June 2024

HIGHLIGHTS

After 16 months of 24/7 electricity availability, in May 2024 Ukraine switched to a mode of electricity supply restrictions due to capacity shortages caused by damage from Russian shelling. The shortages led to restrictions, scheduled and emergency blackouts across the country.

On 18 May, the mobilisation law came into force. The entire male population of Ukraine between the ages of 18 and 60 must update their location and contact phone number within 60 days. Failure to do so will result in heavy fines. More than 90 percent of those who have already completed the process have chosen to update their information using the Reserve+ application developed by the Ministry of Defence.

In this digest, we describe our perspective on how the power outage and the mobilisation law may affect economic processes in Ukraine by the end of 2024.

In early May, the Ministry of Finance of Ukraine and its creditors held negotiations on the restructuring of USD 20 billion of debt (mainly Eurobonds). Judging by the absence of any information from the Ministry of Finance of Ukraine, the negotiations have so far been unsuccessful. However, there are reports in the Western press of proposals by creditors to write off some of the debt and minimise interest payments on the bonds. At the same time, payments are due to start in 2025. This digest looks at the current state of debt in 2024 and the outlook for next year.

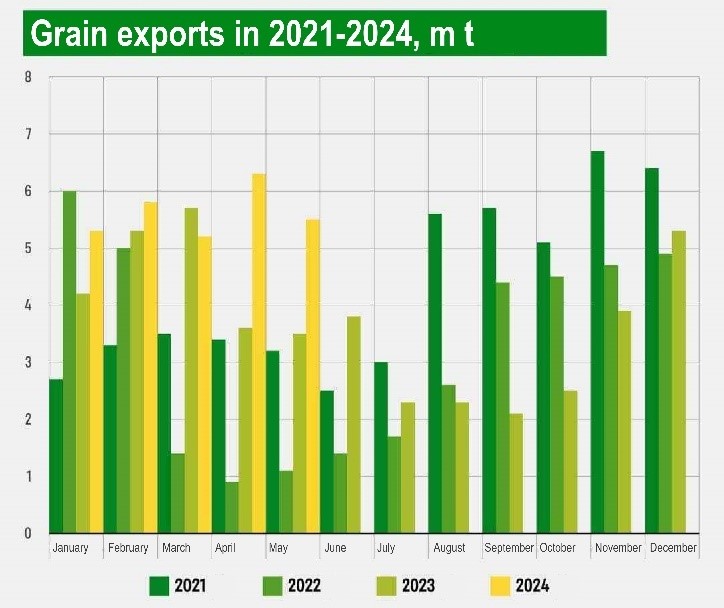

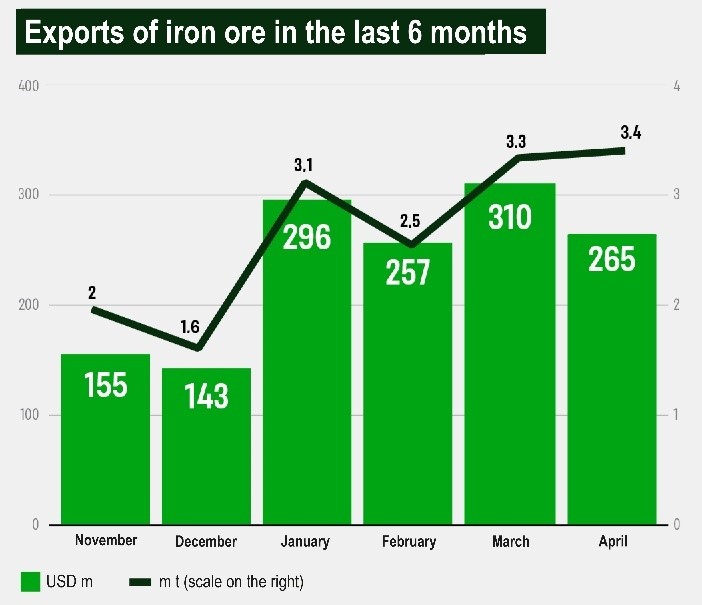

Grain exports are breaking records. In April, we exported over 6 million tonnes (compared to 1 million tonnes in April 2023). Exports of iron ore are actively recovering. In April 2024 compared to November 2023, export growth reached 70%.

