Monthly Energy Digest – August

- On August 25, Russia conducted the most massive attack ever on Ukraine’s power system.

- The government approved the National Renewable Energy Action Plan until 2030.

- For the first time, Ukrenergo held the first long-term auctions to buy ancillary services for five years.

- The government is launching pilot auctions for new renewable power capacities.

The Electricity Market

The general situation in the power system

The situation in the power system improved in late July. At the beginning of August, Ukrenergo restricted consumption by industrial consumers, but households were unaffected. Still, on some days, the Ukrainian power system received emergency technical aid from neighboring countries to cover the shortage. Later, power consumption was not restricted at all. Some nuclear power units were connected to the grid after the maintenance, increasing the volume of available capacities.

On August 25, due to a capacity surplus in the power system and the necessity to restrict production by RES producers, the transmission system operator announced electricity export, which had not happened for more than three months.

However, the situation drastically changed the next day, as Russia launched the most massive attack on the Ukrainian power system. In August, high prices in Europe affected the ability to import electricity. On some days, price caps in Ukraine restricted imports. However, the Russian attack restricted these import capacities for some time as well.

Following the attack, huge deficits occurred in the power system, which caused the necessity for emergency and scheduled cut-offs. Until the end of the month, the power system experienced a lack of capacity due to severe restrictions on the capacity to transmit electricity across the regions. However, the situation was improving daily due to repairs carried out by Ukrenergo.

Russian Attacks on Energy Infrastructure

On August 26, Russia conducted its most massive attack on the Ukrainian power system ever, using 127 missiles and 109 drones, more than 200 of which were intercepted by Ukraine’s air defense. For the first time, Russians used missiles with cluster munition missiles to attack the power system. Facilities in 15 regions were affected.

Power transmission substations and distribution substations of two power plants, including the Kyiv hydropower plant, were under attack. A missile shot the dam of the Kyiv hydropower plant. Frequency changes caused some nuclear power units to be turned off, and operators stopped some manually.

The key Russian aim was to cause a blackout in the country, which would mean a long time without power supply across the country. The power system survived; however, the power supply was restricted. For the first time in 2024, Russia did not attack thermal power plants but attacked substations. Also, Russia continued attacks on gas infrastructure – gas production facilities and underground gas storages. Officials said the Kyiv HPP was not significantly damaged after the attack, and there was no risk to the dam.

