HIGHLIGHTS

On 13 June, the NBU Board cut the key policy rate from 13.5% to 13.0%, effective from 14 June 2024.

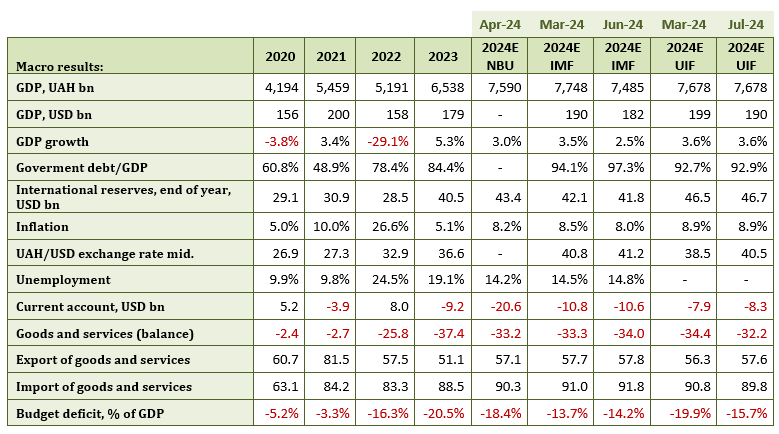

Ukrstat estimated the growth of the Ukrainian economy in Q1 2024 to be 6.5%.

It is higher than predicted by the NBU and the Ministry of Economy.

At the end of June, the Government of Ukraine approved the Budget Declaration for 2025-2027, proposing to increase the tax burden on the economy by 4% of GDP.

International reserves decreased from USD 39.0 billion to USD 37.9 billion in June 2024.

The IMF completed the fourth review of its program with Ukraine for the 4th time, approved the disbursement of the next tranche of USD 2.2 billion, and updated its forecasts for Ukraine’s economy, budget, and balance of payments.

The Ukrainian Institute of the Future has updated its forecasts for Ukraine’s economy, budget, and balance of payments for 2024. We see a threat to the execution of the 2024 budget due to increased expenditures not coordinated with Western partners and the IMF and expenditures not included in the 2024 budget, which could lead to additional money creation at the end of the year.

Fourth Review of the IMF Programme

The IMF completed the 4th review of the program with Ukraine and approved the disbursement of the next tranche of USD 2.2 billion while noting the following:

“The economy was more resilient than expected in the first quarter of 2024, with robust growth outturns, continued disinflation, and the maintenance of adequate reserves. However, the outlook for the remainder of the year and into 2025 has worsened since the Third Review, mainly due to devastating attacks on Ukrainian energy infrastructure and uncertainty about the length of Russia’s war against Ukraine; overall, the outlook remains subject to exceptionally high uncertainty. […] Vigilance against these risks is necessary for timely responses if shocks materialize.[…] Looking ahead, the recovery is expected to slow […]

Timely and predictable external disbursements, strong domestic resource mobilization, and careful liquidity management are necessary for Ukraine to meet its financing needs. Fiscal policies for the remainder of 2024 and preparation for the 2025 budget should be underpinned by steadfast revenue mobilization efforts aligned with the National Revenue Strategy. In this regard, measures that erode the tax base should be avoided, and the tax and customs administration and the Economic Security Bureau of Ukraine (ESBU) should be strengthened. Further strengthening medium-term budgeting, fiscal risks and transparency, and public investment management should advance in support of these goals. An external commercial debt treatment in line with the debt sustainability objectives under the program will be necessary to create the needed space for critical spending and restore debt sustainability in line with the authorities’ strategy.

Continued exchange rate flexibility under the managed exchange rate regime will help strengthen the economy’s resilience to external shocks. Moreover, continued disinflation combined with well-anchored inflation expectations and FX cash market stability suggest scope for further monetary policy easing. A state-dependent and gradual approach to easing FX controls remains essential to safeguard FX reserves. The authorities’ efforts to avoid monetary financing should continue.”

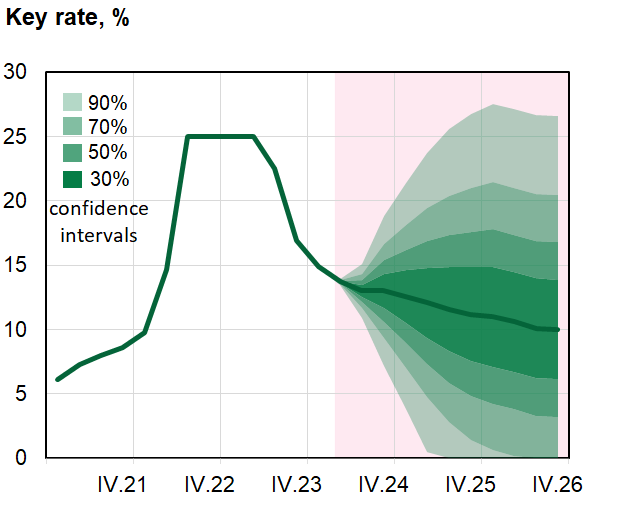

The IMF also updated its forecasts for Ukraine’s economy, budget, and balance of payments. In this digest, we highlight the main changes to the forecasts for 2024.