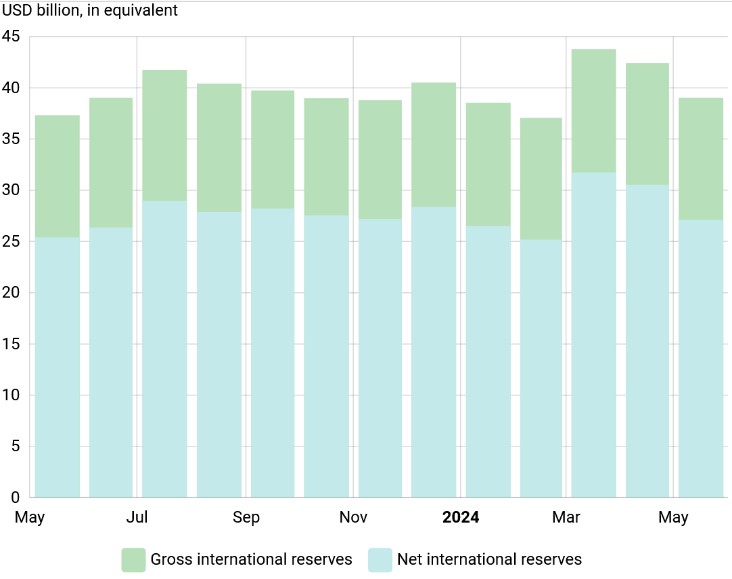

In May 2024, international reserves were down from USD 42.4 billion to USD 39.0 billion.

At the end of May, the hryvnia exchange rate against the US dollar broke through the psychological mark of 40.

| Apr-24 | Mar-24 | Mar-24 | |||||

| Macro results: | 2020 | 2021 | 2022 | 2023 | 2024E NBU | 2024E IMF | 2024E UIF |

| GDP, UAH bn | 4 194 | 5 459 | 5 191 | 6 538 | 7 590 | 7 748 | 7 678 |

| GDP, USD bn | 156 | 200 | 158 | 179 | – | 190 | 199 |

| GDP growth | -3,8% | 3,4% | -29,1% | 5,3% | 3,0% | 3,5% | 3,6% |

| Government debt/GDP | 60,8% | 48,9% | 68,3% | 81,3% | – | 94,1% | 92,7% |

| International reserves, end of year, USD bn | 29,1 | 30,9 | 28,5 | 40,5 | 43,4 | 42,1 | 46,5 |

| Inflation | 5,0% | 10,0% | 26,6% | 5,1% | 8,2% | 8,5% | 8,9% |

| UAH/USD exchange rate mid. | 26,9 | 27,3 | 32,9 | 36,6 | – | 40,7 | 38,5 |

| Unemployment | 9,9% | 9,8% | 24,5% | 19,1% | 14,2% | 14,5% | – |

| Current account, USD bn | 5,2 | -3,9 | 8,0 | -9,2 | -20,6 | -10,8 | -7,9 |

| Goods and services (balance) | -2,4 | -2,7 | -25,8 | -37,4 | -33,2 | -33,3 | -34,4 |

| Export of goods and services | 60,7 | 81,5 | 57,5 | 51,1 | 57,1 | 57,7 | 56,3 |

| Import of goods and services | 63,1 | 84,2 | 83,3 | 88,5 | 90,3 | 91,0 | 90,8 |

| Budget deficit, % of GDP | -5,2% | -3,3% | -16,3% | -20,5% | -18,4% | -13,7% | -19,9% |

Fact 2020-2023, Forecasts of the NBU, IMF, and UIF for 2024

ECONOMIC SITUATION

1. Blackouts for energy consumers

After 16 months of 24/7 electricity availability, in May 2024 Ukraine switched to a mode of electricity supply restrictions due to capacity shortages caused by damage from Russian shelling. The shortages led to restrictions, scheduled and emergency blackouts across the country.

As of early June, available capacity covered only 8 GW of load. In addition, the permitted import capacity of 1.7 GW is fully utilised during peak demand times, and small amounts of urgent assistance are being sought from neighbouring countries to supplement imports (up to 250 MW). Nevertheless, there is an additional shortfall of about 2 GW, which leads to the need to impose restrictions on consumers (planned outages and consumption limits).

