HIGHLIGHTS

Ukrstat estimates GDP growth at 3.7% in the second quarter of 2024.

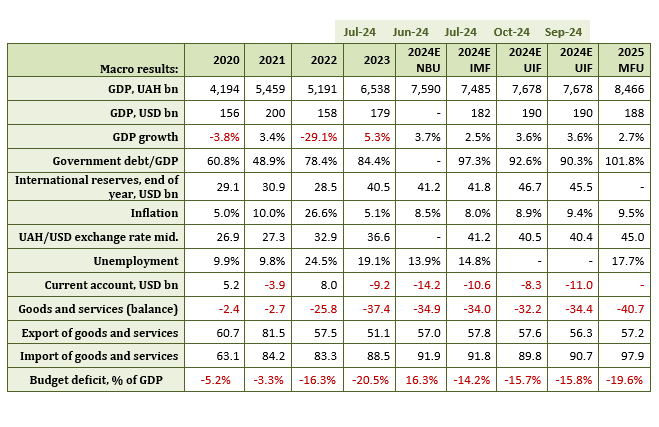

Updated forecast of the Ukrainian Institute for the Future for 2024. We have reassessed the consolidated public finances at the end of the year and believe that the government will be able to close 2024 without increasing the tax burden on the economy. We have also reassessed the balance of payments and revised our forecast for the current account balance and international reserves at the end of 2024.

On October 10, the Verkhovna Rada passed draft law 11416-d on tax increases (5% military tax on salaries instead of 1.5%, military tax on sole proprietors, and 50% tax on banks to be paid in advance for 2024).

International reserves in September 2024 fell from USD 42.3 billion to USD 38.9 billion.

ECONOMIC SITUATION

- GDP growth

Ukrstat has estimated the GDP growth in the second quarter of 2024. Real GDP in the second quarter of 2024 increased by 0.2% (seasonally adjusted) compared to the previous quarter and 3.7% compared to the second quarter of 2023.

Change in real GDP

(in % compared to the same quarter of the previous year)

Source: Ukrstat.

The Ukrainian Institute for the Future has left its forecast for GDP growth in 2024 unchanged at 3.6%.

2. Inflation.

Inflation in the consumer market in September 2024 was 1.5% compared to August 2024 and 6.5% since the beginning of the year. In the consumer market, prices of food and non-alcoholic beverages increased by 1.8% in September. Eggs rose the most (by 12.1%). Prices of vegetables, butter, milk and dairy products, sunflower oil, cereal products, non-alcoholic beverages, bread, meat and meat products, and rice rose by 1.1-3.8%. At the same time, sugar and fruit prices decreased by 1.8% and 0.2%, respectively. Prices for alcoholic beverages and tobacco products rose by 1.4%, driven by a 2.6% increase in the price of tobacco products. Clothing and footwear grew by 7.8%, with clothing prices up 7.9% and footwear up 7.7%.

Year-on-year inflation rose from 7.5% to 8.6% in September.

The Ukrainian Institute for the Future revised its 2024 inflation forecast, raising it from 8.9% to 9.4%.

BUDGET

1. Budget execution

For the first eight months of 2024, the consolidated budget was closed with a deficit of UAH 612.4 billion (+UAH 82 billion surplus in August). This is UAH 13.6 billion less than in the first eight months of 2023 (UAH 626.0 billion). This change was due to UAH 228 billion in grants from the USA and the EU in August.

At the same time, the surplus of local budgets for eight months amounted to UAH 69 billion, while the state budget deficit amounted to UAH 681 billion.

As of September 1, the balances on the accounts of the state and local budgets increased in August from UAH 35 billion to UAH 264 billion, sufficient to finance the state budget expenditures in September and partially in October.