Exports and Imports

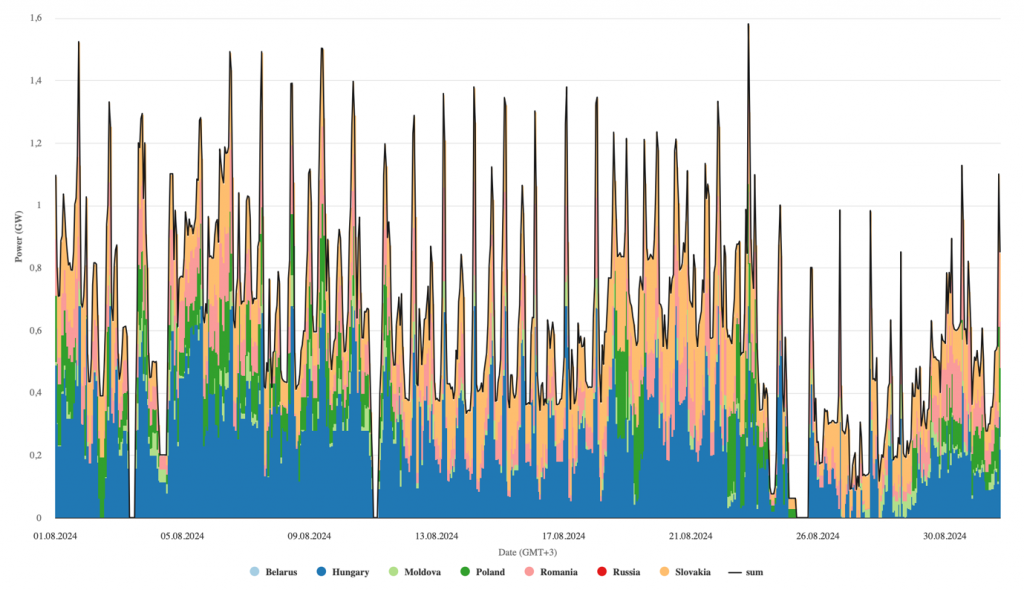

Electricity export (- minus) and import (+ plus) during the month

In August, Ukraine reduced electricity imports by 43%

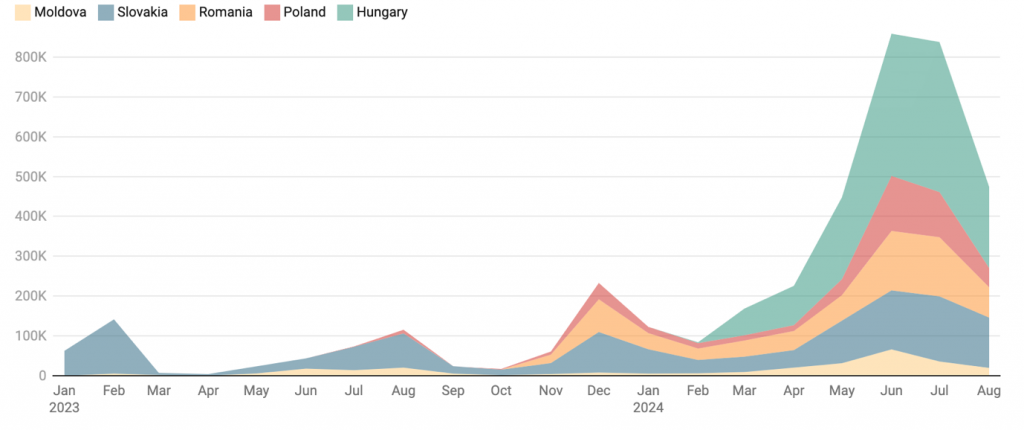

In August 2024, Ukraine reduced electricity imports by 43%, compared to the previous month, to almost 474,000 MWh.

Electricity imports from Poland decreased the most, by 57.5% to 48.2 thousand MWh. Hungary will continue to occupy the largest share of imports, 43%.

Compared to August 2023, the import of electricity increased four times this year. In total, more than 2.1 million MWh of electricity was imported in June-August 2024, which is almost three times more than the total volume of imports for 2023. This year’s peak of electricity import was in June – more than 858 thousand MWh.

Electricity import, per month, 2023-2024, MWh

Europe’s Electricity prices were much higher at the end of summer, limiting Ukraine’s electricity imports. Ukrainian customers were not ready to buy electricity, and in some cases, commercial imports were restricted by the price caps in the Ukrainian electricity market. Another factor that affected imports was the Russian wide-scale attack on August 26, which damaged some time-restricted import capabilities.

Debts and non-payments

Parliament passed a bill regarding paying debts in the electricity market.

The parliament has voted on bill No. 11083, which regulates specific issues of terminology used in implementing smart grids and regulates debt payments.

It stipulates that Ukrenergo will use the funds received from the distribution of interstate cross-border capacity from January 1, 2024, to December 31, 2024, to pay debts in the balancing market and the debt for the feed-in tariff to renewable power producers.

Market shaping

Ukrenergo held the first long-term auctions to buy ancillary services for the upcoming five years.

For the first time, Ukrenergo held a long-term auction to purchase frequency containment reserves (FCR) for five years to ensure the stable operation of the power system.

99 MW of reserves were sold. Thirty-nine generating units participated and made 230 proposals. The previous winners were 12 companies that offered the lowest prices for the provision of the FCR service: from UAH 500 to UAH 1,001 per megawatt. The weighted average price per megawatt is less than UAH 700 (the price cap on the market of auxiliary services for the FCR provision is UAH 1,339.82 per megawatt). The offer in each hour significantly exceeded the auctioned demand and amounted to 368 MW.