Since the first of June, household electricity prices have risen from UAH 2.64 to UAH 4.32 per 1 kWh (an increase of 63%).

In the summer, during the period of scheduled maintenance of NPP units, we should expect a decrease in nuclear power generation capacity. In autumn, nuclear power generation will increase. However, solar power generation is now at its peak and will begin to decline in the autumn.

In the winter, power supply highly depends on the weather, the actions of the Ukrainian government, and the support of Western partners. If the weather is as cold as -10 to -15 degrees Celsius, electricity consumption could reach 18 GW, which would result in non-strategic consumers experiencing blackouts for more than 10 hours a day. If the temperature is around 0 degrees, electricity consumption will reach 15 GW.

Several things can improve the situation:

1) Increase the capacity of electricity imports. From 1.7 to 2.5-3 GW. This will require cooperation with European partners. The government has already started this work. However, the current forecast is to increase the transfer capacity by 500 MW by winter.

2) Repair and restart of several power generation facilities. This will require an air defence circuit that covers each of the facilities being repaired (long-range air defence (Patriot), medium-range air defence and drone defence). Repair is pointless if new missiles destroy the plant again.

3) Supply a large number of 1-2 MW containerised gas generators to regional centres and small towns. Such generators, with the organisational support of central and local authorities, can increase electricity generation by 0.5-1 GW.

4) Start wind power projects now. It won’t help this winter, but it could help next winter. In 1.5 years, up to 4GW of generating capacity can be launched.

The disruptions in electricity supply and the introduction of emergency blackout plans are the main concerns regarding a possible slowdown in economic growth in 2024. As a result, the NBU (National Bank of Ukraine) revised its GDP growth forecast downwards from 3.6% to 3.0%. We take a more positive stance on the implications for GDP growth. However, the impact on household and investor sentiment remains rather negative.

First, strategic facilities will always be powered (they consume about 4.5 GW of electricity), and second, a large number of small businesses will be better prepared for power outages after 2022 having imported a large number of small generators with an estimated total capacity of 1 GW. Third, the correlation coefficient between electricity consumption/production and GDP is decreasing. This is due to the deindustrialisation of the economy and a shift in its structure towards agriculture and services, which are less dependent on electricity and not as energy-intensive as, for example, metallurgy.

We also expect a further round of winter migration from Ukraine to Europe in the event of power cuts of more than 10 hours and lack of heating in homes, which we currently estimate at 500,000-1 million people. This estimate is based on the assumption that most households have very limited financial resources. If European countries open social programmes to provide social housing for Ukrainians in winter, the migration could be much higher.

A programme by central and local authorities, backed by Western funding, to install generators in residential buildings to provide heat in the absence of electricity could also help alleviate the migration problem.

2. The impact of mobilisation on the economy

On 18 May, the mobilisation law came into force. The entire male population of Ukraine between the ages of 18 and 60 must update their location and contact phone number within 60 days. Failure to do so will result in heavy fines. More than 90 percent of those who have already completed the process have chosen to update their information using the Reserve+ application developed by the Ministry of Defence.

The impact of the mobilisation on economic processes is difficult to assess as Ukraine is concealing its personnel losses. We believe that the previously announced figure of 500,000 people to be mobilised is very far from reality, as mobilisation is happening regularly. This is evident from the monthly salaries paid to the military by the Ministry of Finance. In recent months, this amount has been around 80 billion hryvnias (USD 2 billion) per month, suggesting that personnel losses are being replaced by new recruits.

In the long term, it is clear that in the absence of external migration to Ukraine and due to the stabilisation of the number of citizens living abroad, as well as low birth rates, Ukraine will experience a decline in the number of working-age citizens involved in economic processes.

In the event of a loss of manpower, the problem can be solved by involving more women in economic processes and by attracting the elderly, who now find it easier to find work than before the war. Accordingly, businesses have potential reserves for replenishing the labour force with some loss of productivity and additional training costs. In addition, unemployment in Ukraine remains much higher than before the war (19.1% at the end of 2023), which is also an available reserve for the labour market. This does not preclude the need for businesses to reserve their most valuable and hard-to-replace employees.