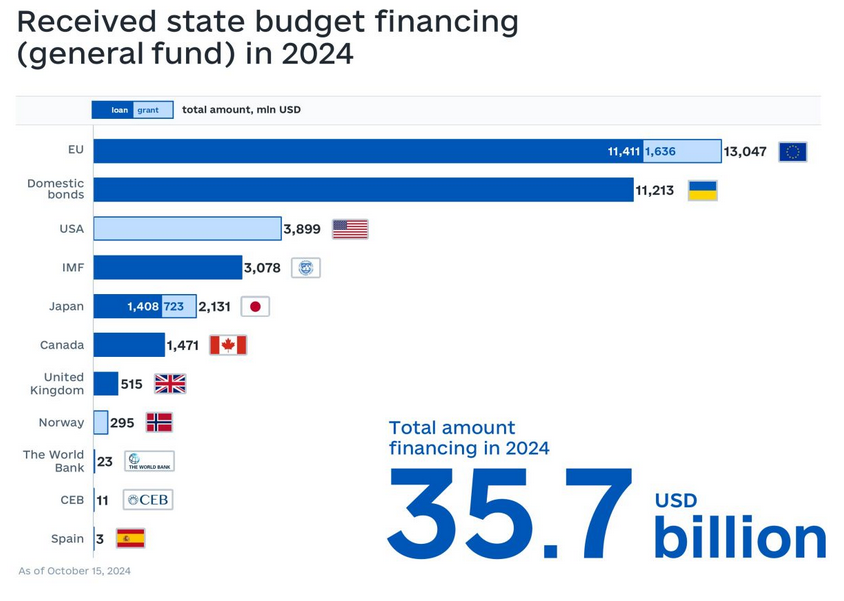

2. External financing

In the first nine months, Ukraine received USD 24.5 billion in external financing. Of this, 6.6 billion were grants, and 17.9 billion were loans.

In September, the state budget received only EUR 10 million from the Council of Europe Development Bank.

Source: Ministry of Finance of Ukraine

3. Public debt

As of September 1, Ukraine’s public and guaranteed debt amounted to USD 154 billion (+USD 9 billion for eight months of 2024).

Ukraine completed the restructuring of its USD 20.5 billion sovereign and government-guaranteed Eurobonds. The restructuring included the exchange of thirteen series of government Eurobonds and one series of government-guaranteed Eurobonds of Ukravtodor for eight new series of Eurobonds with a nominal value of USD 15.2 billion.

As a result of this transaction, Ukraine’s public and publicly guaranteed debt was reduced by approximately USD 5.3 billion.

The Ministry of Finance also significantly overestimated the cost of servicing public debt in 2024 and 2025. Therefore, the Ministry of Finance’s debt service plan for 2024 was reduced from UAH 456 billion to UAH 314 billion (-UAH 142 billion), and for 2025 from UAH 76 billion to UAH 11 billion (-UAH 65 billion) for commercial debt.

The Ukrainian Institute for the Future has also reassessed the public and guaranteed debt by the end of 2024. The debt was reduced from UAH 7113 billion to UAH 6932 billion, or from 92.6% of GDP to 90.3% of GDP.

4. UIF’s forecast for budget execution in 2024

We have reassessed the consolidated state finances until the end of 2024 and believe that the government can close 2024 without increaseng the tax burden on the economy.

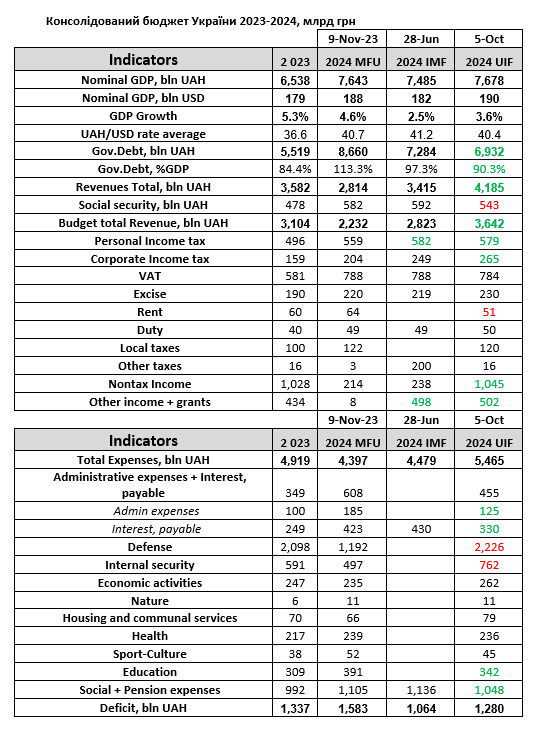

Consolidated budget of Ukraine 2023-2024, UAH billion. Source: Ministry of Finance, IMF, own calculations (does not account for the adoption of draft law 11416-d)

Main points:

1) Tax revenues for the first eight months of the consolidated budget are UAH 316 billion more than last year. The social contribution brings in another UAH 45 billion. Given these dynamics and according to our calculations, the excess tax revenues in 2024 will exceed last year’s by more than UAH 500 billion. If we add the 50% advance tax on banks from 11416-d in 2024, the surplus will exceed UAH 550 billion.

