HIGHLIGHTS

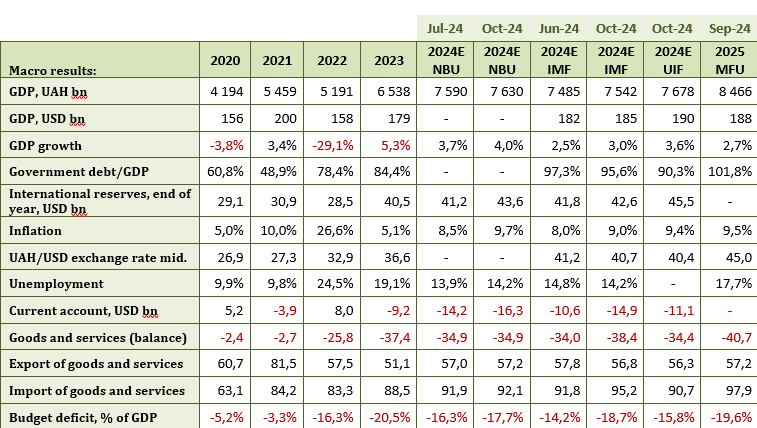

The NBU has updated its forecasts for Ukraine’s economy and balance of payments. The NBU raised its GDP growth forecast for 2024 from 3.7% to 4.0%.

The IMF conducted the 5th review of the program with Ukraine and disbursed another tranche of USD 1.1 billion while updating its forecasts for Ukraine’s economy, budget, and balance of payments.

International reserves declined from USD 38.9 billion to USD 36.6 billion in October 2024.

Fifth Review of the IMF Programme

The IMF completed the 5th review of the arrangement with Ukraine and approved the disbursement of the next tranche of USD 1.1 billion while noting the following:

“Russia’s war in Ukraine continues to bring a devastating social and economic toll on Ukraine. Despite the war, macroeconomic and financial stability is being preserved through skillful policymaking by the Ukrainian authorities as well as substantial external support. The economy has remained resilient despite significant damage to the energy infrastructure, reflecting the continued adaptability of households and firms.

Ukraine’s performance and commitment to the program continue to be strong. All quantitative performance criteria for end-June were met, and those for end-September are expected to have been met. All but one structural benchmark through end-September was completed, while the missed structural benchmark has been reset to accommodate delays in the appointment process partly beyond the authorities’ control. Moreover, two structural benchmarks were due later in the year, and the prior action for the review was also implemented. The program remains fully financed with a cumulative external financing envelope of USD 151 billion in the baseline and USD 187 billion in the downside over the 4-year program period, including new commitments from the Extraordinary Revenue Acceleration Loans for Ukraine (ERA) initiative.

Looking ahead, the recovery is expected to slow amid headwinds from the impact of the attacks on energy infrastructure and the continuing war, while risks to the outlook remain exceptionally high. Preparedness is necessary to enable appropriate policy action should risks materialize.

Ukraine’s financing needs remain large, driven by the continuing war. Timely and predictable external support—on terms consistent with debt sustainability—is essential to closing financing gaps and safeguarding stability.

The Eurobond exchange in August was an important milestone in the authorities’ strategy to restore debt sustainability. Efforts to conclude the remaining steps in line with the authorities’ strategy and the program’s debt sustainability objectives should continue.

Continuing the reform momentum in anticorruption and governance, including ensuring the effectiveness of anticorruption institutions and strengthening governance in the energy sector, remain essential to help contain fiscal risks, secure donor confidence and enhance growth, which would also support Ukraine’s path to EU accession.”

The IMF also updated its forecasts for Ukraine’s economy, budget, and balance of payments. In this digest, we highlight the main changes to the forecasts for 2024.

ECONOMIC SITUATION

- GDP growth

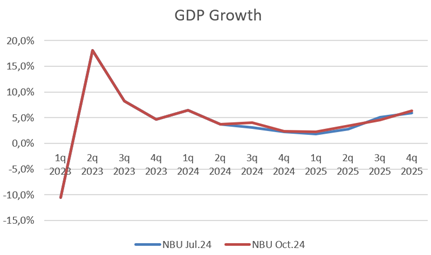

The NBU raised its GDP growth forecast for 2024 from 3.7% to 4.0%. The NBU also updated its forecast for economic development in 2025. The NBU sees GDP growth slowing to 2.3% in Q1 2025 and then accelerating to 6.3% of GDP in Q4 2025.

Source: NBU.

The NBU also raised its forecast for Ukraine’s nominal GDP in 2024 from UAH 7,590 billion to UAH 7,630 billion.