The adoption of the mobilisation law, in our opinion, may have the following effects:

1) Registration of the location and contact phone numbers of all citizens liable for military service will increase the efficiency and quality of mobilisation procedures. This will allow stopping the highly damaging practice of visiting legal businesses to hand out conscription notices en masse. Within 60 days of the mobilisation law coming into force, conscription notices will be sent to the specified addresses. This will minimise state pressure on legal businesses.

2) We are convinced that not all persons liable for military service will comply with the procedure for updating their data as required by law. Therefore, we can expect a partial loss of legally employed staff and their transition to work for the informal economy, as well as the withdrawal of money from bank accounts, and closure of deposits to prevent the state from collecting fines.

3) Partial reduction of supply and demand for transport services. This is because citizens hiding from mobilisation will minimise transportation.

4) Increased corruption at the police level for “turning a blind eye” to violations of mobilisation regulations.

Based on the above, we believe that unemployment in Ukraine will decline at a slower pace than estimated by the NBU (unemployment will fall to 14.2%). This is because the migration of some workers into the informal economy will offset the replacement of labour shortages by hiring unemployed or economically inactive citizens.

Under current conditions, mobilisation will not have a significant impact on economic growth in 2024 and will be part of the overall process of slowing economic growth in 2024.

3. Labour market

The situation in the labour market is already critical. Before the war, the number of CVs on popular recruitment sites in Ukraine was about twice the number of vacancies. This ratio allowed employers to choose between candidates, but even then, there was competition for valuable employees.

Number of job vacancies and CVs

Source: Oboz.ua

In April 2021, there were 99.3 thousand CVs against 48.2 thousand vacancies. In February 2022, the situation changed dramatically. The number of vacancies temporarily dropped tenfold, and there were over 11 CVs per vacancy. Later, the situation started to reverse, and now the market has turned 180 degrees: there are 67 thousand CVs against 62 thousand vacancies. The almost one-to-one ratio means that some employers will find it impossible to find a new employee. The massive staff shortage has already affected all sectors of the economy. Ukraine has never experienced such labour shortages.

We believe this will lead to higher wages and be a pro-inflationary factor in the economy.

4. Inflation

Inflation in the consumer market was 0.6% in May 2024 compared with April 2024 and 2.0% since the beginning of the year. In May, the prices of food and non-alcoholic beverages in the consumer market increased by 0.9%. The highest price increase was for fruit (+10.4%).

In annual terms, inflation is still at a low level of 3.3% per year.

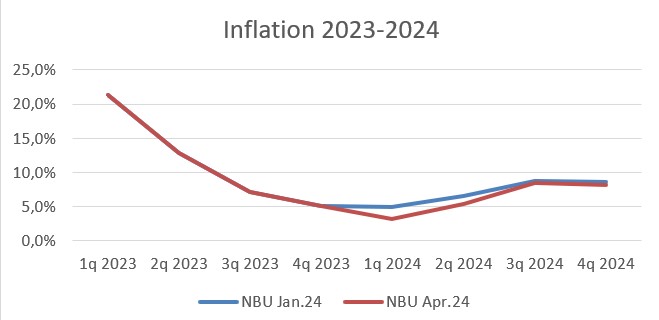

Quarterly inflation forecast

Source: NBU.

In general, inflation is expected to rise in the coming months until the fourth quarter of 2024.

The NBU has lowered its annual inflation forecast for 2024 from 8.6% to 8.2%.

Annual inflation in 2024 is currently forecast at 8.9% by the Ukrainian Institute of the Future.

On 13 June, the NBU will hold a meeting on the key interest rate and we expect the rate to be cut from 13.5% to 13.0%.

5. Changes in exports

The first months of 2024 show positive dynamics in the main items of Ukrainian exports.

Sources: State Customs Service of Ukraine, Ministry of Agrarian Policy and Food of Ukraine

BUDGET

The consolidated budget for the first four months of 2024 was closed with a deficit of UAH 264.9 billion. This is UAH 62 billion more than in four months of 2023 (UAH 203 billion).

The main reasons for the growing deficit are:

1) Less support through grants from the West. While in 2023, UAH 179.5 billion in grants were received in the first four months of the year, this figure dropped to UAH 40.8 billion in 2024.