The auction winners will have a fixed contract in euros with Ukrenergo to provide FCR services for five years, with a one-year postponement from the moment of the auction. Investors will have time until October 2025 to build power plants or energy storage facilities and get the equipment certified to provide this type of reserve.

The second special auction was held to purchase automatic frequency restoration reserves for five years. Ukrenergo purchased 500 MW of fast reserves for five years. The price was also about twice lower than the cost of the service now.

Ukrenergo assessed the cost of building a decentralized power system resistant to attacks.

Ukrenergo says Ukraine must build more than 12 GW of capacity in the coming years to build a distributed power system resistant to possible attacks. This will cost about 12-13 billion euros. According to Ukrenergo’s assessments, Ukraine must build at least 4 GW of new wind power plants, 3.8 GW of thermal power plants, 1.4 GW of gas generation capacities, 1.1 GW of new biomass thermal power plants, and 0.8 GW of energy storage facilities. This will be impossible without private investments.

The government has updated conditions for an unrestricted power supply to industrial customers.

The Cabinet of Ministers adopted a resolution stating that blackout schedules and any other restrictions on electricity supply will not apply to consumers whose self-production covers at least 80% of consumption.

- At the end of May, the Cabinet of Ministers introduced a rule under which a business will not experience scheduled cutoffs if more than 80% of the relevant business’s total consumption volume is imported.

- Previously, the share of imports from October to April had to exceed 50% of hourly consumption, and in May-September – 30%.

Renewable Power Sector

The government approved the National Renewable Energy Action Plan.

On August 13, the Cabinet of Ministers approved the National Renewable Energy Action Plan until 2030 and the Plan of measures for its implementation. This plan supplements the National Energy and Climate Plan, which was adopted earlier.

The document aims to increase the share of green energy in gross final consumption to 27%. The plan envisages 38 measures and performance indicators and identifies the responsible parties.

According to the Plan, renewable energy sources will account for 27% of gross final energy consumption in 2030: 33% for heating and cooling, 29% for electricity production, and 17% for the transport sector.

The government is launching pilot “green” auctions.

The Cabinet of Ministers of Ukraine on August 13 established an additional annual support quota for renewable energy producers (solar, wind, biogas, micro- and small hydropower plants) to hold pilot green auctions in 2024. The schedule for holding auctions to distribute support quotas for 2024 was also approved.

The auction participant’s maximum price offer for 2024 is 9 eurocents per 1 kWh for solar and wind power and 12 euro cents per 1 kWh for others.

The additional annual support quota is 110 MW, of which solar is 11 MW, wind is 88 MW, and other types of alternative energy sources are 11 MW. The first power generation facilities put into operation due to the pilot auctions are expected to start supplying electricity to the grid in 2025.

The Gas Market

Gas balance

In August, gas consumption was 2% higher than last year. Despite the Russian attacks on gas infrastructure facilities, gas production in Ukraine continued growing and, in August 2024, exceeded last year’s level by 1.5%, mainly due to the recovery of production by UkrNaftoBurinnya to 1.4 million m3/day.

The total natural gas reserves in Ukrainian underground gas storage facilities are 11.1 bcm, 18% lower than a year ago (considering 0.6 billion cubic meters of gas owned by non-residents). In August 2024, the average volume of gas injected into storage facilities amounted to 27 million cubic meters daily.

Gas transit status and updates

Kyiv confirmed it controls the gas metering station in Sudhza, Russia (the only one used to transport Russian gas to Europe). At the same time, Gazprom, Naftogaz, and the Ukrainian gas TSO say this has not affected the gas transit, and the volume of gas transmitted corresponded to the booked nominations. In August, the transit of Russian gas through Ukraine decreased by 1.1% to 1.292 billion cubic meters compared to August 2023.

At the same time, from January to August 2024, Russia increased the gas supply for transit through the Ukrainian gas transport system to the European Union and Moldova by 8% – up to 10.3 bcm compared to the same period last year.