2. Inflation.

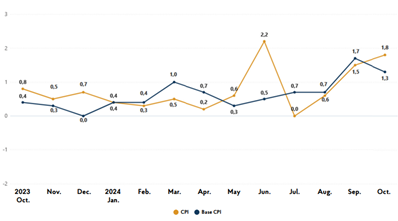

In the consumer market, food and non-alcoholic beverages rose by 3.2% in October. Vegetables and eggs rose the most (18.2% and 18.1% respectively). Prices of butter, fruit, milk and milk products, sunflower oil, processed cereals, beef, soft drinks, bread, lard, fish, and seafood rose by 6.9-1.3%. At the same time, sugar prices decreased by 4.2%.

Prices for alcoholic beverages and tobacco products rose by 1.8%, driven by a 2.6% increase in the price of tobacco products.

Transportation prices rose by 0.5%, mainly due to a 0.8% increase in fuel and oil prices and a 0.7% increase in road passenger fares. At the same time, rail passenger fares fell by 4.7%.

Inflation October 2023-October 2024. Source: Ukrstat

Year-on-year inflation rose from 8.6% to 9.7% in October.

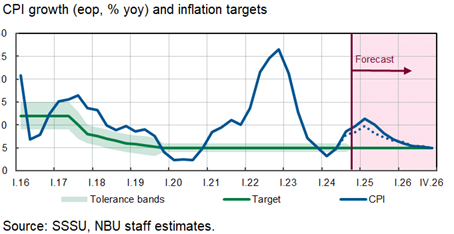

The NBU revised its 2024 inflation forecast, raising it from 8.5% to 9.7%.

The NBU expects inflation to exceed 10% in Q1 2025.

3. Changes to IMF forecasts.

In its forecasts for the 5th review of the program, the IMF has changed its assessment of macroeconomic indicators for 2024. The growth of the Ukrainian economy in 2024 has been improved from 2.5% to 3.0%. Consumer inflation in 2024 was revised from 8.0% to 9.0%, and the deflator index in GDP was revised from 11.7% to 12.0%. As a result, the IMF raised its estimate of Ukraine’s nominal GDP from UAH 7485 billion to UAH 7,542 billion. The average hryvnia/dollar exchange rate in 2024 was revised from 41.2 to 40.7.

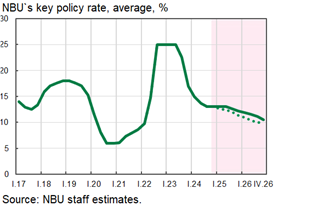

4. NBU interest rate.

On October 31, the NBU kept its key policy rate at 13% to maintain foreign exchange market stability, bring inflation to the 5% target over the coming years, and keep inflation expectations under control.

The NBU’s updated forecast envisages keeping the key policy rate at 13% at least until the summer of 2025.

In the event that price pressures continue to rise above the forecast and threaten to unbalance inflation expectations, the NBU will be ready to tighten its interest rate policy and take additional monetary measures.

BUDGET

1. Budget execution

In 9 months of 2024, the consolidated budget was closed with a deficit of UAH 733.1 billion (UAH 120.7 billion in September). This is UAH 19.1 billion more than in 9 months of 2023 (UAH 714.0 billion).

At the same time, the surplus of local budgets for 9 months amounted to UAH 75 billion, while the state budget deficit amounted to UAH 808 billion.

As of October 1, the balance of the state and local budgets decreased from UAH 264 billion in September to UAH 155 billion, sufficient to finance the state budget expenditures in October.

2. External financing

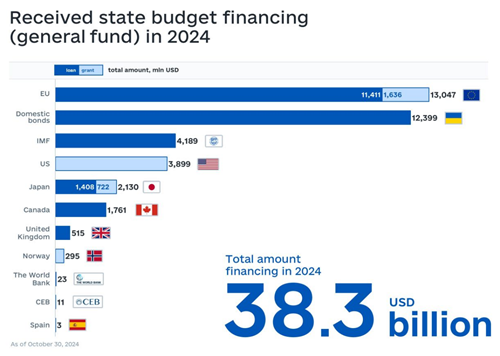

In 10 months of 2024, Ukraine received USD 25.9 billion in external financing. Of these, 6.6 billion were grants, and 19.3 billion were loans.

In October, the budget received USD 1.1 billion from the IMF and USD 300 million from Canada.