ECONOMIC SITUATION

1. GDP growth

Ukrstat estimated the Ukrainian economy to grow by 6.5% in Q1 2024. This is higher than the forecasts of the NBU and the Ministry of Economy.

Ukraine GDP growth, 2021-2024. Source: Ukrstat

According to the Ministry of Economic Development, the Ukrainian economy grew 3.7% in May 2024.

The National Bank downgraded its estimate of Ukraine’s economic growth in 2024 from 3.6% to 3.0% due to missile strikes on Ukraine’s energy sector.

The Ukrainian Institute of the Future left its GDP growth forecast for 2024 unchanged at 3.6%.

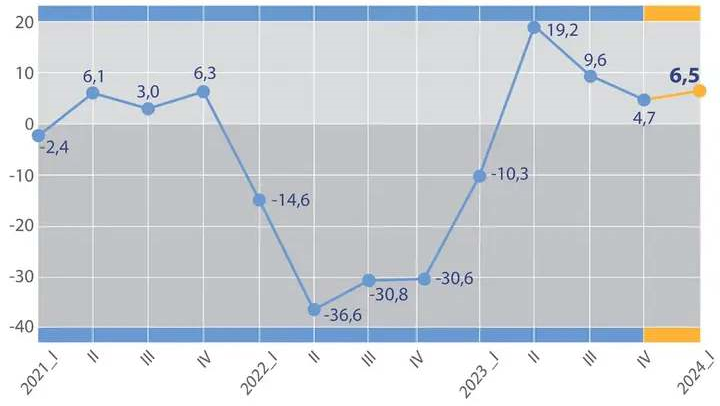

2. Inflation.

Inflation in the consumer market was 2.2% in June 2024 compared with May 2024 and 4.3% in the first half of the year. The sharp acceleration in consumer inflation was driven by a 63% increase in electricity prices and the impact of power outages.

On a year-on-year basis, inflation rose from 3.3% to 4.8% in June.

In general, we expect inflation to rise in the coming months to 8-9% per annum by Q4 2024.

The NBU has lowered its annual inflation forecast for 2024 from 8.6% to 8.2%.

The Ukrainian Institute of the Future has left its forecast for annual inflation in 2024 unchanged at 8.9%.

Quarterly inflation forecast. Source: NBU.

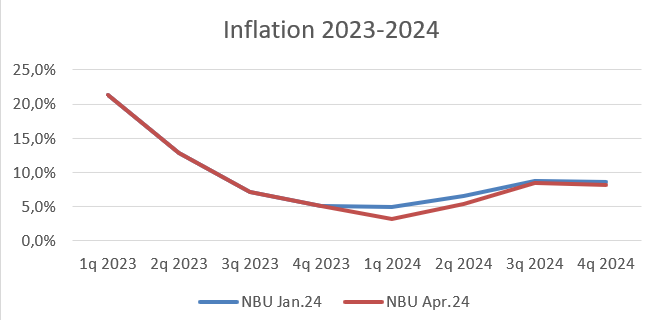

3. NBU interest rate

On 13 June, the NBU Board decided to lower the key interest rate from 13.5% to 13.0%, effective 14 June 2024.

Considering the still moderate inflation rate, the continued improvement in the expected inflation rate, and the balance of risks to further inflationary dynamics, the NBU continued its cycle of easing interest rate policy.

The baseline scenario of the April macroeconomic forecast envisaged a cut in the key policy rate to 13% this year. Still, the NBU is ready to adjust its monetary policy if the balance of risks to inflation and the foreign exchange market changes.

According to the Institute’s experts, the rate should already be below 13%, even though annual inflation rose from 3.3% to 4.8% in June. If inflation expectations rise, they can be promptly raised by 1-2% at any time.

Since March, interest rates on new loans in local currency for the corporate sector have fallen from 16.6% to 15.3%, while rates for households have remained unchanged at 34.6%.

NBU’s forecast for the key interest rate. April 2024

4. Changes to IMF forecasts.

In its forecasts for the 4th review of the program, the IMF changed its assessment of macroeconomic indicators for 2024. Thus, the growth of the Ukrainian economy in 2024 was reduced from 3-4% to 2.5-3.5% (2.5% according to calculations) due to problems in the energy sector, consumer inflation was reduced from 8.5% to 8.0% in 2024, and the GDP deflator index was significantly revised. It was cut from 15.6% to 11.7%. As a result, the IMF lowered its estimate of Ukraine’s nominal GDP from UAH 7,748 billion to UAH 7,485 billion. The average hryvnia/dollar exchange rate in 2024 was raised from 40.8 to 41.2.

