, and equipment are used. But after a full-scale military invasion of Ukraine, the largest pharmaceutical companies are gradually shutting down in Russia.

In conclusion, it should be noted that the Chairman of the Committee of the Federation Council of Russia on Constitutional Legislation, Andrey Klishas, said that the import substitution program in the country has failed. The failure of import substitution is observed in the range of consumer goods, social, and other spheres.

Вам також буде цікаво:

Звіт по проєкту: “Оцінка соціально-політичних настроїв населення України – лютий 2020”

Are the “Good Russians” to blame for Putin’s deeds?

Експертний круглий стіл «Цифрова адженда України: перспективи та ризики»

Боротьба за людей: Україна програла битву, але має виграти війну

THE EU AND THE VISAS IN CRIMEANS` RUSSIAN PASSPORTS

Аналітична записка щодо реформування СБУ