2) At the same time, security spending (defense + internal security) currently amounts to about UAH 3 trillion, including Western military aid. A year ago, it was UAH 2.7 trillion. Thus, the increase in security spending by UAH 500 billion (from the draft law 11417) is, in fact, an increase of UAH 300 billion since the actual figure for 2023 exceeds the plan for 2024 by UAH 200 billion. The Ministry of Finance’s plan for 2024 did not take into account the transit of Western military aid to the Ukrainian budget, which the Ministry of Finance accounts for under non-tax revenues and additional defense spending (about USD 20 billion).

3) Given this increase in security spending and the growth of tax revenues, the state has a reserve of 200-250 billion to increase other expenditures.

4) According to our calculations, the expected increase in spending on healthcare, education, social security, and pensions will amount to about UAH 140 billion in 2024. Economic activity, housing, and communal services can always be curtailed if necessary, and in terms of dynamics, there is no significant increase in spending this year compared to 2023.

5) The most significant increase in expenditures in 2024 was projected for debt service, effectively reaching UAH 200 billion. Ukraine had to pay off its Eurobond debts in 3 years. However, they were restructured, which drastically reduced the cost. The growth of the expenses in 2024 is projected to exceed 80 billion compared to the costs under this item in 2023.

6) In 2024, the IMF forecasts a total of USD 12.1 billion in grants (USD 7.8 billion from the US and EUR 3 billion (USD 3.3 billion) from the EU. + 1 billion in grants to Ukraine from Japan and Norway in early 2024). Thus, Ukraine will receive more grants than in 2023 (USD 12.1 billion vs. USD 11.4 billion). However, due to devaluation, grants are projected at UAH 502 billion vs. UAH 443 billion in 2023 (+59 billion).

7) The consolidated budget deficit for the first eight months of 2024 is lower than in 2023 (UAH 612 billion vs. UAH 626 billion). Moreover, according to our calculations, even without a tax increase at the end of the year, the expected budget deficit will be lower than in 2023 (UAH 1280 billion vs. UAH 1337 billion), even with an increase in defense and security spending to UAH 3 trillion.

Thus, we believe that the government has the capacity to close 2024 without increasing the tax burden on the economy.

On October 10, the Verkhovna Rada passed the draft law 11416-d on tax increases (5% military tax on salaries instead of 1.5%, military tax on sole proprietors, 50% advance tax from banks for 2024). We believe that after the adoption of this law, the state budget may receive an additional UAH 20-25 billion in military tax and UAH 45-50 billion in corporate income tax from banks, whereby our estimate of banks’ pre-tax profit for 2024 is over UAH 200 billion.

According to our calculations, with the adoption of the draft law 11416-d, consolidated revenues are estimated at 55.4% of GDP (vs. 54.8% of GDP in 2023), and consolidated expenditures are estimated at 71.2% of GDP (vs. 75.2% of GDP in 2023). With the adoption of draft law 11416-d, the budget deficit is estimated at 15.8% of GDP, compared to 20.5% in 2023.

