HIGHLIGHTS

On December 20, 2024, the Executive Board of the International Monetary Fund approved the Sixth Review of the Extended Fund Facility (EFF) arrangement. Completing the Sixth Review of the arrangement provides immediate access to SDR 834.9 million (about USD 1.1 billion in equivalent) to support the state budget.

As of January 1, 2025, the balance on the UAH treasury account exceeded UAH 100 billion. Foreign currency accounts amounted to over UAH 163 billion. The prime minister stressed that those are record figures.

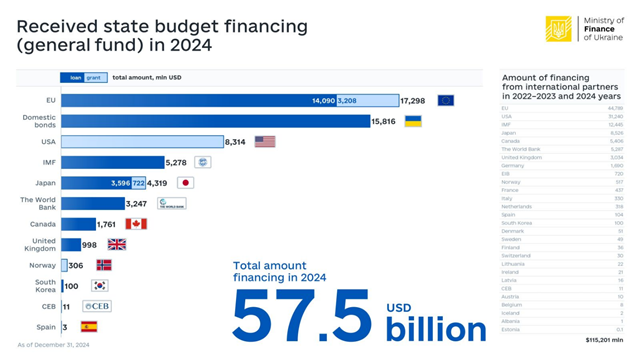

Western funding in 2024 amounted to USD 41.643 billion. Of this, 12.553 billion were grants.

Inflation reached 12.0% in 2024, which exceeded all forecasts.

In December 2024, international reserves increased from USD 39.9 billion to USD 43.8 billion. In total, by USD 3.5 billion in 2024.

Sixth Review of the Arrangement with Ukraine

On December 20, 2024, the Executive Board of the International Monetary Fund approved the Sixth Review of the Extended Fund Facility (EFF) arrangement. With the successful completion of the Sixth Review, the IMF will provide immediate access to SDR 834.9 million (approximately USD 1.1 billion in equivalent) to support the state budget. After the disbursement of this tranche, the total amount of financing received under the program will reach USD 9.8 billion.

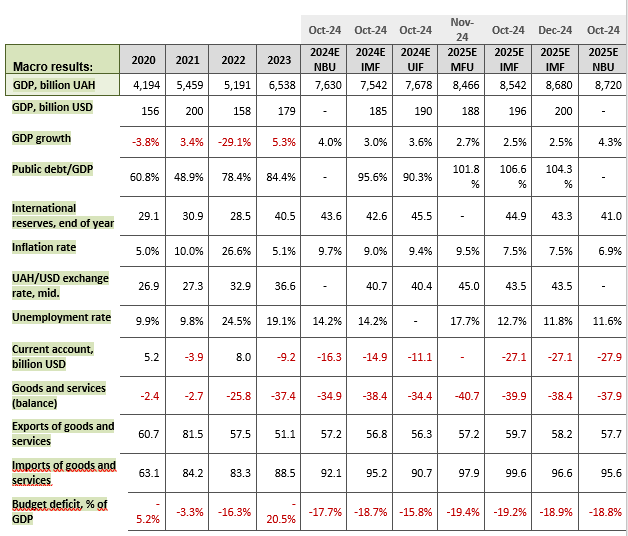

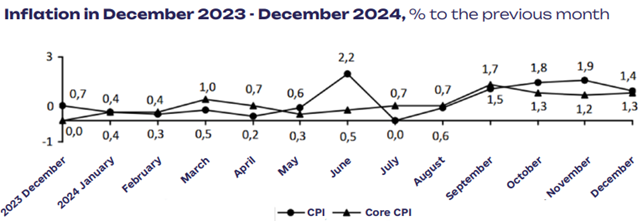

In 2024, Ukraine’s economy grew more substantially than expected by the IMF, thanks partly to the country’s resilience to energy shocks. The Fund expects economic growth to slow in 2025, mainly due to the strenuous labor market situation, the consequences of Russia’s attacks on Ukraine’s energy infrastructure, and continued high uncertainty. At the same time, the IMF notes that risks to the forecast remain extremely high.

The IMF also noted that the financial sector remains stable. To maintain its stability, the NBU, in cooperation with the Deposit Guarantee Fund and the Ministry of Finance, will be working on a framework program for the financial rehabilitation of banks. At the same time, the NBU continues to prepare and implement a methodology for supervisory risk assessment to determine the priorities of its supervision.

The IMF emphasized that the recent tightening of monetary policy was appropriate in light of higher-than-expected inflation and that the NBU should be prepared to take further measures if inflation expectations deteriorate.

ECONOMIC SITUATION

- Economic growth

In the 3rd quarter of 2024, according to preliminary data, GDP growth amounted to 2% of GDP – the worst performance in the last 1.5 years.

After a bounce back from the bottom in 2023, the Ukrainian economy has slowed down in 2024.

Source: Ukrstat

In its Sixth Review, the IMF upgraded its forecast for Ukraine’s economic growth in 2024 from 3.0% to 4.0% of GDP and left unchanged its forecast for economic growth in 2025 – from 2.5% to 3.5% of GDP (with a 2.5% calculated).