2) A 43% increase in spending on internal security this year. From UAH 132.2 billion to UAH 189.1 billion.

3) A 67.9% increase in spending on debt service this year. From UAH 38.6 billion to UAH 64.8 billion.

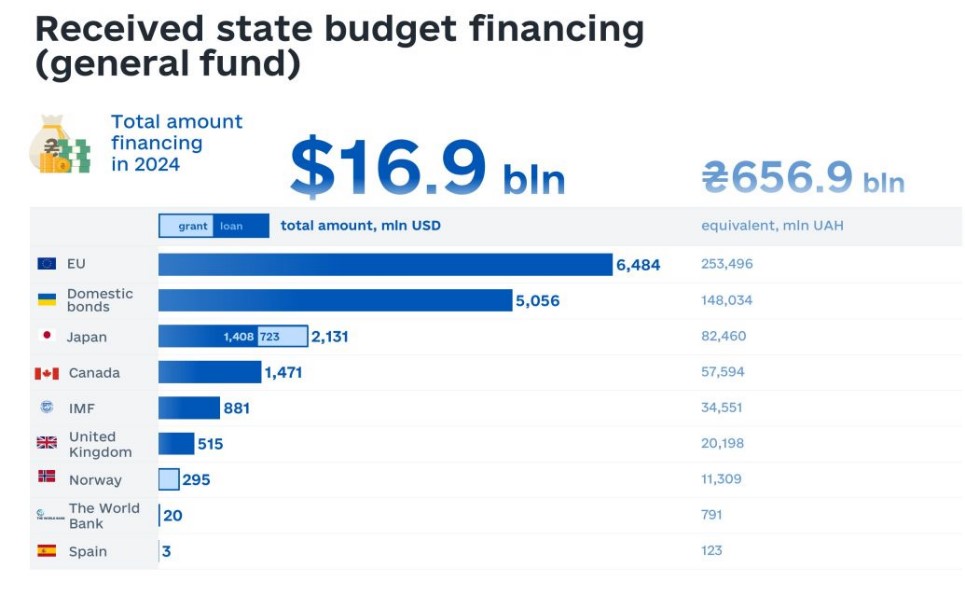

1. External funding

In the first five months of the year, Ukraine received USD 11.8 billion in external financing. Of this, USD 1 billion were grants, and USD 10.8 billion were loans. In May 2024, Ukraine was left without any Western financing. In fact, only USD 20 million was received from the World Bank in May.

Received state budget financing (general fund)

Source: Ministry of Finance of Ukraine

As of 1 May, the balance of the state and local budgets stood at UAH 286 billion, sufficient to finance the Ukrainian budget.

We estimate that between June and December 2024, an additional USD 25 billion in Western funds should arrive. This includes EUR 10 billion from the EU (USD 10.8 billion), USD 7.85 billion from the US, USD 4.5 billion from the IMF, and about USD 2 billion from Japan. In fact, this amounts to more than USD 3.5 billion per month.

2. Government debt

In early May, the Ministry of Finance of Ukraine and its creditors held negotiations on the restructuring of USD 20 billion of debt (mainly Eurobonds). Judging by the absence of any information from the Ministry of Finance of Ukraine, the negotiations have so far been unsuccessful. However, there are reports in the Western press of proposals by creditors to write off some of the debt and minimise interest payments on the bonds. At the same time, payments are due to start in 2025.

If the Ministry of Finance of Ukraine fails to reach an agreement with the creditors on the restructuring, Ukraine will have to pay UAH 153 billion (USD 3.75 billion) in interest alone on this debt for 2022-2023-2024, with a principal amount of UAH 110 billion (USD 2.7 billion) due in September.