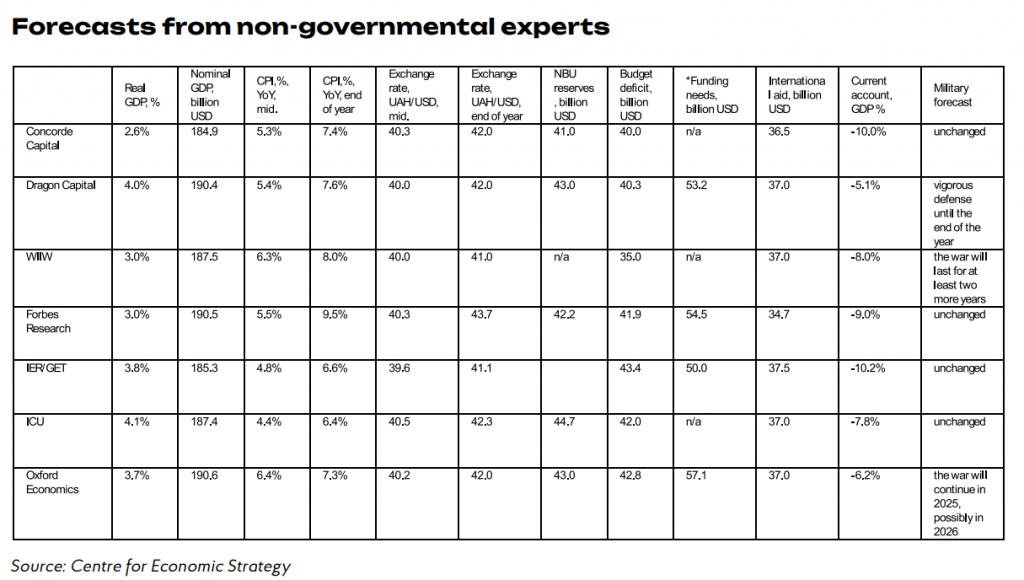

5. Forecasts of non-governmental organizations.

The Centre for Economic Strategy surveyed several experts and think tanks on their forecasts of Ukraine’s macroeconomic indicators for 2024-2025 and presented the survey results on 24 June.

The majority of experts forecast economic growth of between 2.6 and 4.1% in 2024, inflation of between 7.4 and 9.5%, and an exchange rate of the dollar to the hryvnia of around 42 at the end of the year.

Most experts are confident that Ukraine will receive the 37 billion in planned foreign aid.

Source: Centre for Economic Strategy.

6. Comments on the UIF forecast update.

Our March forecast included potential risks related to the energy sector. The figure for 3.6% shows a slowdown after 5.3% growth in 2023, considering the risks of shelling, power cuts, etc. The first-quarter GDP data, which exceeded the NBU’s and the Ministry of Economy’s expectations, and the stabilization of exports at USD 3.3-3.4 billion per month, urge us to maintain our forecast and not revise it downwards, despite the challenging situation with electricity supply.

Despite the low annual inflation rate of 3.3% in May 2024, we see several pro-inflationary factors – a 16%[1] increase in nominal wages in the economy, the devaluation of the national currency from UAH 36.57 to UAH 40.70/USD, a 63% increase in electricity prices, which led to a rise in annual inflation for the first half of the year to 4.8%. The additional costs for businesses due to the lack of electricity are also evident. All these factors lead to negative forecasts of an acceleration of inflation in the coming months and annual inflation reaching 8-9% by October 2024. As a result, we have maintained our forecast for consumer inflation at an annual rate of 8.9% for the rest of the year and 13.4 % for the GDP deflator in 2024. Accordingly, nominal GDP remains at UAH 7,678 billion, which is almost UAH 200 billion higher than the IMF’s updated forecast.

We have lowered our forecast of Ukraine’s GDP in US dollars from USD 199 billion to USD 190 billion by revising the average hryvnia/dollar exchange rate in 2024 from 38.5 to 40.5.

