HIGHLIGHTS

On July 25, the NBU Board decided to keep the key interest rate at 13.0%.

On July 18, the Government of Ukraine submitted a draft law to increase the tax burden on the economy by 4-5% of GDP, expected to take effect on September 1, 2024.

At the end of July, Ukraine agreed with its creditors to restructure its external commercial debt of USD 23.4 billion. The deal reduces budget expenditures on debt service by UAH 130-140 billion in 2024.

International reserves in July 2024 decreased from USD 37.9 billion to USD 37.2 billion.

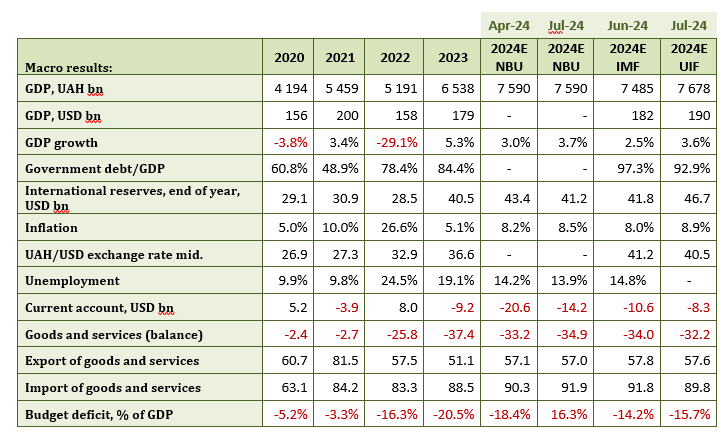

The NBU published an updated inflation report and adjusted its economic forecasts for 2024-2026.

Tax burden increase

On July 18, the Government of Ukraine submitted a draft law to increase the tax burden on the economy by 4-5% of GDP, expected to take effect on September 1, 2024.

The draft law on increasing the tax burden comes in a package with the draft Budget Law and, according to the Government of Ukraine, will be adopted together. The draft Budget Law provides for increased security spending by UAH 500 billion by the end of the year but has not yet been approved by Western partners and the IMF. In its fourth review at the end of June, the IMF left its expenditure forecast for 2024 virtually unchanged.

In July 2024, the Verkhovna Rada approved a gradual increase in fuel excise tax until 2028. From September 1, 2024, the excise tax on fuel will increase from 213 to 242 euros/ton (+13%). And from January 1, 2025, the excise tax on fuel will increase to 272 euros/ton (+27%). From 2028, the excise tax on fuel will increase to 359 euros per ton.

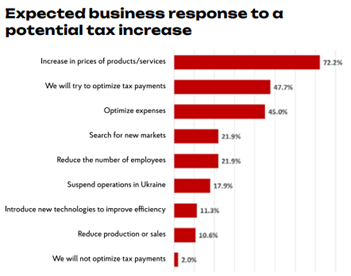

Advanter Group has surveyed taxpayers on their actions in case of a sharp tax increase from September 1. Most expect higher prices and will try to optimize taxes.

Research by Advanter Group.

ECONOMIC SITUATION

1. GDP growth

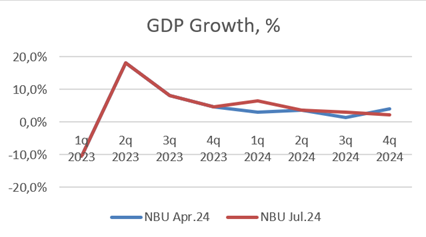

Despite the electricity shortage and lower harvests compared to last year, the NBU slightly raised its annual economic growth forecast – from 3.0% to 3.7%. The NBU attributes this to better results in the first quarter, the expected expansion of budgetary expenses, and the development of distributed generation, supported in part by large-scale credit programs.

Source: NBU.