| Indicators | 2021 | 2022 | 2023 | 2024E | 2025E |

| Domestic debt, UAH bn (end of the year) | 1063 | 1390 | 1588 | 1796 | 2000 |

| Debt service, UAH bn | 100 | 118 | 200 | 232 | 262 |

| Debt service, % of GDP | 1,83% | 2,27% | 3,06% | 3,02% | 2,98% |

| Foreign debt, USD bn (end of year) | 47,66 | 63,59 | 94,79 | 128,00 | 151,00 |

| Debt service, UAH bn | 57 | 40 | 49 | 248 | 203 |

| incl. IMF | 3 | 7 | 25 | 36 | 49 |

| incl. Eurobonds | 45 | 26 | 1 | 153 | 76 |

| Debt service, % of GDP | 1,04% | 0,77% | 0,74% | 3,23% | 2,31% |

| Total amount of state-guaranteed debt, USD bn (end of year) | 11,34 | 9,85 | 8,73 | 7,60 | 6,50 |

| Total government debt, USD bn (end of year) | 97,96 | 111,45 | 145,30 | 178,36 | 201,94 |

Source: Ministry of Finance of Ukraine, UIF estimates

On the other hand, having signed a four-year programme with the IMF, Ukraine is now replacing USD 10 billion of IMF debt, which was lent at 2-3% per annum, with a debt of USD 15.6 billion at an interest rate of about 8.5%. As a result, in 2024, in addition to principal repayments under the old IMF programmes, Ukraine will have to pay UAH 36 billion (about USD 900 million) in interest to the IMF, according to the Ministry of Finance of Ukraine. We estimate that after receiving USD 5.4 billion in IMF loans in 2024, Ukraine’s interest payments to the IMF will increase to UAH 49 billion (USD 1.1-1.2 billion) in 2025.

In addition, we should keep in mind Ukraine’s 2015 GDP-linked bonds, which are valid until 2041. In 2023, the Ukrainian economy grew by 5.3%, and in 2025, Ukraine will need to pay an estimated USD 700-800 million in «tax on the growth» of the Ukrainian economy in favour of creditors, whom the Ministry of Finance has been concealing for nine years.

Combined with domestic debt, which is currently issued at 16-18% per annum in UAH, at a time when the NBU is keeping the interest rate very high (currently 13.5%, but it was at 25% for more than a year), with an inflation rate of 3.2% per annum, Ukraine has to pay USD 11 billion a year in interest to a narrow circle of domestic and foreign investors. In fact, we can say that half of the US and EU aid this year will be spent on debt service.

The Ukrainian Institute of the Future believes that the following steps should be taken

to minimise the risk of Ukraine defaulting this year and, in the years, to come:

1) It supports the creditors’ initiative to partially write off debt and minimise interest payments on commercial debt, as well as to postpone the start of payments from 2025. This will reduce debt service costs in 2024 and beyond.

2) It supports the restructuring/redemption of Ukraine’s GDP-linked bonds until 2041. In the context of Ukraine’s post-war recovery, it is expected that payments on GDP-linked bonds could reach 0.5-1% of GDP per year, while total issuance is currently estimated at 1.5% of GDP (30-60% per annum).

3) It supports negotiations with the IMF to restructure/partially write off the debt to the IMF. Interest rates with the IMF should be reduced from 8-9% per annum to 2-3%, as was the case before the war.

4) It supports a significant reduction in the interest rate on NBU certificates of deposit, which will increase NBU profits paid to the state budget and reduce domestic borrowing rates, minimising budgetary expenditure on domestic debt service.

Balance of payments

1. Current account

The current account in the first four months of 2024 showed a negative balance of USD 3.7 billion. This is much worse than in 2023 at USD -1.6 billion. The main reason is the lower level of financial support in grants. While in 2023, USD 4.9 billion in grants were received in the first four months, in 2024, this figure dropped to USD 1 billion.

In 2024, the level of remittances from migrant workers to Ukraine declined significantly (from USD 1 billion per month to USD 800 million), but this decline was balanced by a smaller outflow of investment income from Ukraine.

The sharp decline in imports of services in 2024 was caused by a significant reduction in support for Ukrainian migrants with a source of origin in Ukraine, both due to the exhaustion of financial resources for support and an increase in income generated in the country of migration.

The high trade deficit and the significant current account deficit remain a devaluation factor that will put pressure on the hryvnia.

As long as this imbalance is covered by financial account inflows, there is no serious risk to the foreign exchange market as such – yet, in the event of a funding freeze or funding delay, as we saw in April and May, there is an immediate impact on the hryvnia exchange rate.