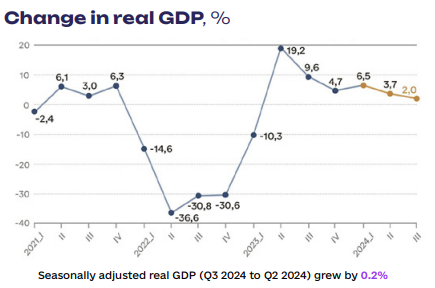

2. Results of power outages in 2024

In reality, the blackouts in 2024 turned out to be much better than expected in the summer. The scheduled power outages took effect for 1951 hours in 2024. The peak of power outages occurred in June and July when Ukraine experienced very high air temperatures.

We believe that the power outage experienced by consumers was, at worst, half as long since the blackouts occurred according to 3-3 or 4-4 hour schedules. Therefore, by our estimation, the actual power outage for consumers lasted 900 hours in 2024. This is 37 days out of 365. Or 10-12% – a much better result than expected.

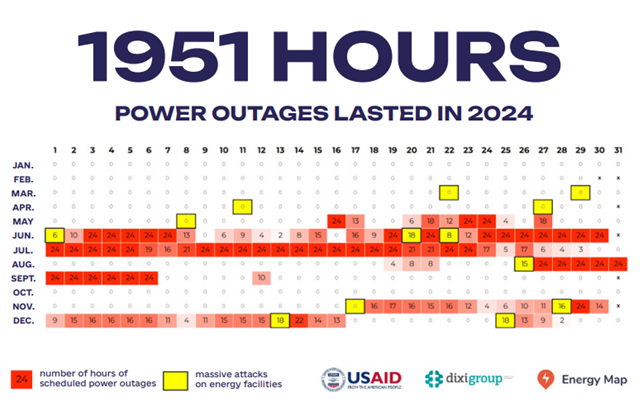

3. Inflation

In December 2024, consumer inflation was 1.4% compared to November 2024, and 12.0% for the year.

Core inflation was 1.3% in December 2024 compared to November 2024 and 10.7% for the year.

Source: Ukrstat

In the consumer market, prices of food and non-alcoholic beverages rose by 1.8% in December. Prices of butter, sunflower oil, milk and dairy products, vegetables, processed cereals, bread, beef, fish and fish products, pasta, and pork increased by 5.2% – 1.0%. At the same time, prices of eggs decreased by 1.5%.

Prices of alcoholic beverages and tobacco products rose by 2.0%, driven by a 2.7% increase in tobacco products and a 1.2% in alcoholic beverages.

Clothing and footwear fell 3.9%, with footwear down 4.0% and apparel down 3.9%.

Year-on-year inflation rose from 11.2% to 12.0% in December.

At the same time, the cost of utilities surged by 18.9% in 2024 and food by 14.1%. Clothing and footwear fell by 4.3%.

BUDGET

- Budget execution

In 11 months of 2024, the consolidated budget was closed with a deficit of UAH 1048.4 billion (UAH 125.6 billion in November). This is UAH 66.1 billion more than in 11 months of 2023 (UAH 982.3 billion).

At the same time, the surplus of local budgets for 11 months amounted to UAH 80 billion, while the state budget deficit amounted to UAH 1128.4 billion,

As of December 1, the cash amount of the government and local budgets increased from UAH 56 billion to UAH 216 billion in November. These gains are due to USD 6.4 billion of external financing.

According to the latest information from the Ukrainian prime minister, as of January 1, 2025, the balance on the UAH treasury account exceeded UAH 100 billion. Foreign currency accounts amounted to over UAH 163 billion. These are record figures.

According to the latest data, in 2024, the state budget was closed with a deficit of UAH 1,359 billion. According to the results of 2024, the general and special funds of the state budget earned UAH 3,120.5 billion in taxes, fees, and other payments. expenditures of the state budget amounted to UAH 4,479.3 billion, including UAH 3,488.8 billion from the general Fund.

In 2024, the social contribution to the pension and social insurance funds amounted to UAH 548.8 billion.

- External financing

In 2024, Ukraine received USD 41.634 billion in external financing. Of these, 12.553 billion were grants, and 29.081 billion were loans.

In December 2024, the general Fund of the State Budget of Ukraine received USD 9.4 billion in external financing:

- USD 4,411.1 million – macro-financial assistance from the EU;

- USD 3,935.3 million – from the USA, Japan, and the UK;

- USD 1, 088.8 million – from the IMF;

Source: Ministry of Finance of Ukraine

- Public debt

As of December 1, Ukraine’s public and publicly guaranteed debt amounted to USD 159.7 billion (USD +14.4 billion for 11 months of 2024).

The IMF revised its forecast for Ukraine’s public debt ratio at the end of 2024, lowering it from 95.6% to 92.2% of GDP.

However, we believe that the public debt ratio will be lower than our October forecast of 90.3% of GDP in 2024. We now estimate that the public debt will reach 87-88% of GDP at the end of 2024. This was achieved because:

- Local debt lowered, and domestic debt devalued.

- Ukraine received more grants than expected (12.5 billion dollars).

