HIGHLIGHTS

The Ministry of Finance of Ukraine has announced that Ukraine will receive approximately USD 22 billion out of USD 50 billion in grants in 2025 through the ERA mechanism. The funding will be secured by revenues from frozen Russian assets.

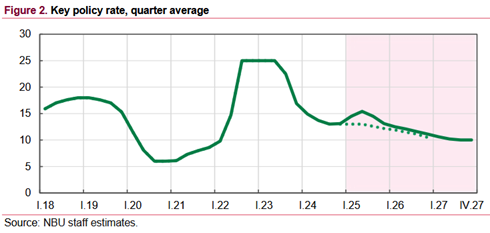

On January 31, the National Bank of Ukraine (NBU) released a new inflation report, indicating a likely increase in the NBU interest rate to 15.5% in 2025.

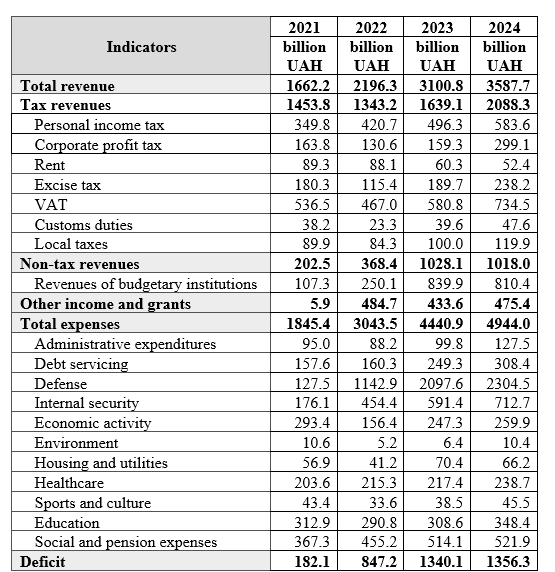

The consolidated budget for 2024 closed with a deficit of UAH 1,356 billion or 17.6% of GDP.

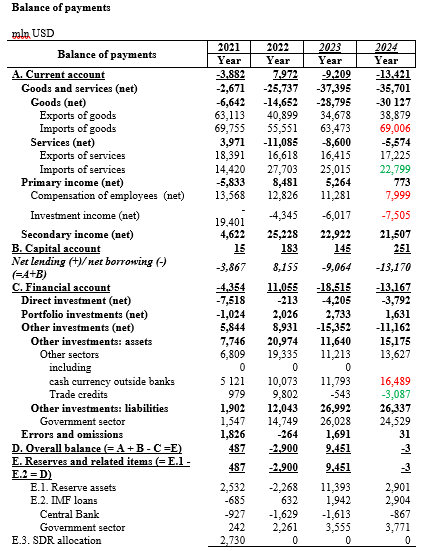

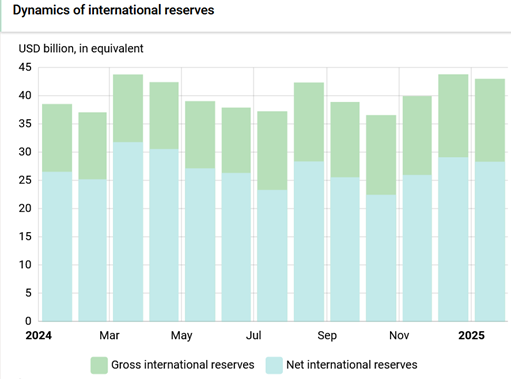

The balance of payments for 2024 was positive. International reserves increased from USD 40.5 billion to USD 43.8 billion in 2024. The trade deficit for 2024 amounted to USD -35.7 billion, which is lower than in 2023 (USD -37.4 billion).

International reserves in January 2025 decreased from USD 43.8 billion to USD 43.0 billion.

The Ukrainian Institute for the Future has provided an assessment of macroeconomic indicators for 2025. In the scenario of continued war until the end of 2025, economic growth is expected to reach 1.8% of GDP, inflation at 9.9%, and a budget deficit of 8.5% of GDP. A more detailed 2025 forecast will be presented soon.

* Nominal GDP data for 2024 is sourced from the latest NBU report (January 2025). GDP growth data is based on estimates from the Ministry of Economy and UIF.

ECONOMIC SITUATION

- Economic growth

According to the Ministry of Economy, GDP growth in 2024 amounted to 3.6% of GDP. The NBU revised its GDP growth forecast for 2024 down from 3.6% to 3.4%.