Mln USD

| Items of the balance of payments | 2024 | 2023 | 2024 | |||

| Jan.* | Feb.* | Mar.* | Apr.* | Jan-Apr | Jan-Apr* | |

| A. Current account | -477 | -119 | -1 569 | -1 516 | -1 568 | -3 681 |

| Goods and services (net) | -2 044 | -1 905 | -2 984 | -2 814 | -11 762 | -9 747 |

| Goods (net) | -1 556 | -1 522 | -2 480 | -2 369 | -7 599 | -7 927 |

| Exports of goods | 3 377 | 3 392 | 3 237 | 3 324 | 12 771 | 13 330 |

| Imports of goods | 4 933 | 4 914 | 5 717 | 5 693 | 20 370 | 21 257 |

| Services (net) | -488 | -383 | -504 | -445 | -4 163 | -1 820 |

| Exports of services | 1 348 | 1 360 | 1 411 | 1 423 | 5 255 | 5 542 |

| Imports of services | 1 836 | 1 743 | 1 915 | 1 868 | 9 418 | 7 362 |

| Primary income (net) | 683 | 192 | 488 | 514 | 1 768 | 1 877 |

| Credit | 935 | 889 | 878 | 923 | 4 250 | 3 625 |

| Debit | 252 | 697 | 390 | 409 | 2 482 | 1 748 |

| Compensation of employees (net) | 814 | 800 | 813 | 806 | 4 021 | 3 233 |

| Credit | 815 | 801 | 814 | 808 | 4 027 | 3 238 |

| Debit | 1 | 1 | 1 | 2 | 6 | 5 |

| Investment income (net) | -131 | -608 | -325 | -292 | -2 253 | -1 356 |

| Credit | 120 | 88 | 64 | 115 | 223 | 387 |

| Debit | 251 | 696 | 389 | 407 | 2 476 | 1 743 |

| o/w: reinvested earnings | 92 | 72 | 79 | 80 | 1 422 | 323 |

| Secondary income (net) | 884 | 1 594 | 927 | 784 | 8 426 | 4 189 |

| Credits | 976 | 1 683 | 1 019 | 873 | 8 812 | 4 551 |

| Debits | 92 | 89 | 92 | 89 | 386 | 362 |

2. Financial account

The financial account showed a surplus of USD 5.5 billion in the first four months of 2024. This is worse than in 2023 (USD 6.8 billion).

There are two reasons for this:

The first reason is the lower level of reinvestment of investment income. While in 2023, the first four months of reinvestment in Ukraine amounted to USD 1.4 billion, in 2024, it was only USD 323 million.

The second reason is the higher level of foreign currency purchases by the population. While in 2023, in the first four months of the year, household purchases of foreign currency amounted to USD 4.3 billion, in 2024, they reached USD 5.3 billion.

Western credit support to Ukraine (excluding the IMF) effectively remained at the 2023 level of USD 8.9 billion.

