Monthly Energy Digest – February 2025

- Russian drone damaged a New Safe Confinement at the 4th unit of the Chornobyl NPP.

- Russian forces began launching large-scale combined attacks on Ukraine’s gas production facilities. The drop in gas production necessitated immediate imports to meet the demand.

- Despite the cold temperatures and higher demand, the power system’s operation proved to be more stable than expected.

The Electricity Market

The general situation in the power system

The power system operated more stably this month than previously anticipated. In February, Ukraine faced extremely low temperatures, increasing electricity demand. This led to emergency cutoffs in some areas on specific days and power supply restrictions for industrial and commercial customers. However, most households did not encounter scheduled power cutoffs. An enhanced mechanism for transmitting power across the Dnipro River has strengthened the power supply situation on the left bank, which faces deficits in power generation capacity.

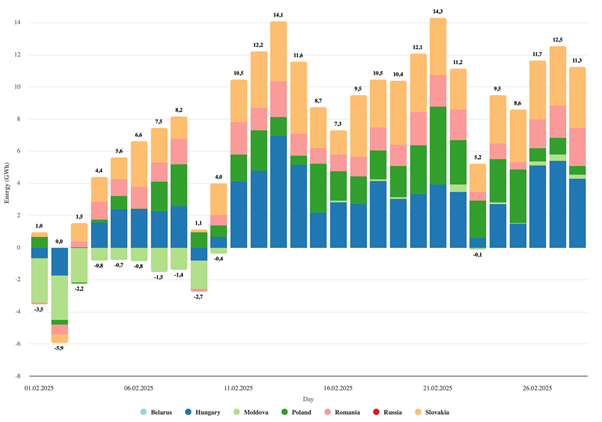

Electricity export (- minus) and import (+ plus) during the month

The average power generation load was the same as in February 2024. However, higher demand resulting from low temperatures led to increased imports and decreased electricity exports, which also helped prevent massive supply restrictions. According to data from ENTSO-E’s Transparency Platform, electricity imports rose by more than six times in February 2025 compared to a year earlier, increasing from 35 to 224 GWh.

Russia continues targeting the power system while changing its tactics. It intensifies attacks on power facilities in specific regions, deploying a larger number of drones and missiles against individual sites. Power plants and substations have been affected in Kharkiv, Mykolaiv, and especially Odesa. These strikes caused temporary power outages in the regions.

Exports and Imports

In February 2025, Ukraine increased electricity imports by 30%.

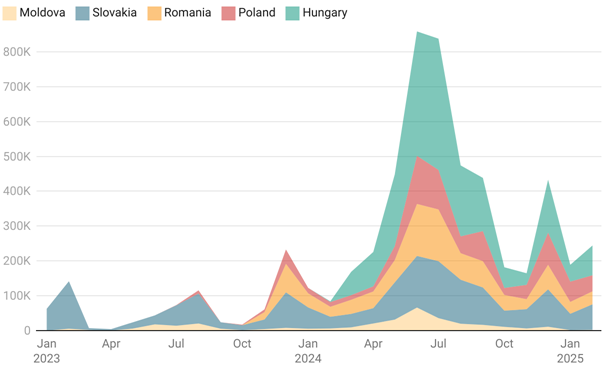

In February 2025, Ukraine increased electricity imports by nearly 30% compared to January 2025, reaching a total of 244 thousand MWh. Most of the electricity was imported from Hungary (35% of the total volume) and Slovakia (30%). The least amount was delivered from Moldova (part of the volume may have been reimported from Romania). Compared to February 2024, electricity imports increased 2.9 times.

In January 2025, Ukraine reduced its electricity imports by 56% compared to December 2024, totaling nearly 189 thousand MWh.

Electricity import, per month, 2023-2025, MWh (data collected by ExPro agency)

Debts and non-payments

Redirection of Ukrenergo’s funds to pay market debts was launched.

With its decision on February 25, the energy regulator initiated the process of redirecting Ukrenergo’s funds to pay market debts, according to the law passed by Parliament in late 2024. The NEURC recommends that electricity market participants direct the funds received from Ukrenergo to repay their debts to the company.