Source: Ministry of Finance of Ukraine

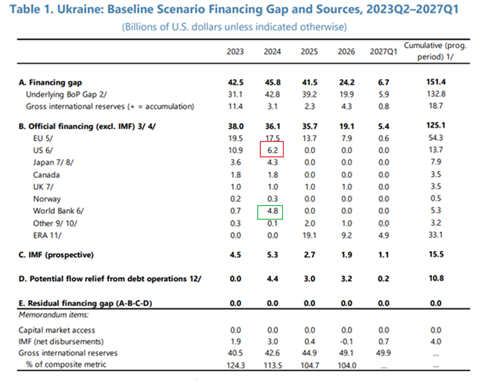

Based on IMF data, Western financing in 2024 has been revised. The World Bank, which was not included in the IMF’s 2024 financing plan, is expected to disburse USD 4.8 billion by the end of the year. The IMF also lowered its forecast for (grant) financing from the United States. According to the IMF forecast, the United States will disburse only USD 6.2 billion instead of USD 7.8 billion, as voted by Congress.

Source: IMF, October 18, 2024.

The new IMF financing forecast is USD 41.4 billion in 2024. This means that in the remaining 2 two months, Ukraine should receive about USD 15.5 billion in Western financing.

3. Public debt

As of October 1, Ukraine’s public and guaranteed debt amounted to USD 155 billion (+USD 10 billion for 9 months of 2024).

The IMF has lowered its forecast for Ukraine’s public debt at the end of 2024 from 97.3% to 95.6% of GDP.

4. Changes to IMF forecasts.

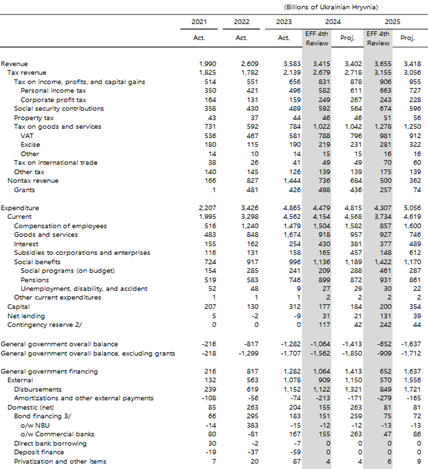

In its forecasts for the fifth program review, the IMF changed its assessment of the budget execution in 2024 and significantly revised its forecast for the 2025 budget.

Consolidated finances. Source: IMF, 18.10.2024

Main points:

- The baseline scenario has been revised. In the baseline scenario, the war ends in the fourth quarter of 2025 instead of the end of 2024. In the pessimistic scenario, it ends in mid-2026.

- In 2024, the IMF overestimated the grant support. Instead of USD 12.2 billion, the IMF now expects USD 10.7 billion in grants. The United States will fall short by USD 1.5 billion. This increases the projected budget deficit by UAH 61-63 billion.

- The IMF has significantly revised the budget deficit 2024 from 14.2% to 18.7% of GDP. It has also substantially revised the budget deficit for 2025. Previously, it assumed that the war would last until the end of 2024. Now, it seems that the war will continue in 2025. Therefore, the budget deficit for 2025 has been revised from 7.5% to 19.2% of GDP.

- The IMF expects grant financing of USD 1.7 billion in 2025. In its current calculations, the IMF does not take into account the USD 50 billion in ERA funds that will come from Russia’s frozen assets in Europe and that Ukraine will not have to repay.

- The IMF and Ukraine have agreed that in 2025, the IMF will increase financing to Ukraine by about USD 1.3 billion, which was previously planned for 2026-2027.

- The average exchange rate is estimated at 40.7-40.8 hryvnia/dollar in 2024 and 43.5 hryvnia/dollar in 2025.

- The IMF envisages a second stage of commercial debt restructuring, which will include GDP-linked bonds. The process of commercial debt restructuring should be completed by May 2025.

- In its calculations, the IMF considers the tax increase from the draft law 11416-d (increase of military tax), passed by the Verkhovna Rada but has not yet been signed by the President. The IMF also considers that the Verkhovna Rada will vote on a plan to increase cigarette excise taxes. In addition, the IMF strongly recommends that Ukraine increase VAT. At the same time, the calculations do not include a VAT increase for 2025.

- The IMF supports continued work on the National Revenue Strategy and has worked with Ukraine to develop a new structural framework for 2025 (April 2025), reporting through digital platforms. In our view, this implies lifting bank secrecy and transferring tax data on income and expenses to personal cards, potentially leading to additional tax liabilities for transferring funds on personal cards.

Balance of payments

1. Balance of payments in September of 2024.

The balance of payments in September 2024 was significantly negative. In fact, Ukraine did not receive any external financing in September.

Among the significant items in September, two should be noted:

- Remittances from migrant workers to Ukraine. In September, remittances fell to USD 650 million. A year ago, USD 8.6 billion was transferred between January and September, while this year, it was only USD 6.1 billion.