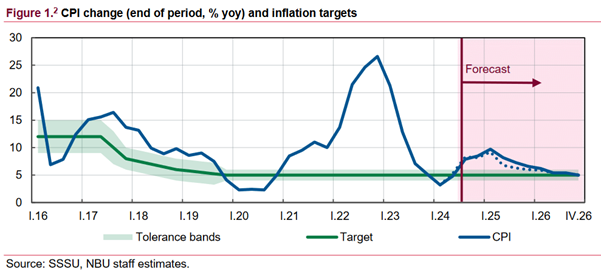

2. Inflation.

Inflation in the consumer market was 0.0% in July 2024 compared to June 2024 and 4.3% since the beginning of the year. In the consumer market, prices of food and non-alcoholic beverages decreased by 0.6% in July. Vegetables and eggs were the most affected by the dropped prices (down 19.6% and 11.4% respectively). Alcoholic beverages and tobacco rose by 1.0%, including 1.3% for tobacco products and 0.7% for alcoholic beverages. Clothing and footwear fell 3.7%, including 4.1% for clothing and 3.4% for footwear. Transport prices rose by 0.7%, mainly due to a 0.8% increase in road passenger transport fares and a 0.6% rise in fuel and oil prices.

On an annualized basis, inflation rose to 5.4% year-on-year in July from 4.8% year-on-year.

The NBU revised its forecast for annual inflation in 2024 from 8.2% to 8.5%.

The current forecast of the Ukrainian Institute for the Future for annual inflation in 2024 is 8.9%, but we see several pro-inflationary factors. First, there was a significant increase in industrial inflation in June by 14% and up to 26% in annual terms due to a 28% increase in electricity prices for industrial enterprises. The second inflationary factor is the increased excise taxes on fuel, which will raise logistics costs. The third inflationary factor is an increase in the tax burden by 4-5% of GDP if the President approves and signs the Government’s draft law.

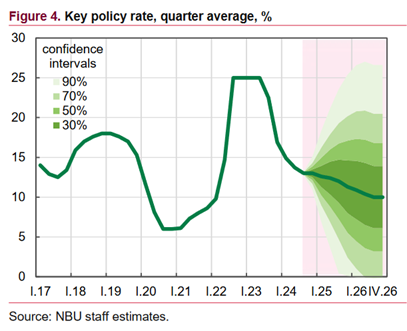

3. NBU interest rate

The NBU Board decided to keep the key interest rate at 13%. This decision is to ensure the foreign exchange market’s stability and bring inflation closer to the 5% target over the forecast horizon.

The baseline scenario of the NBU forecast assumes that the cycle of key rate cuts will resume only in early 2025. However, the NBU will react flexibly to changes in the balance of risks to inflation and the foreign exchange market.

In June 2024, the interest rate on new hryvnia loans for the corporate sector decreased from 15.3% to 15.2% and for households from 34.6% to 34.1%.

NBU’s forecast for the key policy rate. July 2024

BUDGET

1. Budget expansion by UAH 500 billion.

On July 18, the Government of Ukraine submitted draft law 11417, which provides for an increase in security spending by UAH 500 billion by the end of the year and, in our opinion, has not been approved by Western partners and the IMF. In its 4th review at the end of June, the IMF left its forecast of budget revenues and expenditures for 2024 virtually unchanged.

The Government of Ukraine has increased tax revenues and reduced debt service costs by UAH 61 billion. The government plans to cover the additional deficit by increasing the tax burden by 4-5% of GDP and borrowing an additional UAH 220 billion in domestic government bonds on the local market in 2024.

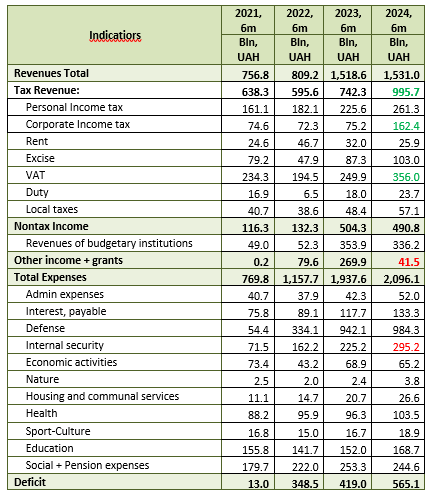

2. Budget execution

For six months of 2024, the consolidated budget was closed with a deficit of UAH 565.1 billion (UAH 145 billion in June). This is UAH 146.1 billion more than in the first six months of 2023 (UAH 419 billion).