As reported earlier, Ukrenergo will allocate the excess income from its dispatch department operations in 2023-2024 as follows: 45% will be used to repay Ukrenergo’s debts on the balancing market, 45% to settle debts owed to the State Enterprise “Guaranteed Buyer” for payments to industrial RES projects, and 10% to repay debts to universal service providers for payments to residential solar power plants. The total amount to be paid is about UAH 12 billion. The savings result from the fact that, because of the warfare, not all services Ukrenergo was supposed to acquire in the market and, therefore, pay for were available.

According to the information presented at the parliamentary committee hearings, as of the end of February, the debt owed to producers of electricity from renewable sources amounts to UAH 24.7 billion, which is UAH half a billion less than at the beginning of the year. Ukrenergo’s debt to the Guaranteed Buyer for the service for RES support currently amounts to UAH 19.4 billion, which is UAH 2 billion less than at the beginning of the year. Ukrenergo owes UAH 18.4 billion to participants in the balancing market, with UAH 6.8 billion owed to UkrHydroEnergo. Meanwhile, debts to Ukrenergo have surpassed UAH 36 billion, including UAH 11.8 billion from UkrInterEnergo, the last resort supplier. Ukrenergo’s debt to universal service providers also amounts to UAH 3.4 billion.

Renewable power sector

Renewable power production rose by 6.4% in 2024.

In 2024, the amount of electricity generated from renewable sources (wind, solar, biomass, and small hydro) in Ukraine rose by 6.4% compared to 2023, reaching 11 million MWh. Overall, the share of renewable energy sources in the balance was nearly 11%. The annual peak for RES production (by volume) occurred in August, reaching 1,165 thousand MWh, while the lowest amount was recorded in December.

RES shared its total electricity production, amounting to 9.8% in 2023 and 7% in 2022.

Nuclear Power Sector

The Verkhovna Rada approved the purchase of equipment for Khmelnytskyi NPP-3,4.

On February 11, the Verkhovna Rada passed a draft law authorizing Energoatom to purchase two nuclear power reactors from Bulgaria. This equipment will be used in government plans to finish construction equipment power units No. 3 and No. 4 at the Khmelnytskyi NPP. The cost of the reactors is around 600 million euros. Bulgaria has not made its final decision regarding the deal’s approval.

At the same time, independent experts have expressed concerns about purchasing and utilizing this equipment. First of all, these reactors are of Soviet/Russian design and have been stored in Bulgaria for years, likely not meeting modern nuclear safety requirements unless they have been updated. And that refers to the Russian Rosatom, which possesses the technology and has the capability to upgrade the equipment.

Those reactors are a different model from what was originally planned for construction at Khmelnitsky NPP, so they will not fit the concrete structures that have already been built on the site. Experts also expressed concerns about whether the constructed concrete structures would not depreciate after decades of idling in the open air.

The Gas Market

Gas balance

Massive attacks on gas production facilities

Starting from late January, Russian forces started conducting combined massive attacks on Ukraine’s gas production facilities. At least four massive attacks were conducted by the end of February. Facilities of the state and private-owned companies were heavily damaged. Government didn’t disclose the data about guest production drop, however, international media said about a 30-40% drop.

This created an immediate need to import gas to satisfy demand during the extreme cold weather. The situation was complicated by February being the most frigid winter month, with especially low temperatures, which drove the significant spike in gas demand: cold weather resulted in a 25% increase in gas demand. These strikes may be part of a Russian strategy to pressure Kyiv into resuming gas transit, as this could facilitate gas imports.

According to our assessment, if there are no strikes, the existing gas resources would be sufficient to meet demand by the end of March, despite the record low volume of gas in storage at the end of 2024. It is possible that during the year Naftogaz refrained from importing excessive volumes of gas out of fear of attacks on underground gas storage facilities, which began systematically in March-April last year.

Gas imports in February increased to a maximum in 1.5 years – 512 million cubic meters.

In February 2025, Ukraine imported 511.8 million cubic meters of natural gas, marking the highest monthly volume in 1.5 years, since September 2023. This amount represents a twelvefold increase compared to January 2025. Most gas (45.8%) came from Slovakia—234.4 mcm. Additionally, 218 million cubic meters (42.6%) were imported from Hungary, and 59.5 million cubic meters (11.6%) were imported from Poland.