According to our estimates, Ukraine’s dollar-denominated GDP increased from USD 179 billion to USD 192 billion in 2024, despite the devaluation of the average hryvnia exchange rate from 36.6 to 40.2 UAH/USD.

Source: Ukrstat

Figure translation:

Change in real GDP

(in % to the respective quarter of the previous year)

Seasonally adjusted real GDP (Q3 2024 to Q2 2024) grew by 0.2%

The NBU has revised its GDP growth estimate for 2025, lowering it from 4.3% to 3.6% of GDP.

- Inflation

Consumer inflation in January 2025 compared to December 2024 was 1.2%, and compared to January 2024 – 12.9%. Core inflation in January 2025 compared to December 2024 was 1.3%, and compared to January 2024 – 11.7%.

On the consumer market in January, food and non-alcoholic beverage prices increased by 1.2%. Prices for vegetables, sunflower oil, non-alcoholic beverages, bread, butter, grain processing products, meat and meat products, milk and dairy products, fruits, fish, and fish products rose by 0.9–5.5%. Meanwhile, egg prices dropped by 23.1%, and the prices for pasta and sugar fell by 0.8% and 0.6%, respectively.

Prices for alcoholic beverages and tobacco products increased by 1.6%, mainly due to a 2.3% rise in tobacco prices.

Clothing and footwear prices decreased by 5.5%, with clothing prices falling by 5.6% and footwear by 5.4%.

Transportation costs rose by 1.4%, mainly due to a 2.5% increase in road passenger transport fares and a 2.1% rise in fuel and lubricants prices.

Changes in prices over the past 12 months. Source: Ukrstat.

Figure translation:

Change in prices

(in % to the previous month)

2024 JanuaryFebruary March April May June July August September October November December 2025 January

-o- CPI -A- Core CPI

According to the NBU’s updated forecast, the inflation rate for 2025 is expected to be 8.4% by the end of the year. However, inflation is projected to rise to 14% annually in the first quarter of 2025.

Our estimate suggests that inflation may indeed reach 14% annually by the end of the first quarter of 2025. However, under current conditions, it will be challenging to achieve the 8.4% level by the end of 2025.

- NBU interest rate

The NBU has revised its key policy rate forecast for 2025. After increasing the rate from 13.5% to 14.5% on January 23, the new inflation report suggests a further rate hike to 15.5% at the next meeting.

Our assessment indicates that the key policy rate increase has a limited effect on slowing inflation, as inflation in Ukraine has a non-monetary nature.

BUDGET

- Budget performance

The consolidated budget for 2024 closed with a deficit of UAH 1,356 billion or 17.6% of GDP, which is lower than in 2023 when the budget deficit was 20.6% of GDP.

According to our estimates, consolidated state revenues in 2024 amounted to 53.6% of GDP, of which 19.4% of GDP came from non-tax revenues and grants. Consolidated expenditures in 2024 reached 71.2% of GDP, with security-related expenses accounting for UAH 3,017 billion or 39.1% of GDP. This is lower than in 2023, when security expenditures were 41.1% of GDP, and consolidated spending reached 75.2% of GDP.

Consolidated budget 2021-2024. Source: Ministry of Finance.

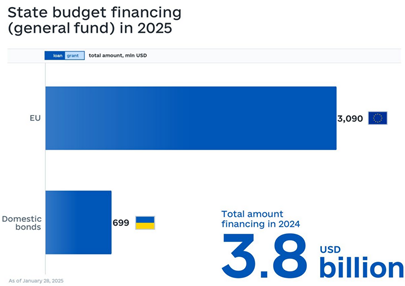

- External financing

In January 2025, Ukraine received EUR 3 billion in funding under the EU’s ERA mechanism.

Source: Ministry of Finance of Ukraine

The Ministry of Finance of Ukraine has announced that Ukraine will receive approximately USD 22 billion out of USD 50 billion in grants in 2025 through the ERA mechanism. The funding will be secured by revenues from frozen Russian assets.

These figures differ from the NBU’s forecast, which estimated around USD 30 billion in grant financing for Ukraine in 2025. However, we believe that the Ministry of Finance has more comprehensive information regarding financing. According to NBU data, USD 38.5 billion in Western financing is expected in 2025.