Mln USD

| Items of the balance of payments | 2024 | 2023 | 2024 | |||

| Jan.* | Feb.* | Mar.* | Apr.* | Jan-Apr | Jan-Apr* | |

| C. Financial account | 1 415 | 1 207 | -7 905 | -185 | -6 783 | -5 468 |

| Direct investment (net) | -167 | -147 | -258 | -218 | -1 681 | -790 |

| Direct investment: assets | 0 | 0 | -1 | 0 | 157 | -1 |

| Direct investment: liabilities | 167 | 147 | 257 | 218 | 1 838 | 789 |

| o/w: | ||||||

| reinvestment of earnings | 92 | 72 | 79 | 80 | 1 422 | 323 |

| debt instruments | 49 | 40 | 109 | 66 | 194 | 264 |

| Portfolio investment (net) | -147 | -50 | 148 | 37 | 806 | -12 |

| Portfolio investment: assets | -259 | -52 | 122 | 32 | 583 | -157 |

| Portfolio investment: liabilities | -112 | -2 | -26 | -5 | -223 | -145 |

| Equities | 0 | 0 | 1 | 0 | 0 | 1 |

| Debt securities | -112 | -2 | -27 | -5 | -223 | -146 |

| General government | 19 | -9 | -9 | -12 | -29 | -11 |

| Banks | -26 | 0 | -25 | 0 | -96 | -51 |

| Other sectors | -105 | 7 | 7 | 7 | -98 | -84 |

| Other investment (net) | 1 747 | 1 455 | -7 621 | 22 | -4 818 | -4 397 |

| Other investment: assets | 2 583 | 1 152 | 752 | 867 | 5 714 | 5 354 |

| Central bank | -7 | 3 | -17 | -7 | 32 | -28 |

| General government | 0 | 0 | 0 | 0 | 0 | 0 |

| Banks | 703 | -39 | 169 | 302 | 1 204 | 1 135 |

| Other sectors | 1 887 | 1 188 | 600 | 572 | 4 478 | 4 247 |

| o/w: | ||||||

| foreign cash outside the banking system | 1 635 | 1 408 | 1 072 | 1 162 | 4 301 | 5 277 |

| trade credits | 241 | -205 | -453 | -571 | -40 | -988 |

| Other investment: liabilities | 836 | -303 | 8 373 | 845 | 10 532 | 9 751 |

| Central bank | 0 | 0 | 0 | 0 | -1 | 0 |

| General government | 261 | -140 | 7 945 | 875 | 8 644 | 8 941 |

| Banks | 24 | -72 | 32 | 47 | -27 | 31 |

| Other sectors | 551 | -91 | 396 | -77 | 1 916 | 779 |

| Long-term loans | 269 | -112 | -208 | -22 | 41 | -73 |

| Short-term loans | 0 | 2 | -2 | 0 | 4 | 0 |

| Trade credits | 282 | 19 | 606 | -55 | 1 871 | 852 |

| Items of the balance of payments | 2024 | 2023 | 2024 | |||

| Jan.* | Feb.* | Mar.* | Apr.* | Jan-Apr | Jan-Apr* | |

| IMF loans | 0 | -131 | 157 | -81 | 1 851 | -55 |

| Central bank | 0 | -131 | -261 | -81 | -643 | -473 |

| Central government | 0 | 0 | 418 | 0 | 2 494 | 418 |

The IMF balance was negative by USD 55 million in the first four months of 2024. Ukraine repaid more to the IMF than it received in new loans. This is much worse than in 2023 (when the balance was USD +1.85 billion).

3. Hryvnia exchange rate

At the end of May, the hryvnia exchange rate against the US dollar broke through the psychological mark of 40. We believe this is a natural consequence of both the NBU’s change in exchange rate policy and the virtual absence of Western funding over the past 1.5 months.

This led to public panic, which was exacerbated by the introduction of the mobilisation law. As a result, the NBU sold more than USD 1 billion in the last week of May.

UAH/USD dollar exchange rate from 01/09/2023

Source: NBU.

Despite the public panic, we are moderately optimistic about the hryvnia exchange rate. A further USD 25 billion of Western financial assistance is expected by the end of 2024. This should lead to a positive balance of payments in the second half of 2024. Thus, the hryvnia exchange rate will remain under the control of the NBU. The current devaluation is also helping to reduce the budget deficit.

4. International reserves

International reserves decreased from USD 42.4 billion to USD 39.0 billion in May. Net sales of foreign currency by the NBU in May amounted to USD 3,075.9 million. The government’s foreign currency accounts with the NBU received USD 143.1 million. The NBU spent USD 143.1 million to service and repay the government’s foreign currency debt. In addition, Ukraine paid USD 240.8 million to the International Monetary Fund.

The current forecast of the NBU for the level of international reserves at the end of 2024 is USD 43.4 billion.

The current forecast of the Ukrainian Institute of the Future is USD 46.5 billion by the end of 2024.

Change in international reserves over the past 12 months

Source: NBU.

EXPECTED EVENTS

13/06. NBU. Decision on the key interest rate.

End June. IMF. The 4th review of the IMF-Ukraine programme. This will be followed by a decision on the possibility of allocating the next tranche to Ukraine.

08/07. UIF. Update of the forecast. GDP growth, inflation, budget execution by the end of 2024, debt, the balance of payments, and international reserves by the end of 2024.

Вам також буде цікаво:

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine (August 2024)

Macroeconomic Digest of Ukraine (November 2024)

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine(July 2024)

Macroeconomic Digest of Ukraine