President Volodymyr Zelenskyy once again stated that Ukraine will not extend the agreement on the transit of Russian gas but is ready to consider requests from European companies. Naftogaz Chairman Oleksiy Chernyshov, during his visit to Slovakia, said Ukraine intends to continue transporting natural gas to Slovakia, but this requires implementing new solutions. However, there is still no agreement with Baku regarding the transit of Azeri gas through Russia and Ukraine to the EU.

Gas import and storage

Naftogaz will start buying gas from the EU without customs clearance yet.

Naftogaz starts purchasing gas in Europe but will not clear it through customs, so it will not be considered an import. The gas will be pumped to Ukraine in gas storage facilities in a customs warehouse mode. Although gas will be paid for, Naftogaz will not pay VAT until customs clearance. The first gas supplies are planned for September 2024. The entire reserve stock will be purchased with EBRD loans for 200 million euros.

Prices

The government extended gas price regulations for non-commercial customers until May 2025.

The Cabinet of Ministers of Ukraine has extended the special obligations (PSO) regarding gas supply to heating and communal energy enterprises, household consumers, operators of gas distribution systems, and electricity producers until April 30, 2025. In fact this means the gas will be subsidized for a huge range of consumers.

Gas prices (UAH/cubic meter, VAT included) will remain the same:

- UAH 7.96 for households.

- UAH 7.42 – to produce thermal energy production for the households.

- UAH 16.39 – to produce thermal energy production for budgetary institutions.

- 10.5 UAH – for electricity production in the condensation cycle.

- 16.5 UAH – for electricity production in the heating cycle.

The Oil Sector

Oil transit status and updates

The adviser to the head of the Office of the President, Mykhailo Podolyak, on Aug 30, said Ukraine was going to stop the transit of Russian oil through the Druzhba pipeline from January 1, 2025. He addressed some resolution of the European Union – a consolidated decision – that Hungary, Slovakia, and the Czech Republic should find opportunities to diversify oil and stop the transit of Russian oil through Ukraine. Podolyak denied his statement in a few hours.

Later, Naftogaz denied any plans to stop oil transit to Europe until the contract expired. However, Naftogaz supports the fastest possible diversification of energy supply sources by Europe.

The transit of Russian oil to the EU through the Ukrainian part of the Druzhba oil pipeline doubled in July, from 0.54 million tons in June to 1.09 million tons in July 2024. Russian Tatneft sharply increased oil supplies to refineries in Slovakia and Hungary through the southern branch of the Druzhba pipeline in July, replacing Lukoil’s oil.

Most of the oil was transported to Hungary in July—0.43 million tons, 8% less than in June. On the other hand, oil supplies to Slovakia increased fivefold to 0.34 million tons. In addition, 0.32 million tons of oil were transported to the Czech Republic, while there was no transit there in June.

Developments on Assets Nationalizations

UkrNaftoBurinnya resumed natural gas production at the Sakhalin field.

The Sixth Administrative Court of Appeal allowed UkrNaftoBurinnya (UNB) to resume gas production at the Sakhalin field. Following the decision, the state regulator granted the company a license. UkrNaftoBurinnya is gradually resuming natural gas production at the Sakhalin field. So, on August 10, the company produced about 1.39 million cubic meters of natural gas.

Before the production stop at the beginning of December 2023, UNB produced 1.56 million cubic meters of natural gas per day at the Sakhalin field. The total natural gas production in Ukraine due to UNB’s resumption of production on August 10 increased above 53 million cubic meters per day for the first time since the end of November 2023.

- Gas production in Ukraine decreased by 3% after the halt of UNB production. In recent months, before the production stop, the company produced about 45 million cubic meters of natural gas per month and was one of the top 3 private gas-producing companies in Ukraine.

- On December 1, 2023, after carrying out all the necessary technological procedures, the Sakhalin oil and gas condensate field completely stopped producing natural gas and gas condensate. The reason for taking such measures was the decision of the Sixth Appeal Administrative Court of Ukraine on the annulment of the special permit for the use of subsoil No. 6349 dated July 10, 2019.