Norway will provide funds to Naftogaz for purchasing natural gas.

Norway will finance Naftogaz Group’s purchase of natural gas through the European Bank for Reconstruction and Development. The amount of funding available for natural gas purchases remains uncertain. This financing is part of a broader aid package aimed at strengthening Ukraine’s energy security. Norway is poised to allocate approximately €380 million for gas purchases, repairs of electricity grids, emergency generators, and nuclear safety measures.

Developments on Assets Nationalizations and Sanctions

The court ruled in favor of the Ministry of Justice concerning nationalizing Russian “Tatneft” assets in Ukraine.

The Supreme Anti-Corruption Court upheld the lawsuit filed by the Ministry of Justice of Ukraine concerning the seizure of assets belonging to the public joint-stock company Tatneft. Those include 100% share in the authorized capital of Tatneft-AZS-Ukraine LLC; 92.98% share in the authorized capital of LLC Kharkiv-Capital; 88.97% of the share in the authorized capital of Poltava-Capital LLC.

- In May 2022, at the request of the State Bureau of Investigation, the Court seized billions in assets from the Russian Tatneft group of companies. A total of 115 real estate properties were confiscated, including oil depots, gas stations, non-residential buildings, land parcels, and 118 fuel trucks cars.

- In June 2022, the assets seized from the Russian company Tatneft were handed over to the National Agency of Ukraine for Identification, Tracing and Asset Management (ARMA), and in August 2023, they were assigned to the management of Ukrnafta.

- In June 2024, the Antimonopoly Committee of Ukraine granted Ukrnafta permission to acquire management shares in the authorized capital of three LLCs owned by Tatneft: Poltava Capital, Kharkiv Capital, and Tatneft-AZS-Ukraine.

- Ukrnafta reported that most of the assets were depreciated and required huge investments.

The state stopped another gas production company Smart Energy.

The state stopped another gas production enterprise of the Smart Energy group – Prom-Energo Product LLC. Prom-Energo Product LLC operated in the Kharkiv region near the front, producing an average of 30,000 cubic meters of gas and 1 ton of condensate per day. This is already the second company of the group, which is forced to stop work due to the suspension of special permits for the extraction of hydrocarbons, according to Smart Energy.

Ukraine has imposed sanctions against one of the company’s beneficiaries, who is also accused of high treason. According to Ukrainian legislation, in cases of sanctions, the license for gas production must be revoked.

Other News and Developments

International aid

International aid

As media outlets reported, the U.S. Department of State ended a U.S. Agency for International Development initiative that had invested hundreds of millions of dollars to help restore Ukraine’s energy grid from attacks by the Russian military. USAID officials involved in the agency’s Ukraine mission informed about this. The decision was made before the Zelensky-Trump meeting on February 28.

Other Russian Attacks on Energy Infrastructure

Russian drone hit New Safe Confinement at the 4th unit of the Chornobyl NPP

On February 14, a Russian drone struck the New Safe Confinement (NSC) of the Shelter over the fourth unit of the Chernobyl nuclear power plant, which exploded in 1986. The attack damaged the NSC’s external and internal layers and caused a fire that harmed equipment in the crane maintenance garage. After the fire, local decay persisted for three weeks. There were no radiation leaks. The NSC is currently unable to perform its primary function: isolating the fourth unit.

The NSC was constructed with EUR 1.5 billion in funding from international donors, under the guidance of the European Bank for Reconstruction and Development, and became operational in 2019.

The NSC was constructed to prevent the spread of nuclear materials from the Shelter in case of an accident there and to create an isolated space to conduct deactivation works to make the area environmentally safe.

In terms of nuclear safety, the Russian strike on the power system still poses a risk to the safe operation of Ukrainian NPPs.

Based on the OISNT we conducted, the drone struck the NSC from the northern side, which is nearer to border with Belarus. This indicates that the drone was not impacted by electronic weapons, which changes the trajectory of drones sending those outside Ukraine.

The Cabinet of Ministers of Ukraine has allocated over UAH 1.5 billion to ensure the safety of the Chornobyl nuclear power plant shelter.