- State debt

As of January 1, Ukraine’s total public and guaranteed debt amounted to USD 166.1 billion, an increase of USD 20.7 billion in 2024, representing 90.4% of GDP.

According to our estimates, Ukraine’s public and guaranteed debt increased from 84.4% of GDP in 2023 to 90.4% of GDP in 2024.

According to the Ukrainian Institute for the Future, if Ukraine receives USD 22 billion in grants in 2025, its public and guaranteed debt will reach 95.1% of GDP by the end of 2025.

Balance of payments

- Balance of payments in 2024

The balance of payments for 2024 was positive. International reserves increased from USD 40.5 billion to USD 43.8 billion in 2024. The trade deficit for 2024 amounted to USD -35.7 billion, lower than in 2023 (USD -37.4 billion). However, the trend of import growth exceeding export growth amid significant hryvnia devaluation poses a risk.

Balance of payments 2021-2024. Source: NBU.

Among the negative aspects of 2024, it is important to acknowledge the negative balance of foreign currency purchases by the population, which increased by USD 4.7 billion over the year, from USD 11.8 billion to USD 16.5 billion, as well as the primary income balance, which declined from USD 5.264 billion to USD 773 million in 2024.

Among the positive aspects of 2024, the stabilization of service imports and expenditures made with hryvnia-denominated cards abroad should be noted. However, this is primarily due to the depletion of resources on hryvnia cards and income generation from places of residence abroad. Another positive factor is the return of trade credits that were withdrawn in 2022. A total of USD 3 billion in funds has been repatriated.

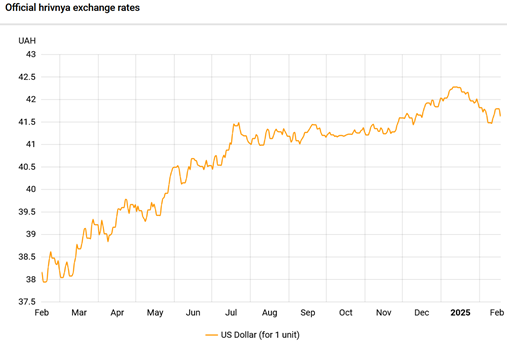

- Hryvnia exchange rate

In 2024, the hryvnia depreciated from 38 UAH/USD to 42 UAH/USD, with an average exchange rate for the year standing at 40.2 UAH/USD.

In recent weeks, we have observed a strengthening of the hryvnia, which appreciated against the dollar from 42.3 to 41.5 per dollar. This is beneficial in terms of curbing inflation, as we discussed in the previous digest. However, we believe these trends will be temporary. According to our estimates, as well as the National Bank of Ukraine’s (NBU) assessment in the January inflation report, the balance of payments in 2025 is expected to be negative. This will contribute to further depreciation processes in 2025. Nevertheless, the NBU holds USD 43 billion in reserves to ensure these processes remain manageable.

According to our forecast, the dollar exchange rate will return to 42 UAH/USD in February.

Hryvnia to U.S. Dollar Exchange Rate Over the Past 12 Months. Source: NBU.

- International reserves

As of January 2025, international reserves decreased from USD 43.8 billion to USD 43.0 billion.

The NBU’s net foreign currency sales in January amounted to USD 3,756.3 million, marking a 29.4% decline compared to December.

A total of EUR 3,000 million (USD 3,090 million) was credited to the government’s foreign currency accounts at the National Bank.

Government payments for servicing and repaying public debt in foreign currency totaled USD 535.8 million, including:

- USD 373.3 million for servicing and repayment of foreign currency-denominated government bonds (OVDPs);

- USD 85.1 million for servicing external government bonds (OZDPs);

- USD 77.2 million for servicing and repaying debt to the World Bank;

- USD 0.2 million for payments to other creditors of Ukraine.

The current volume of international reserves covers 5.3 months of future imports.

Changes in International Reserves Over the Past 12 Months. Source: NBU.

Вам також буде цікаво:

WHY THE UKRAINIAN PUBLIC ORGANIZATIONS IN EDUCATION AREA SHOULD UNITE?

Explosions in warehouses in Kalynivka: “who is to blame?” and “what to do?”

Prospects for education development in Ukraine: sociological survey of one illusion

What should we do with Donbas and Crimea after de-occupation: world practice of transitional justice

Real estate in Crimea became a tool of blackmail

Exit capital tax – economic visa-free regime of Ukraine (uk)