- Return of trade credits to Ukraine. In September, USD 409 million was returned to Ukraine. A year ago, USD 297 million was returned between January and September, compared to USD 2491 million in 2024.

2. Hryvnia exchange rate

Since the beginning of August, the hryvnia/US dollar exchange rate has stabilized in the 41-41.5 hryvnia/US dollar range.

We believe that in November, the NBU will keep the exchange rate in the 41.0-41.5 range. There are two reasons for this:

- Ukraine will receive more than USD 15 billion in Western financing in the next two months and will have a positive balance of payments.

- Inflation is already higher than the NBU’s previous forecasts, and the NBU will not devalue the national currency now, thus curbing inflationary processes.

Hryvnia exchange rate against the US dollar over 12 months. Source: NBU.

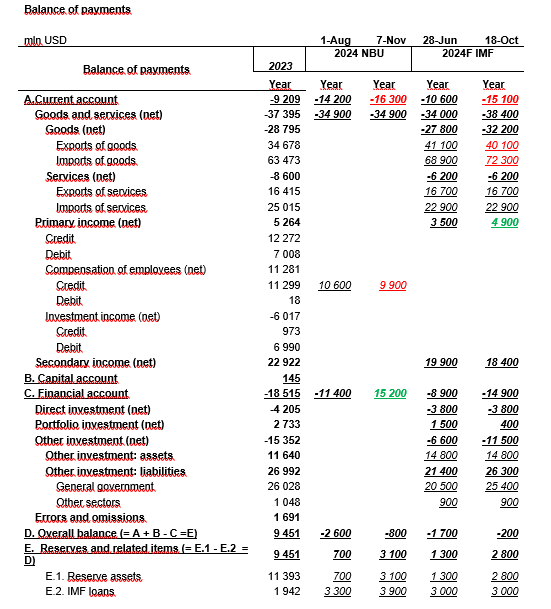

3. Changes to the NBU and IMF forecasts in 2024

The NBU and the IMF reassessed the balance of payments.

Ukraine’s balance of payments 2023-2024, USD billion Source: NBU, IMF.

Main points:

- The NBU downgraded its current account forecast from USD -14.2 billion to USD -16.3 billion due to a revaluation of grants to be received by the end of the year and a decrease in the forecast for remittances of wages to Ukraine.

- The IMF downgraded its current account forecast from USD -10.6 billion to USD -15.1 billion due to a revaluation of the trade balance from USD -34 billion to USD -38.4 billion and a decrease in grant aid by USD 1.5 billion.

- The NBU and the IMF significantly improved the financial account balance by increasing loan financing to Ukraine (USD 4.8 billion from the World Bank).

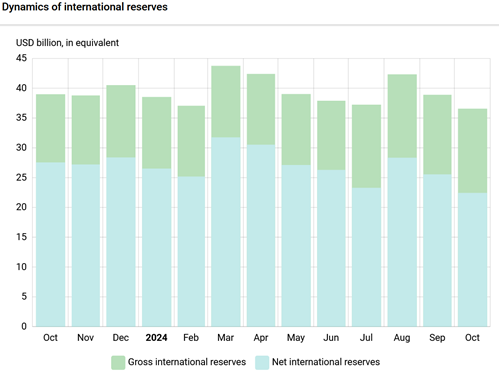

4. International reserves

In October, international reserves decreased from USD 38.9 billion to USD 36.6 billion.

The net sale of foreign currency by the NBU in October amounted to USD 3,427.9 million. The government’s foreign currency accounts with the NBU received USD 1,991.4 million. Of this amount:

- USD 1,111.2 million was received from the International Monetary Fund;

- USD 569.1 million from the placement of foreign currency government bonds;

- USD 289.5 million from the Government of Canada.

The NBU paid USD 943.4 million for the servicing and repayment of public debt in foreign currency, including:

- USD 710.0 million – servicing and repayment of foreign currency domestic government bonds;

- USD 186.0 million – servicing and repayment of debt owed to the World Bank;

- USD 21.6 million – servicing and repayment of debt to the EIB;

- USD 11.6 million – debt servicing payments to the EU;

- USD 14.2 million – payments to other international creditors.

In addition, Ukraine paid USD 87.9 million to the International Monetary Fund.

The NBU has revised its international reserves as of the end of 2024. The forecast of international reserves is USD 43.6 billion.

The IMF has revised Ukraine’s international reserves at the end of 2024. The forecast of international reserves is USD 42.6 billion.

Change in international reserves over the past 12 months. Source: NBU.

Вам також буде цікаво:

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine

Macroeconomic Digest of UkraineFebruary 2025

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine (January 2025)

Macroeconomic Digest of Ukraine