Budget 2021-2024 6th fact of budget execution. Source: Ministry of Finance.

Nevertheless, tax revenues for the first six months of 2024 are already UAH 253 billion higher than in 2023.

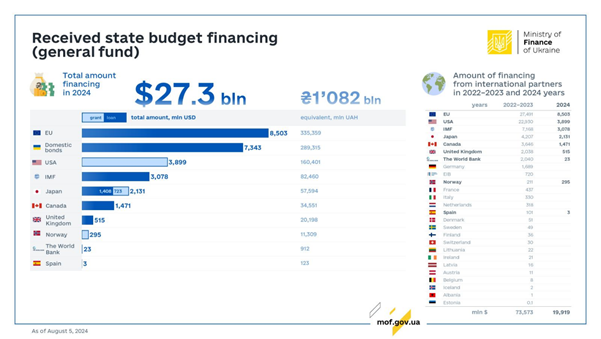

3. External financing

In the first seven months of the year, Ukraine received USD 16 billion in external financing, compared to USD 23 billion in the first seven months of 2023. Of these, 1 billion were grants, and 15 billion were loans.

As of July 1, the balances of the state and local budgets decreased from UAH 128 billion in June to UAH 57 billion, which is problematic for ensuring the financing of the Ukrainian budget. This is less than the balances at the end of February when Ukraine did not receive Western funds for two months.

At the same time, the surplus of local budgets for six months amounted to UAH 53 billion. This means that there are practically no funds at the state budget level.

In July 2024, Ukraine received only USD 2.2 billion from the IMF. This is absolutely insufficient to make budget payments with a budget deficit of UAH 150 billion for the last two months, when the government has practically no money in its accounts as of July 1.

Source: Ministry of Finance of Ukraine

In August, the budget received 3.9 billion dollars from the United States and 4.2 billion euros ($4.6 billion) from the EU, of which 1.5 billion euros was a grant. Also, in August, the budget will receive additional resources of about 40 billion hryvnias of corporate income tax. Thus, the problem with budget liquidity may become relevant again only in October-November 2024.

The baseline scenario of the NBU forecast assumes that Ukraine will continue to receive significant external financing, which will, however, gradually decrease as the domestic capacity to cover budget expenditures from its own resources increases. This year, international partners are expected to provide Ukraine with about USD 38 billion in loans and grants and no less than USD 31 billion next year.

4. Public debt

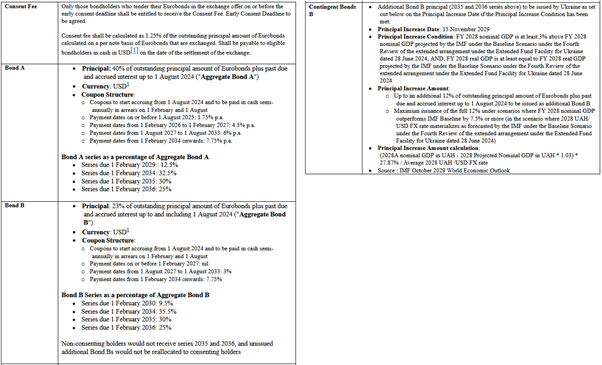

In late July, Ukraine reached an agreement with its creditors to restructure its USD 23.4 billion in external commercial debt. The agreement reduces budget expenditures on debt service by UAH 130-140 billion in 2024.

Terms of restructuring. Source: London Stock Exchange.

Restructuring information:

1) Eurobonds + bonds of Ukravtodor in the total amount of USD 23.4 billion are subject to restructuring. In the form of 13 series of bonds with maturities in 2024-2035.

2) These bonds will be replaced by Series A bonds with a nominal value of 40% or UAH 9.36 billion and Series B bonds with a nominal value of 23% or UAH 5.38 billion.