BUDGET

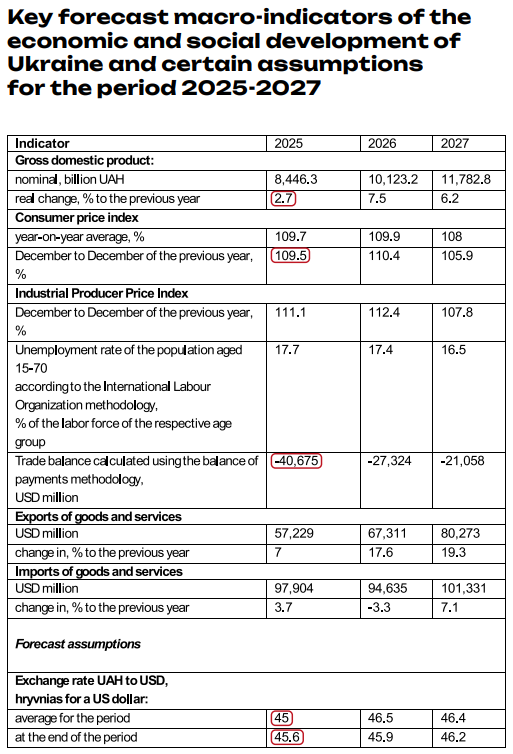

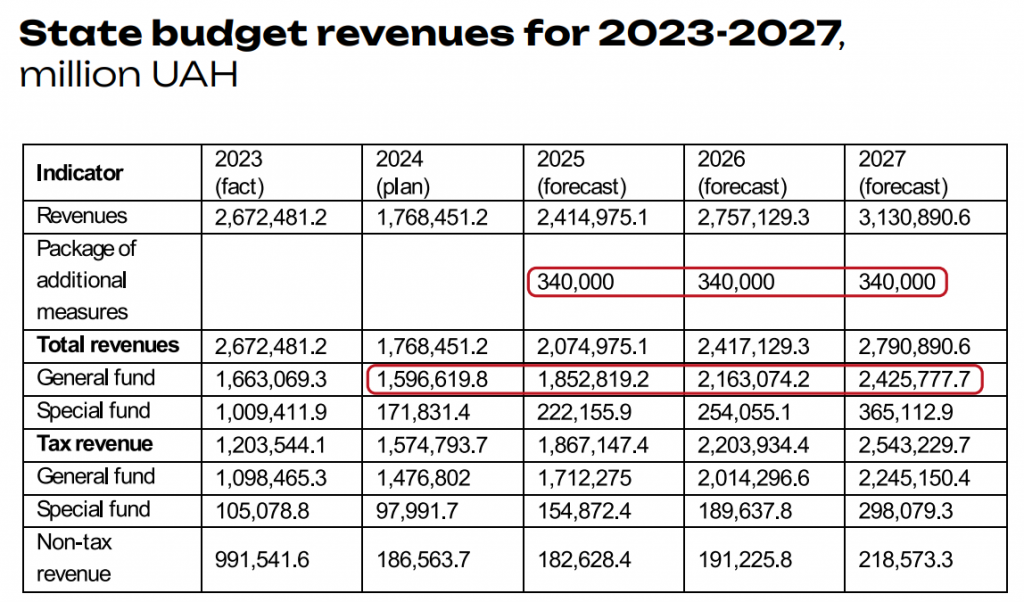

1. Budget Declaration for 2025-2027

At the end of June, the Ukrainian government adopted the Budget Declaration for 2025-2027, which proposed increasing the tax burden on the economy by 4% of GDP (UAH 340 billion).

According to the Ministry of Economy’s forecasts, the Ukrainian economy is expected to contract up to 2.7% of GDP in 2025, with consumer inflation at 9.5% per year, the national currency depreciation of 10%, and an average exchange rate of UAH 45/USD. The trade deficit is expected to widen to USD 40.6 billion.

Source: Ministry of Economy forecast

Based on these economic development parameters, as well as a significantly higher budget deficit of 18.2% of GDP in 2025, compared to the IMF forecast of 7.5% of GDP in 2025, and state security spending of UAH 2.23 trillion, the 2025 Budget Declaration clearly assumes Ukraine will be at war throughout 2025, despite President Zelenskyy’s announced intention to complete the peace plan by the end of 2024.

At a government meeting on 28 June, Prime Minister Denys Shmyhal noted that Ukraine has already signed 20 security agreements with its allies, including the EU and the US. This unique achievement opens up new opportunities for defense cooperation and lays the foundation for our future security in peacetime. Under these agreements, international partners plan to provide Ukraine with a total of USD 60 billion in military assistance annually over the next four years.

At the same time, despite this support, the 2025-2027 Budget Declaration increases state budget spending on security and defense from UAH 1.69 trillion in 2024 to UAH 2.226 trillion in 2025 (+33%). We believe that current tax and other revenues will not be sufficient to cover this increase in spending, so the government plans to raise taxes by UAH 340 billion (+4% of GDP).

Source: Ministry of Economy forecast

Based on the text of the 2025-2027 Budget Declaration, one of the short-term priorities of tax policy will be to broaden the current tax base, in particular through changes to the military tax, including a review of the tax rate, the range of taxpayers, the tax base, and the tax objects.

2. Budget execution

The consolidated budget closed the first five months of 2024 with a deficit of UAH 419.7 billion (UAH 154 billion in May), which is UAH 133.8 billion more than in the first five months of 2023 (UAH 285,9 billion).