Others

The competition for the role of chairman of the board at NPC “Ukrenergo” has been announced.

The Supervisory Board of NPC Ukrenergo announced a competition for the position of Chairman of the company’s board. Documents are accepted until March 14, 2025. Korn Ferry, one of the best global consulting companies for the search of top executives, will support the competition.

***

End of the winter

The end of February marked the conclusion of winter, which turned out better than many had anticipated and feared.

Despite the shelling, the extent of the outages was minimal compared to what it could have been. On one hand, the weather was beneficial; until early February, we experienced unusually warm temperatures. Additionally, during the summer and fall, a significant portion of previously damaged thermal power plants was restored. To some extent, the extra supplies of air defense systems helped better protect energy facilities and prevent collapse. However, some facilities in the unified energy system suffered serious damage, particularly on the left bank of the Dnipro River. Yet, some of the shelling remains virtually invisible to consumers. Primarily, this pertains to the shelling of gas infrastructure. Since the end of January, the Russian army has conducted four large-scale strikes on gas facilities.

However, the end of winter does not signify the end of problems. As last year demonstrated, spring can usher in a new wave of shelling. Additionally, the spring-summer period is now equally as challenging as winter and is far from free of difficulties. On one hand, solar generation is expected to rise, but this does not address the issue of evening demand peaks. On the other hand, during spring and summer, nuclear power units will undergo scheduled preventive maintenance, decreasing the power system’s available capacity. Consequently, there is a potential risk of shortages during the hot summer months.

Gas supply issues for the next winter

Russian attacks on natural gas infrastructure this winter do not threaten gas supplies by the end of March. However, this raises serious challenges for gas supplies in the next winter season. The uncertainty regarding future possible attacks and the exact drops in gas availability complicates any planning. Additionally, underground gas storage facilities have also been under attack, leaving uncertainty about the safety of storing gas underground for the upcoming winter. Therefore, the key point is to create favorable conditions to ensure gas availability to meet the demand for the next winter.

In January, the energy ministry expected that Ukraine would need to import one bcm of gas to get through the next winter. However, damage to gas production facilities and a drop in gas production mean that the volume of imports will be much higher next year.

The primary issue with gas supply for the next winter is market overregulation and the current public service obligation model (PSO). The full-scale war distorted Ukraine’s gas market, which was already affected by excessive regulation through the PSO mechanisms. With the onset of the full-scale war, gas exports were banned, while gas consumption among commercial consumers in the free market significantly declined due to decreased industrial production. Additionally, new groups of consumers in the regulated pricing segment were included, as a regulated price for gas used in electricity production was established. Consequently, the full-scale war led to a serious distortion, resulting in a substantial increase in the share of the regulated segment, which refers to those who will receive gas at a regulated, lower price instead of the market rate.

Ultimately, such a situation distorts price markers in the natural gas market and creates a situation where gas on the Ukrainian market is “traded” significantly below the price at which it is imported. This situation would not be a problem with minimal import volumes. But to get through the next winter, imports will no longer be minimal. And besides, prices in Europe could potentially be higher than last year.

Imported gas is significantly more expensive than gas in Ukraine’s regulated sector, where gas is subsidized for many consumers across various categories. In a scenario where we need to import a substantial amount of expensive gas, the current model of regulated and undervalued prices will become unviable (for instance, in some categories, the regulated price can be 3-4 times lower than the price of imported gas). This raises an immediate question: who will cover the subsidized low price of gas for many categories of Ukrainian consumers if the cost of imported gas is much higher? However, there isn’t any free money in the economy—we heavily rely on foreign aid and borrowing. And there is a risk of diminished international assistance.

To withstand the upcoming winter and guarantee adequate gas supplies to meet demand, the gas market regulations need to be reassessed, and the market should be further liberalized.

At the same time, the shift from spring to summer will present challenges related to energy sufficiency, primarily concerning electricity.

Вам також буде цікаво:

Macroeconomic Digest of Ukraine (January 2025)

Macroeconomic Digest of Ukraine

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine (August 2024)

Ukraine’s Energy Sector Developments

Macroeconomic Digest of UkraineFebruary 2025