3) The value of Series A and B bonds also includes interest not paid by Ukraine in 2022-2024 (about USD 3.75 billion, or about +15%). Therefore, the nominal value of Series A is USD 9.36 billion + 15%, and Series B is USD 5.38 billion + 15%.

4) Redemption of the principal amount of Series A bonds in 2029, 2034-2036, Series B bonds in 2030, 2034-2036.

5) A new condition was added: if real GDP in 2028 is higher than in the IMF 4th review (4.3% growth) and nominal GDP in 2028 is 3+% higher than nominal GDP in 2028 according to the IMF 4th review, Ukraine is obliged to repay up to 12% of the principal in 2035-2036. In fact, 12% is already due at 7.5% of nominal GDP growth above the IMF forecast. We believe the second part of the condition will be met with 100% probability, but there may be problems with real GDP growth above 4.3%. It implies additional principal payments of USD 2.8 billion in 2035-2036.

6) Now for the interest. In 2024, a commission of 1.25% will have to be paid. This amounts to about USD 250 million. This is much less than the Ministry of Finance’s current plan of USD 3.75 billion. In 2025, we have to pay 1.75% on Series A, which is 9.36 + 15% billion * 1.75% – about USD 180 million (UAH 7-8 billion) instead of UAH 76 billion in the plan of the Ministry of Finance (although we do not know how much of this amount is payments on the GDP warrants for economic growth of 5.3% in 2023).

7) In 2025-2033, interest on Series A will increase to 7.75%, while there will be no interest on Series B until 2027, when interest will increase to 7.75%.

Bottom line: interest has been significantly reduced until 2033. Principal repayment has been deferred until after 2029. The debt has been partially written off by 10%, and a further 12% will be written off if GDP growth is below 4.3% in 2028. This is very positive for Ukraine and minimizes the risk of default in 2025.

As of July 1, Ukraine’s public and guaranteed debt amounted to USD 152 billion (+7 billion in 1H2024). This slight increase in public debt in H1 was attributable to the following factors:

1) Net external financing was only USD 12 billion.

2) The devaluation of the hryvnia from 38 to 41 per dollar reduces domestic debt.

3) Guaranteed debt decreased by USD 1 billion.

The updated public debt forecast by the Ukrainian Institute for the Future for the end of 2024 is 92.9% of GDP. It assumes that Ukraine will receive UAH 12.1 billion in grants and will account for funding from the US as grants. The difference in the level of public debt compared to the IMF estimate is lower here due to the higher nominal GDP of the Ukrainian economy in 2024.

Balance of payments

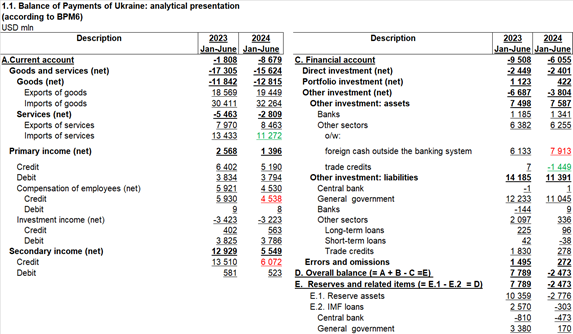

1. Balance of payments for the 1st half of 2024.

The balance of payments in the first half of 2024 was much more negative than in the first half of 2023. While in 2023, international reserves increased from USD 28.5 billion to USD 38.8 billion (+10.3 billion) in the first half of the year, in 2024, they fell from USD 40.5 billion to USD 37.9 billion (-2.6 billion) in the first half of the year.

There are three main negative trends in 2024:

1) Remittances from migrant workers to Ukraine. While USD 1 billion per month was transferred a year ago, in 2024, it was only USD 800 million, with a downward trend.

2) Ukraine actually received no grant aid in 2024 (reflected in secondary revenues) and received only USD 1 billion in grants in the first half of the year. Therefore, secondary revenues are 6.5 billion lower than a year ago.