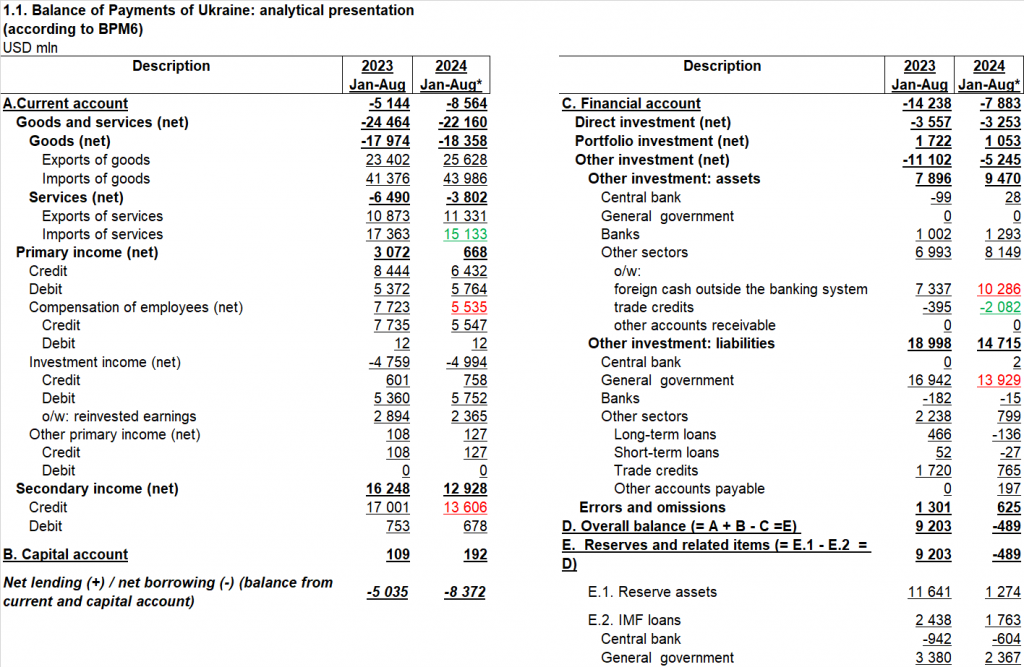

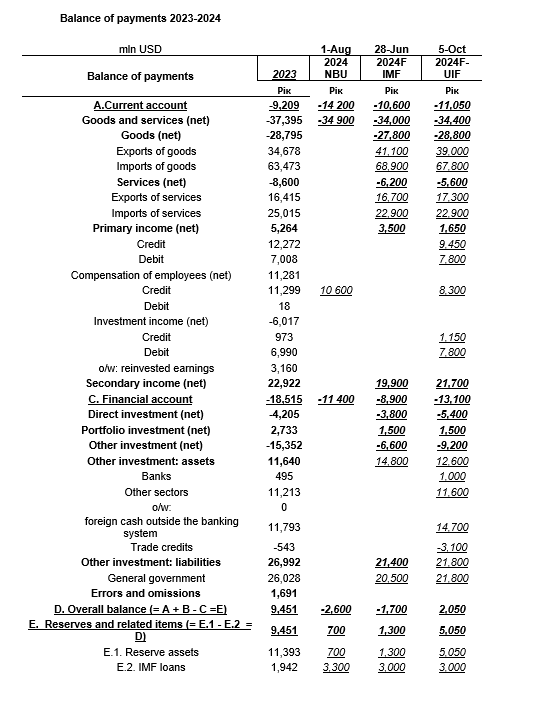

Balance of payments

1. Balance of payments in January-August of 2024.

Trends in the balance of payments that deserve attention include:

The January-August balance of payments in 2024 was significantly negative compared to 2023. In contrast to 2023, when international reserves increased from USD 28.5 billion to USD 41.4 billion (+12.9 billion), in 2024, between January and August, reserves increased from USD 40.5 billion to USD 42.3 billion (+1.8 billion).

Among the negative trends in 2024, there are three main items:

1) Remittances from migrant workers to Ukraine. While USD 7.7 billion (USD 950 million per month) were transferred between January and August a year ago, only USD 5.5 billion (USD 700 million per month) were transferred in 2024, showing a further downward trend;

2) In the first seven months of 2024, Ukraine did not actually receive any grant aid (reflected in secondary income) and received only USD 1 billion in grants. The situation improved significantly in August. Ukraine received USD 5.5 billion in grants, but secondary incomes between January and August 2024 fell by USD 3.4 billion compared to the previous year;

3) Cash purchases of foreign currency by households. For January-August 2024, the balance was USD 10.3 billion, compared with USD 7.3 billion in 2023.