- On May 23, 2023, the Cabinet of Ministers handed over UNB’s assets, which had been seized in criminal proceedings, to the management of Ukrnafta. On April 7, 2023, the court seized UNB’s corporate rights and transferred them to the Agency for Investigation and Asset Management (ARMA) management on April 11. Oligarch Ihor Kolomoisky was one of the major owners of UNB.

Smart Energy has resumed production in the Kharkiv region.

Smart Energy Group has resumed the activities of one of its Kharkiv companies, launching wells of the Vasyshchiv deposit in the Kharkiv region.

The State Geological Survey renewed the validity of three suspended Smart Energy special permits at the end of June. The companies of the Ukrgazvydobutok and Prom-Energo Produkt groups did not work for more than a year due to the state’s forced suspension of special permits for hydrocarbon extraction, Smart Energy noted, adding that during this time the state lost UAH 1.65 billion in taxes and almost 195 million cubic meters of gas.

In April-May 2023, the State Geological Survey suspended the operation of three special permits of Smart Energy Group companies, as the SBU believed that the beneficial owner of the companies remained the pro-Russian former deputy Vadym Novinsky, against whom sanctions were imposed.

Other News and Developments

Zaporizhzhia NPP Developments

A fire broke out in the cooling tower of the ZNPP.

On August 11, 2024, around 8:00 p.m., a fire broke out at the cooling tower on the territory of the Zaporizhzhia nuclear power plant. Technological equipment was damaged. The fire did not affect the radiological and nuclear safety. Towers are located 1 km from the closest nuclear power unit.

The International Atomic Energy Agency (IAEA) representatives inspected the damaged cooling tower. The IAEA emphasized that the station’s nuclear safety was not affected, as the cooling towers are not working.

Others

The Paris Arbitration Tribunal will consider the case regarding Ukrenergo’s claims against Russia regarding the lost assets in Crimea.

The arbitration tribunal in Paris, appointed to consider the case by the Permanent Chamber of the Arbitration Court, on August 5, 2024, ruled in favor of Ukrenergo, recognizing that the court has jurisdiction to consider the company’s dispute with the Russian Federation.

UkrHydroEnergo is preparing for international arbitration for Kakhovka HPP.

UkrHydroEnergo has announced the purchase of services for providing legal representation in international arbitration on compensation for losses caused by the destruction of the Kakhovka HPP, which was blown up by the Russian occupying forces in June of last year.

The government appointed two new members of the NEURC.

The Cabinet of Ministers appointed Yury Vlasenko and Ruslan Slobodyan to the positions of members of the National Commission for State Regulation in the Energy and Utilities Sectors (NEURC). Later, Vlasenko was elected as a chair of the commission.

Naftogaz has appointed Roman Malyutin as CEO of UkrTransGaz.

Naftogaz of Ukraine has appointed Roman Malyutin as the general director of UkrTransGaz for three years. From January 2023, Malyutin was acting CEO of UkrTransGaz. Before the appointment, he headed the technical department of UkrTransGaz, where he was responsible for the operation of compressor stations, energy, and metrology areas. He also accompanied projects on developing low-carbon technologies and storing hydrogen mixtures.

The turbine of the first wind farm was launched in Transcarpathia.

A turbine with a capacity of 1.8 MW of a wind power plant has been put into operation in Zakarpattia Oblast in test mode – the first in this region. The turbine’s capacity is 4.8 MW, capable of providing electricity for up to 3,000 households. The planned wind power plant’s total installed capacity will be 80 MW, and the electricity produced will be enough to supply 50,000 households annually.

Вам також буде цікаво:

Trump and his team: what should Ukraine expect?

The US imposed new sanctions against the Russian Federation: who suffered and why?

THE COAL ERA IN SLOVAKIA: WHY AND FOR WHAT GREENPEACE ACTIVISTS WERE DETAINED?

Forecast 2018: the next year is decisive for education

THE GAME OF THE ХХІ CENTURY: IS UKRAINE OFFLINE?

University admissions process began in Ukraine