The main reasons for the increase in the deficit are:

1) Less grant money from the West. While Ukraine received UAH 225.5 billion in the first five months of 2023, it received only UAH 41.1 billion in 2024.

2) A 34% increase in spending on internal security this year, from UAH 178.2 billion to UAH 239.8 billion.

3) A 20.8% increase in spending on debt servicing this year, from UAH 84.5 billion to UAH 102.1 billion.

4) A substantial increase in “other” defense spending.

Nevertheless, tax revenues for five months in 2024 are already UAH 231 billion higher than in 2023.

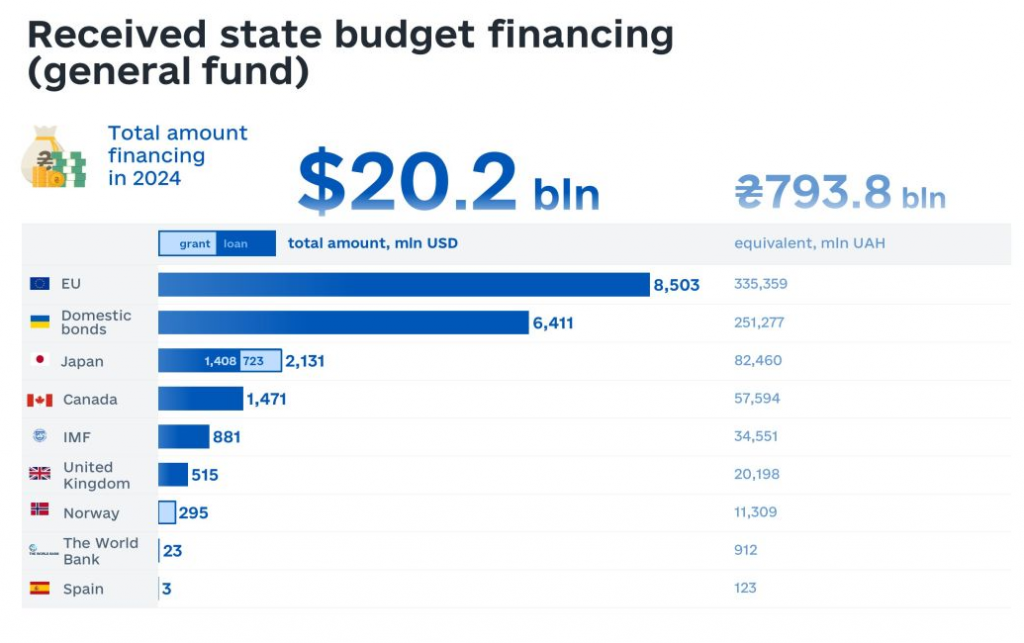

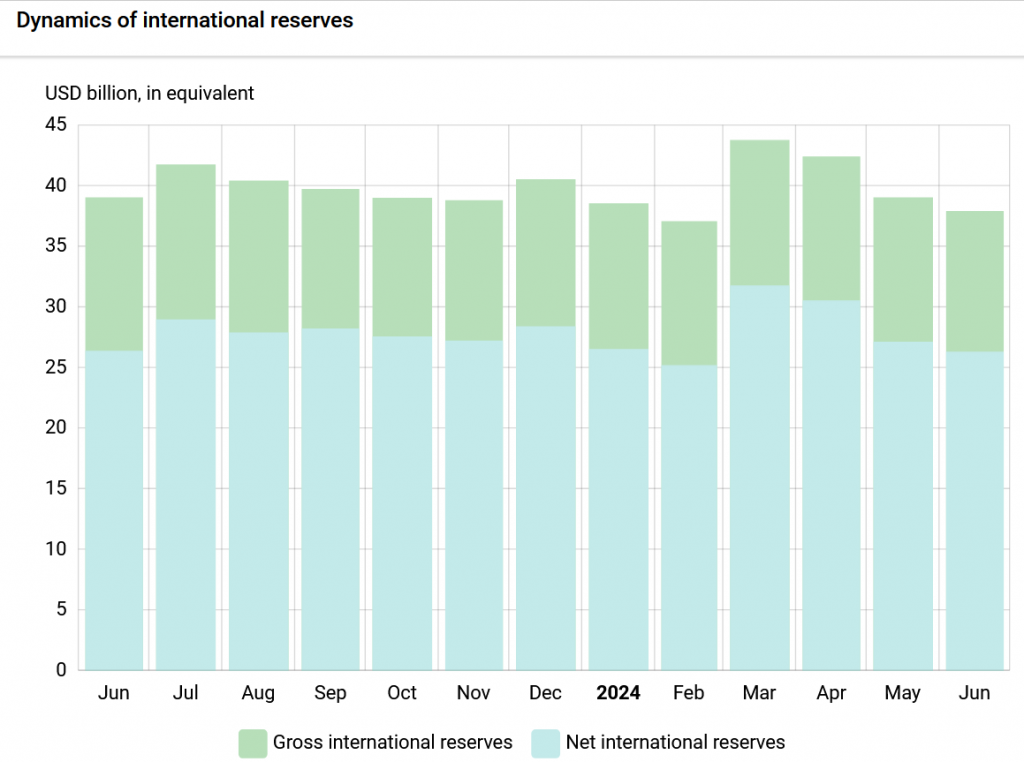

3. External financing

In the first six months of the year, Ukraine received USD 13.8 billion in external financing, compared to USD 16.2 billion in the first six months of 2023. Of this, USD 1 billion were grants, and USD 12.8 billion were loans. In June 2014, Ukraine received only EUR 1.9 billion (about USD 2.02 billion) from the EU.

Source: Ministry of Finance of Ukraine

As of 1 June, the balances of the state and local budgets fell from UAH 286 billion in May to UAH 128 billion, making it difficult to finance the Ukrainian budget. This is lower than the balances at the beginning of the year. We believe that cash balances on 1 July will be even lower, pointing to a major liquidity crisis in Ukraine’s public finances.

In early July, Ukraine received a further USD 2.2 billion IMF loan, and we estimate that it will receive around USD 24 billion in Western financing in the second half of 2024. This includes EUR 8.1 billion (USD 8.9 billion) from the EU, USD 7.85 billion from the US, USD 4.5 billion from the IMF and USD 2.2 billion from Japan. This is the total amount expected to be available from Western partners to finance the budget until the end of 2024. Still, a liquidity crisis could reoccur if the US continues to delay its funding (Ukraine did not receive any funding from the US in 2024).

The IMF document contains several figures on grant financing in 2024. First of all, this involves funding from the United States. Even though this financing is provided in the form of an interest-free loan for 40 years, with the possibility of its cancellation by the US President after 15 November 2024 and after 15 January 2026, the IMF suggests that the Ministry of Finance should consider this money as a grant and not increase the debt in its accounts (USD 7.85 billion). Also, in May 2024, the European Council agreed to channel the extraordinary proceeds from Russia’s frozen assets in Europe (EUR 3 billion in 2024) to Ukraine. As a result, the IMF estimates that Ukraine will receive USD 12.1 billion in grants in 2024 (USD 11.1 billion in the second half of 2024).