3) People buy foreign currency in cash. For most of the duration of the war, foreign currency purchases amounted to USD 1 billion per month, but with the devaluation of the hryvnia this year, they have accelerated to USD 1.3-1.4 billion per month.

Among the positive trends in 2024, we can note two key indicators:

1) Imports of services. The imports are largely driven by Ukraine’s support for our refugees in Europe. 2024 shows a decrease in the outflow of money under this item, both due to the lack of money in Ukraine and the transition of some refugees to income from their country of residence. Imports of services declined from USD 13.4 billion to USD 11.3 billion.

2) Return of trade credits to Ukraine. In 2022, USD 11 billion in trade credits were withdrawn from Ukraine. In 2023, the outflow stopped. In 2024, there was a recovery under this item, which amounted to USD 1.4 billion.

Balance of payments for the first half of 2023-2024. Source: NBU.

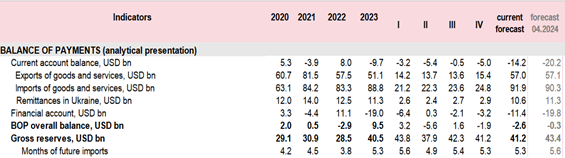

2. Changes in the NBU forecast

The NBU has significantly revised its forecast for both current and financial accounts. As we understand it, the NBU now regards the funds from the US as grants rather than loans, as recommended by the IMF.

Accordingly, the forecast for the current account in 2024 has been improved from USD -20.2 billion to USD -14.2 billion. The forecast for the financial account has been revised downward from USD 19.8 billion to USD 11.4 billion.

Source: NBU Inflation Report.

The NBU also lowered its forecast for private remittances to Ukraine from USD 11.3 billion to USD 10.6 billion.

As a result, the NBU lowered its forecast for international reserves at the end of 2024 from USD 43.4 billion to USD 41.2 billion.

3. Hryvnia exchange rate

In July, the hryvnia continued its controlled devaluation against the US dollar to 41.5 hryvnia/USD. However, by late July and early August, we saw a slowdown in devaluation expectations.

Hryvnia exchange rate against the US dollar from September 01, 2023. Source: NBU.

We believe the devaluation in August will be limited and steered by the NBU. The new devaluation factor we see is the government’s plans to increase the tax burden. This will stimulate additional imports of cars, which may increase in price by more than 15%.

The UIF forecast assumes an exchange rate of 42.0 hryvnia/dollar by the end of 2024.

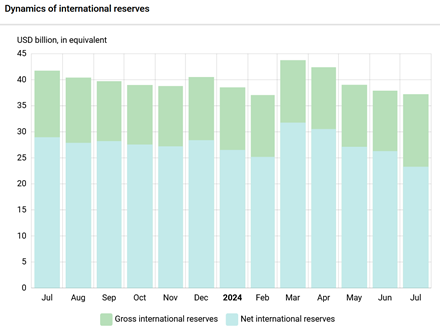

4. International reserves

In July, international reserves decreased from USD 37.9 billion to USD 37.2 billion. The net sale of foreign currency by the NBU in July amounted to USD 3,305.0 million. The government’s foreign currency accounts with the NBU received USD 2,482.7 million. Of this amount, USD 2,197.0 million was received from the International Monetary Fund.

The NBU changed its forecast for the amount of international reserves at the end of 2024 from USD 43.4 billion to USD 41.2 billion.

The current IMF forecast for international reserves at the end of 2024 is USD 41.8 billion.

The current forecast of the Ukrainian Institute for the Future is USD 46.7 billion by the end of 2024.

Change in international reserves over the past 12 months. Source: NBU.

FORTHCOMING EVENTS

Late August: Parliament. Voting and signing of amendments to the budget and taxes.

Early September: IMF. 5 review of the arrangement with Ukraine.

Вам також буде цікаво:

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine

Macroeconomic Digest of Ukraine

Macroeconomic Digest of Ukraine(July 2024)

Macroeconomic Digest of Ukraine (November 2024)

Macroeconomic Digest of Ukraine