- The U.S. dollar strengthened against the euro. Ukraine’s debts to the EU have devalued by an estimated USD 4 billion over the last 3 months.

Balance of payments

1. Balance of payments in November of 2024.

The balance of payments was positive in November 2024. Ukraine received external financing in the amount of about USD 6.3 billion. As a result, the financial account balance was positive in November at USD 4.3 billion, and the current account deficit (USD -841 million in November) fell by obtaining part of the financing through grants.

We note the following items as significant in November:

- Significant deterioration in primary income in 2024. In the first 11 months of 2024, the surplus amounted to only USD 577 million, compared to USD 4,205 million in 2023. This is due to both a decrease in the transit of labor remittances to Ukraine by migrant workers (USD 7.3 billion in 2024 vs. USD 10.3 billion in 2023) and an increase in the withdrawal of profits from Ukraine (USD 8.0 billion vs. USD 7.1 billion in 2023). The IMF has significantly revised its forecast for 2024 for primary income from USD +3.8 billion to USD -0.3 billion.

- For the second month in a row, household purchases of foreign currency exceeded USD 1.6 billion. In the first 11 months of 2024, foreign currency purchases reached USD 14.9 billion, up from USD 10.2 billion in 2023. Given these dynamics, household purchases of foreign currency will exceed our October forecast by more than USD 1.3 billion. The latter is the primary reason international reserves did not reach the USD 45 billion mark as of January 1, 2025.

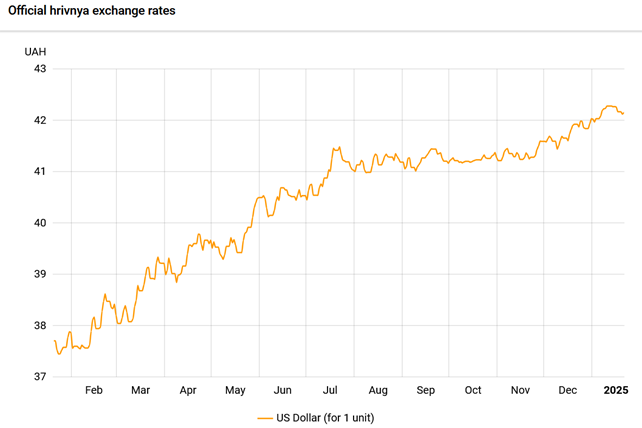

2. Hryvnia exchange rate

Since the beginning of December, we have seen a change in the NBU’s exchange rate policy. Despite higher-than-expected inflation and USD 15 billion in aid from the West, the NBU has resumed a controlled devaluation regime for the hryvnia/U.S. dollar exchange rate, which has already moved from the range of 41-41.5 hryvnias to 42-42.5 hryvnias per dollar in early January 2025.

From an inflationary standpoint, we consider the NBU’s actions inherently irrational, as stabilizing the hryvnia exchange rate is a strong argument for reducing inflation, which is already 2-3 percent higher than the NBU’s forecasts.

UAH/USD exchange rate for 12 months. Source: NBU.

3. International reserves

International reserves in December 2024 increased from USD 39.9 billion to USD 43.8 billion.

In December, the NBU’s net foreign exchange sales amounted to USD 5,308.5 million, almost twice as much as in November. Last month’s increase in the NBU’s foreign exchange interventions was mainly due to a traditional seasonal factor, namely the increase in budget spending and business operations at the end of the year.

The government’s foreign currency accounts with the NBU increased by USD 9,461.1 million. Of this amount:

- USD 4,411.1 million – EU macro-financial assistance;

- USD 3,935.3 million – from the World Bank, including funding from the USA, Japan, and the UK through the DPL mechanism;

- USD 1,088.8 million – from the IMF;

- USD 25.9 million – from other creditors.

The Government of Ukraine paid USD 132.6 million for public debt service and repayment in foreign currency, including:

- USD 75.2 million – debt owed to the World Bank;

- USD 4.5 million – debt owed to the CEB;

- USD 52.9 million – debt owed to other international creditors.

In addition, Ukraine paid USD 252.0 million to the International Monetary Fund.

Current international reserves cover 5.5 months of future imports.

Change in international reserves over the past 12 months. Source: NBU.

FORTHCOMING EVENTS

January 23: NBU. Decision on the key interest rate.

January 30: NBU 1Q2025 inflation report.

January 30: Ministry of Finance. Execution of the consolidated budget for 2024.

January 30: NBU. Balance of payments for 2024.

Вам також буде цікаво:

Global Investment Market: role of Ukraine

NEW IMMIGRATION LAW IN GERMANY: CONSEQUENCES FOR UKRAINE

Tax on the withdrawn capital will save Ukrainian business from “double bookkeeping”: calculations of economists of the Ukrainian Institute for the Future

Why didn’t Ukraine become energy self-sufficient state during 26 years

“DEMOCRATIC ELECTIONS ARE NONSENSE. MOSCOW DECIDED WHO WILL WIN”, – BORODAI ABOUT THE “PSEUDO-ELECTIONS” IN ORDLO

THE MEDIA: OPERATION “DEOLIGARCHIZATION”