This will contribute to a better estimate of Ukraine’s budget deficit, a better debt-to-GDP ratio, and a better current account figure for the balance of payments.

4. Public debt

Under two scenarios, the IMF reassessed the public debt at the end of 2024 and its subsequent development until 2023. At the end of 2024, the IMF sees the public debt at 97.3% of GDP. In the baseline scenario, the war should end by 2024, and the budget deficit should not exceed 7.5% of GDP in 2025. Then, according to the IMF, the public debt will stop growing by the end of 2025 and will remain below 100% of GDP (97.6% of GDP). The IMF’s primary long-term goal is to reduce the public debt to 65% of GDP by 2033. Other targets include a public debt of 82% of GDP by 2028. At the same time, given its high financing needs, Ukraine should seek to achieve debt relief through debt restructuring in the range of 1-1.8% of GDP per year during 2024-2027.

The Ukrainian Institute of the Future has updated its forecast for public debt at the end of 2024 to 92.9% of GDP. It assumes that Ukraine will receive USD 12.1 billion in grants and will account for the funds from the US as grants. The difference in the level of public debt compared to the IMF’s estimate is lower here due to the higher nominal GDP of the Ukrainian economy in 2024.

5. Changes to IMF forecasts

Even though Ukrainian officials have stated that additional financing of UAH 200 billion will be needed in 2024, the IMF, in its forecasts under the 4th review of the program, has not changed its assessment of the budget execution in 2024. Revenues were increased by UAH 28 billion (adjustment of income tax revenues). Expenditure was increased by UAH 39 billion. Grants are expected to amount to 12.1 billion UAH in 2024. The budget deficit will increase from 13.7% to 14.2% of GDP due to a decline in Ukraine’s nominal GDP.

6. Changes to UIF forecasts

Our changes to the 2024 budget projections are based on changes in budget revenues, expenditures, and funding levels, a significant inflow of Western military aid in 2024, and the capping of Western funding.

We were skeptical about the government’s VAT revenues, which in 2023 stood at 8.9% of GDP. However, the abolition of VAT privileges combined with the hryvnia depreciation, import growth, and the actual level of revenues in the first five months of 2024 (up 46% from UAH 203 billion to UAH 299 billion) led us to significantly revise our VAT revenues for 2024 to reach 10% of GDP.