Among the positive trends in 2024, two items are notable:

1) Imports of services. The support of Ukrainian refugees in Europe occupies a significant part of this item. In 2024, there was a decrease in the outflow of money under this item due to the exhaustion of funds in Ukraine and the transition of some refugees to income from sources in their country of residence. Imports of services decreased from USD 17.4 billion to USD 15.1 billion;

2) The return of trade credits to Ukraine. In 2022, USD 11 billion in trade credits were withdrawn from Ukraine. In 2023, the outflow stopped. In 2024, there is a return of funds under this item, which amounted to USD 2.1 billion between January and August 2024.

Balance of payments for eight months of 2023-2024. Source: NBU.

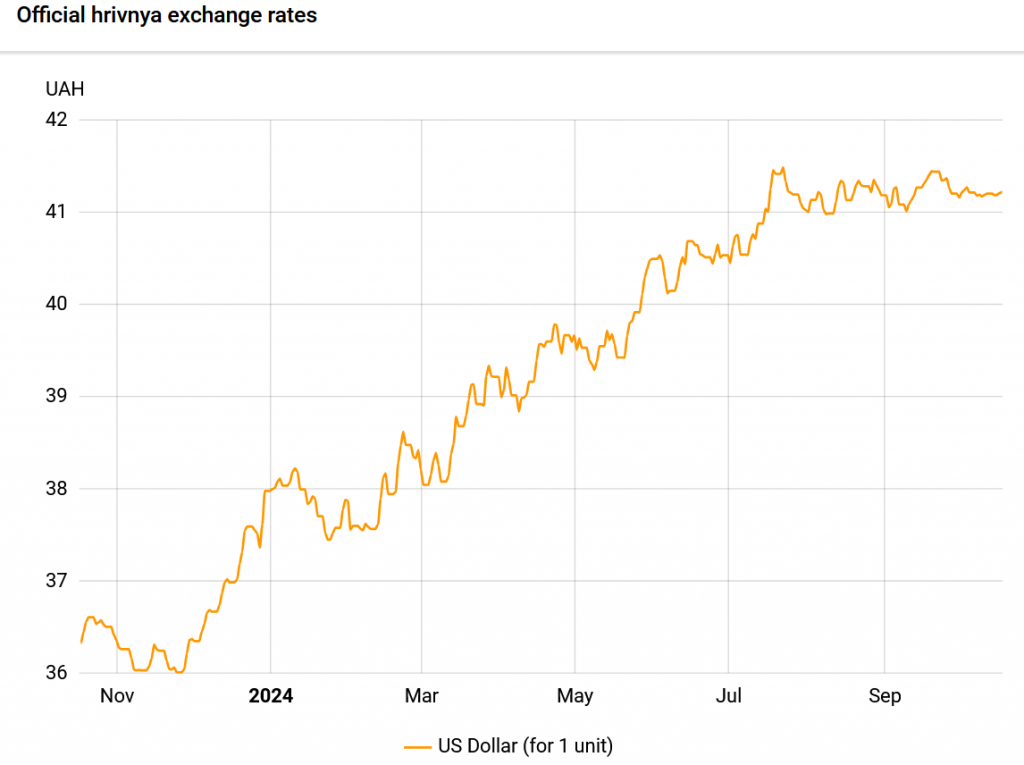

2. Hryvnia exchange rate

Since the beginning of August, the hryvnia exchange rate against the US dollar has stabilized in the UAH 41-41.5 per dollar range.

Hryvnia exchange rate against the US dollar over 12 months. Source: NBU.

We believe that in October, the NBU may maintain the exchange rate in the range of 41.0-41.5, although there is a risk that devaluation will be used as a partial solution to the budget problems.

3. Changes to the UIF forecasts

The Ukrainian Institute for the Future has reassessed the balance of payments until the end of 2024.

We have lowered the forecast for the current account balance in 2024 from USD -8.3 billion to USD -11.0 billion. The trade balance is revised from USD -32.2 billion to USD -34.4 billion, reflecting both lower goods exports and higher goods imports. Primary income is revised from USD +2.8 billion to USD +1.6 billion. This is mainly due to a decline in remittances to Ukraine from USD 9.6 billion to USD 8.3 billion in 2024.

We have upgraded our forecast for the financial account. We estimate the financial account balance to total USD 13.1 billion in 2024, excluding IMF settlements.