We see high risks in the growth in security spending that is not directly related to the war. Specifically, expenditures from the general fund of the state budget on military salaries increased by only UAH 11 billion in 5 months of 2024, from UAH 366 billion to UAH 377 billion (+3%), while expenditures on the use of goods and services to support the Armed Forces of Ukraine decreased from UAH 190.9 billion to UAH 101.3 billion (-UAH 89.6 billion). At the same time, total expenditures on internal security from the state budget’s general fund increased from UAH 155 billion to UAH 188 billion (+21%), and total defense expenditures increased from UAH 535 billion to UAH 579 billion in 5 months of 2024. Thus, the total of “other” security expenditures increased from 133 to 279 billion UAH.

We cannot confirm these figures due to the confidentiality of the expenditure. Still, we can assume, on the one hand, additional costs related to mobilization measures and, on the other hand, social payments related to the death of soldiers (UAH 15 million, or USD 380,000 per soldier). Such expenditures are not in line with the IMF and Western partners, are very harmful (having already led the budget to reduce spending on soldier protection by 1.8 times), and directly result in a significant overrun of budget expenditures, which could reach UAH 600 billion by the end of 2024.

At the same time, these budgetary problems could be exacerbated by the absence of an agreement on rescheduling commercial debt payments, which could result in additional costs of UAH 150 billion in foreign currency.

In revising our forecast, we have lowered the debt service amount to UAH 330 billion, assuming that commercial debt restructuring will take place, and raised total security spending for the year from UAH 2,534 billion to UAH 2,830 billion (36.9% of GDP), assuming that the West will provide military aid of around UAH 800 billion to the Ukrainian budget.

Our assumptions also include UAH 38 billion in grants and loans and UAH 300 billion of additional domestic market borrowing, with a budget deficit of UAH 1207 billion (15.7% of GDP) and partial containment of security spending in the second half of 2024. At the same time, total government revenues will amount to UAH 4118 billion (53.6% of GDP) in 2024. Total expenditure will reach UAH 5 325 billion (69.3% of GDP).

Balance of payments

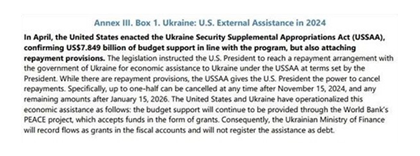

1. Changes to IMF forecasts

The balance of payments has not undergone any significant changes in the IMF’s forecast for 2024. The primary adjustment in the IMF’s calculations was made to imports of services and goods. The IMF increased its forecast for imports of services for the year from USD 21.5 billion to USD 22.9 billion and reduced its forecast for imports of goods from USD 69.6 billion to USD 68.9 billion. Overall, including grant assistance of USD 12.1 billion, the current account with the IMF changed from -10.8 billion to -10.6 billion. The financial account did not change significantly, falling from USD -13.4 billion to USD -12.9 billion. This was mainly due to a decline in foreign direct investment from USD 4.2 billion to USD 3.8 billion.

According to the IMF, Ukraine will have 41.8 billion in foreign exchange reserves by the end of the year. This is slightly lower than the IMF’s March forecast of USD 42.1 billion in reserves at the end of 2024.

2. Changes to the UIF forecasts

We have revised our estimate of the year-end balance of payments. In particular, we have increased our forecast for goods exports from USD 38.5 billion to USD 40 billion due to the good export dynamics in the first five months of this year and the possibility of continued exports by sea in the second half of 2024.

We have also revised goods imports from USD 64.5 billion to USD 67 billion and reduced services imports to USD 22.8 billion.

The forecast for workers’ remittances was lowered to USD 9.6 billion, and profit outflows from Ukraine were raised to USD 7.8 billion.

The current account forecast has been revised from USD 7.9 billion to USD 8.3 billion, which is better than both the IMF and NBU forecasts. We assume that the inflow of financial aid from the US will be accounted for as secondary income rather than as loans at the NBU level and as grants at the Ministry of Finance level.

In the financial account, we now assume that the Western funds will be fully received by the year’s end (USD 38 billion). We also estimate outflows into foreign currency reserves at USD 15.1 billion, which is significantly higher than the USD 11.8 billion in 2023. It will increase to USD 15.1 billion by the end of the year.

At the same time, despite a USD 2.6 billion decline in foreign exchange reserves in the first half of 2024, we are optimistic about the foreign exchange reserves level for the year. According to our updated forecast of foreign exchange reserves at the end of 2024, provided that commercial debt is restructured and external financing is fully received, reserves will reach USD 46.7 billion, which is better than the IMF and NBU forecasts and significantly better than the current level of international reserves as of 1 July – USD 37.9 billion.

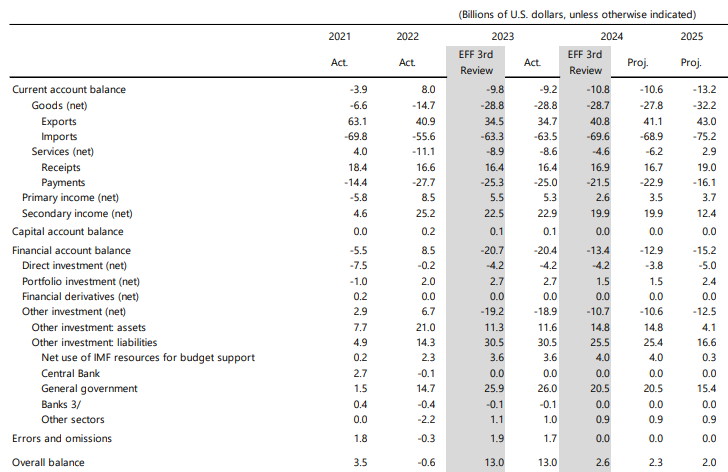

3. Hryvnia exchange rate

In June, in the absence of Western financing for two months, the hryvnia continued its gradual depreciation against the US dollar to 40.7 UAH/USD by 27 June. However, with the arrival of funding from the EU on 27 June and from the IMF in early July, depreciation expectations have declined.

Hryvnia/US dollar exchange rate from 01/09/2023. Source: NBU.

We believe that the NBU will moderate and manage the devaluation in July. Indeed, we face a critical trade deficit, estimated at USD 32.2 billion in 2024, but it is fully covered by financial aid, and if it arrives as planned and on time, there is no obvious reason for depreciation. However, if the financing is delayed, the NBU may decide to devalue the hryvnia further. Currently, the main pro-devaluation factor is the delay in the US funding.

The updated UIF forecast assumes an exchange rate of 42.0 UAH/USD by the end of 2024.

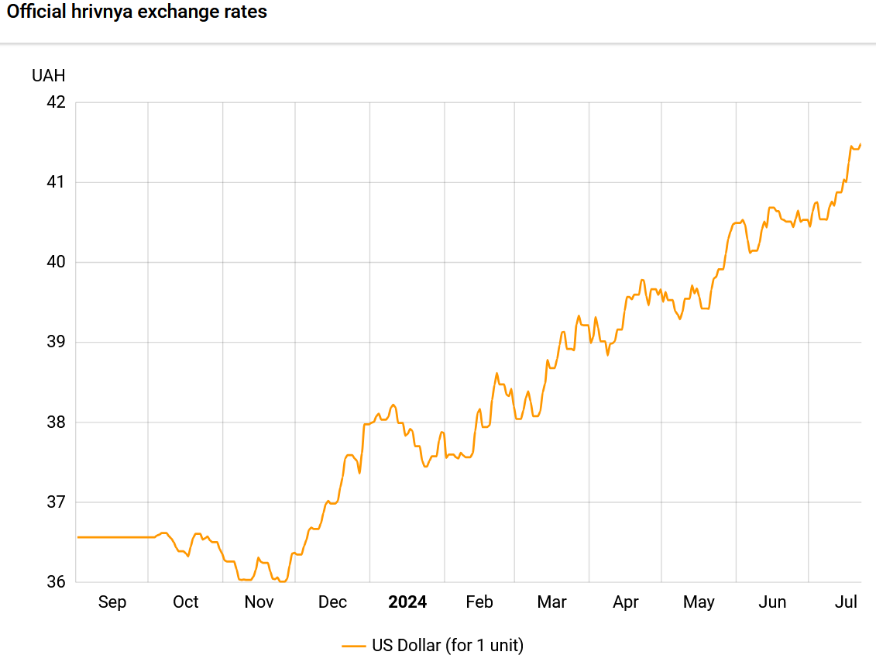

4. International reserves

International reserves decreased from USD 39.0 billion to USD 37.9 billion in June. The NBU’s net foreign exchange sales in June amounted to USD 2,994.6 million. The government’s foreign currency accounts with the NBU received USD 2,431.7 million. Of this amount, USD 2021 million came from the EU and USD 3.0 million from the World Bank. Ukraine also paid USD 247.6 million to the International Monetary Fund.

The NBU’s current forecast for the state of international reserves at the end of 2024 is USD 43.4 billion.

The IMF’s updated forecast for international reserves at the end of 2024 is USD 41.8 billion.

The updated forecast of the Ukrainian Institute of the Future is USD 46.7 billion at the end of 2024.

Change in international reserves over the past 12 months. Source: NBU.

FORTHCOMING EVENTS

25 July: NBU will set the key policy rate.

1 August: Ministry of Finance: Deadline for debt restructuring.

2 August: NBU inflation report.

[1] An indirect estimate by UIF experts based on data on the growth of personal income tax revenue for five months in 2024 compared to the same period in 2023.

Вам також буде цікаво:

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine

Ukraine’s Energy Sector Developments

Macroeconomic Digest of Ukraine (November 2024)

Macroeconomic Digest of Ukraine

Macroeconomic Digest of Ukraine