Ukraine’s balance of payments 2023-2024, USD billion Source: NBU, IMF, own calculations.

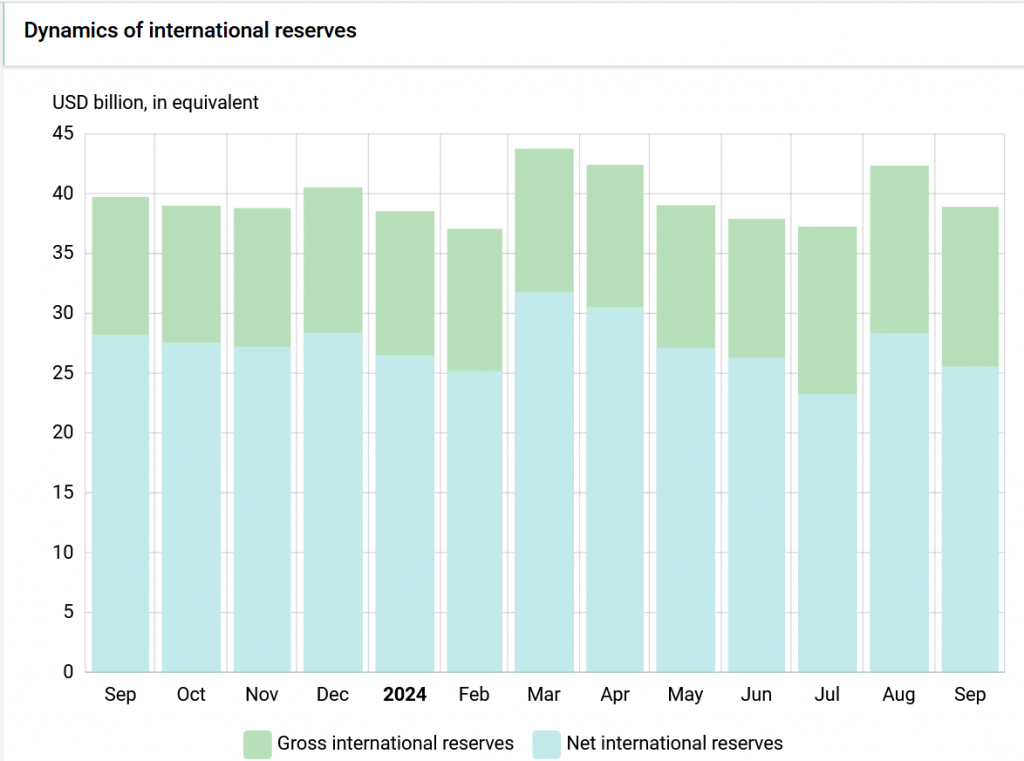

4. International reserves

In September, international reserves decreased from USD 42.3 billion to USD 38.9 billion. The net sale of foreign currency by the NBU in September amounted to USD 3,213.2 million. The government’s foreign currency accounts with the NBU received USD 674.7 million. Of this amount:

- USD 603.6 million was received from the placement of foreign currency domestic government bonds;

- USD 60.0 – from the World Bank;

- USD 11.1 million – from the Council of Europe Development Bank.

The NBU paid USD 552.4 million in foreign currency for public debt servicing and repayment, including:

- USD 456.3 million – servicing and repayment of domestic government bonds in foreign currency;

- USD 52.1 million – debt servicing and repayment to the World Bank;

- USD 44.0 million – paid to other international creditors.

In addition, Ukraine paid USD 729.8 million to the International Monetary Fund.

The Ukrainian Institute for the Future has reassessed international reserves for the end of 2024. The forecast for international reserves is at USD 45.5 billion. This is higher than the forecasts of the NBU and the IMF.

Change in international reserves over the past 12 months. Source: NBU.

FORTHCOMING EVENTS

Mid-October: The IMF updates its forecast based on the results of the fifth review of the arrangement with Ukraine.

November 1: NBU, inflation report for Q4 2024.

Вам також буде цікаво:

Macroeconomic Digest of Ukraine(July 2024)

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine (November 2024)

Macroeconomic Digest of Ukraine (August 2024)

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine